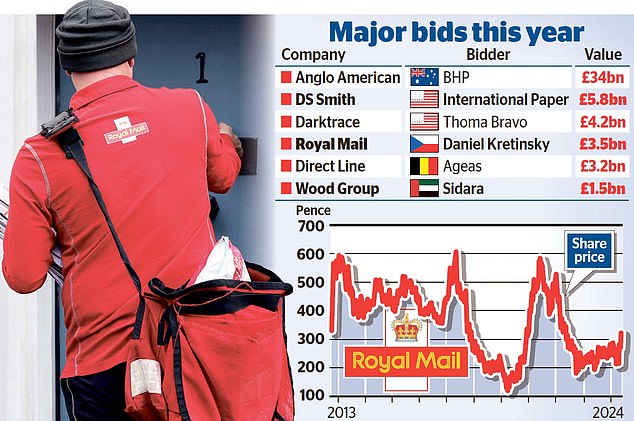

Royal Mail is just the latest British company to be targeted by foreign buyers this year, with foreign deals worth more than £60bn.

In one of the most dramatic days in the postal service’s 508-year history, parent company International Distribution Services (IDS) backed a takeover bid by Czech billionaire Daniel Kretinsky of 370 pence per share, or £3.5bn.

The bid marked an increase of almost 16 per cent on the previous rejected 320p bid submitted by the tycoon’s EP group.

And this brings the total value of deals from overseas companies listed in London to more than £60bn this year, according to City broker Peel Hunt.

Kretinsky, known as the “Czech Sphinx”, already owns 27.5 per cent of IDS, is a co-owner of West Ham United FC and has a stake in Sainsbury’s.

Takeover target: Royal Mail parent International Distribution Services backed Czech billionaire Daniel Kretinsky’s £3.5bn bid

IDS chairman Keith Williams said it was a “fair” price and reflected “current growth plans and the progress being made”.

A deal with Kretinsky would see the loss-making Royal Mail fall into foreign hands for the first time since it was established by Henry VIII in 1516.

However, although IDS shares soared 16 per cent, or 43.4p, to 314.8p, the price is still well below the offer price of 370p, suggesting investors believe that The agreement may not be finalized.

The raid follows a series of acquisitions in 2024 with packaging group DS Smith, telecoms testing company Spirent Communications and transport company Wincanton among those that fell into the hands of foreign bidders.

Last month, cybersecurity group Darktrace backed a £4.2bn acquisition by US private equity firm Thoma Bravo.

But some companies, although targeted by foreigners, have been fighting.

Anglo American rejected two bids from Australian miner BHP, while Currys and Direct Line fended off the bids.

In another act of defiance, FTSE 250 Wood Group was the latest to reject a takeover offer from its Dubai rival Sidara.

The industrial engineering group yesterday rejected a £1.5bn bid, worth 212p a share, just a week after rejecting Sidara’s first £1.2bn offer.

But the attack on UK plc has fueled concerns that British companies are undervalued and face a “frenzy” of merger and acquisition activity.

Another concern is the lack of companies entering the stock market through initial public offerings (IPOs).

One analyst even warned that the London stock market was facing a “death by a thousand cuts” as listed companies bow to foreign takeovers.

But City analysts have suggested that IDS, which also owns the profitable Netherlands-based parcel delivery business GLS, has managed to secure a decent and improved deal given its complex past.

Danni Hewson, analyst at AJ Bell, said: “Once you take into account all the baggage that comes with the IDS, it seems like a fair price and it’s hard to see anyone else rushing to beat that offer.”

But he added: “The fact the shares are not trading anywhere near the offer price of 370p means the market has little faith it will break the line.”

Royal Mail is on a mission to reform the Universal Service Obligation, meaning it must deliver letters nationwide for the same price every day except Sunday.

Williams criticized ministers for not allowing Royal Mail reform to go ahead, leaving it vulnerable to a takeover.

“It is regrettable that despite four years of petitions, the Government has not seen fit to undertake reform of the Universal Service to improve our financial position and ensure that Royal Mail can provide an economically sustainable service to the British public,” he said. .