<!–

<!–

<!– <!–

<!–

<!–

<!–

Housing affordability in NSW has hit a horrific record low with families forced to pay more than half their weekly income just to keep a roof over their heads.

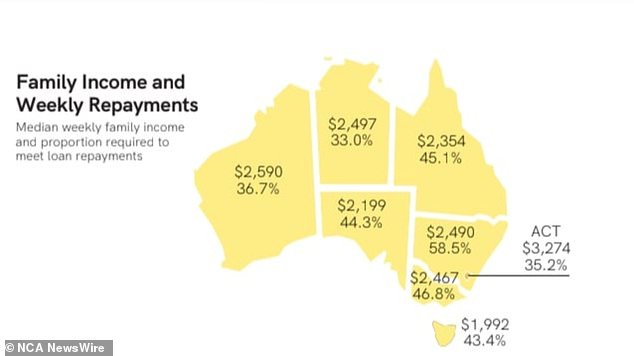

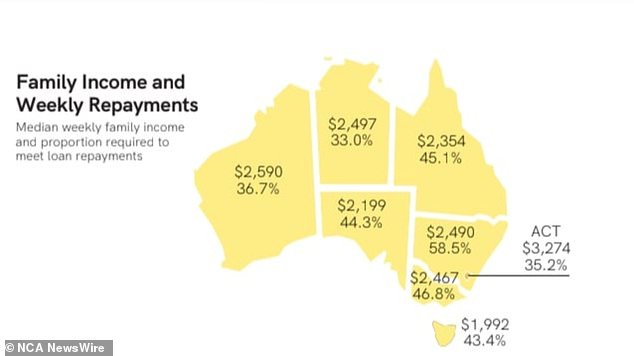

The Real Estate Institute of Australia report showed families in NSW were forced to use 58.5 per cent of their weekly income to pay mortgage repayments.

The state ranked worst in housing affordability between October-December 2023, with average monthly repayments up nearly $800 from the end of last year.

Tenants in NSW fared slightly better in the report, with the median family income required to meet payments still the highest in the country despite falls.

NSW families spend 58.5 per cent of their weekly income on home loan repayments (pictured, Sydney)

Australia’s housing market is recognized as one of the toughest in the world despite our abundance of land

The percentage of family income needed to repay the mortgage

Families at the end of 2023 were forced to spend almost a third – 27.3 per cent – of their income on their rent, compared to 21.1 per cent in neighboring Victoria.

While families south of the Murray River generally fared better in the latest REIA report, both rental and housing affordability fell in the last quarter of 2023.

Residents in the state had to spend 46.8 percent of their weekly income on home loan repayments, up 1.6 percent from the previous quarter.

The Sunshine State came a close third, according to the report, with Queenslanders spending 45.1 per cent of their income on mortgages and 22.3 per cent on rent.

South Australia and Tasmania followed close behind with families spending 44.3 per cent and 43.4 per cent of their income on loan repayments respectively.

The Northern Territory and ACT were found to be the most affordable when it came to the share of weekly income, followed by Western Australia.

The Victorians came in a distant second, with families spending 46.8 per cent of their income on take-home pay (pictured, Melbourne)

Home loans and rent payments across the country

Canberrans spent less than 20 per cent of their weekly income on rent and just over 35.2 per cent on mortgage repayments at the end of 2023.

Critically, the report found families in the ACT earned almost $800 a week more on average than their counterparts in NSW.

The average home loan was also about $170,000 less than its neighbour, although it was about $100,000 more expensive than WA and $170,000 more than the NT.

Families in the north of the country spent just 33 percent of their weekly income on their mortgage repayments and 24 percent on their rent.

Although marginally more expensive, WA families still spent almost $600 more per month on their repayments in 2023 than in 2022, according to the report.

Where families buy housing

The report also found that the number of first home buyers increased by a whopping 16.8 percent in the last quarter of 2023, with around 31,445 families entering the market.

Despite the country’s worst home ownership statistics, NSW recorded more than 1300 more first home buyers between October-December 2023 than in 2022.

Nevertheless, Victoria reported having the most first home buyers during that period – 10,000 – and new mortgages more widely, just shy of 24,000.

South Australia, Western Australia, Tasmania and the ACT all reported increases in the number of first-time buyers, while Queensland and the Northern Territory remained stable.