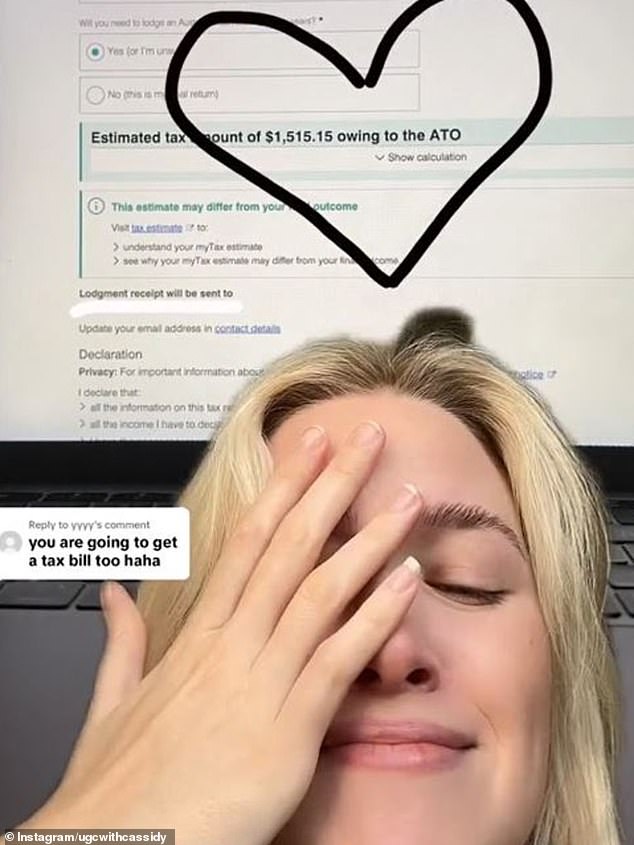

A young Australian woman has been issued a warning after receiving a bill from the ATO for more than $1,500 for failing to include HECS repayments in the taxes deducted from her salary.

Queenslander Cassidy took to social media to reveal she completed her tax return this year, but instead of receiving the expected refund, she was left with a huge bill.

“Let this be a lesson to make sure your employer deducts mandatory HECS debt payments from your salary so you don’t end up with a tax bill,” he said.

The 22-year-old explained that the problem arose because she had not ticked the student loan box on her tax file number declaration form when she started a new job in the recruitment industry.

“(The tax bill) was entirely my fault,” he told news.com.au this week.

She realised the mistake after commenters on a previous video pointed out that she might have a tax bill, so she made a voluntary payment of $2,000 towards her HECS.

However, this amount did not negate the required repayments and was simply added as an extra contribution.

“It turns out voluntary repayments don’t work like that… It’s definitely something people with HECS debt need to be careful about… I still paid more than the minimum requirement in voluntary repayments,” he said.

Queenslander Cassidy took to TikTok to reveal she completed her tax return this year, but instead of receiving the expected refund, she was left with a huge bill.

She said her advice to others would be to make sure all employers are aware of a HECS debt and double-check that the student loan repayment box is ticked on all tax forms.

People with HECS debts should also be aware that any payments they make are held by the ATO and not credited to HECS until a tax return is lodged, so interest is earned on the full amount until it is reduced annually.

As of 1 June, HECS loan interest rates rose by 4.7 per cent following a rise of 7.1 per cent the previous year, which is the largest in three decades.

Loans are indexed each year based on inflation figures.

The changes included in this year’s budget will see the lower of the consumer price index (CPI) or wage price index (WPI) used for indexation, which should reduce the amount of interest accrued on HECS.