The Biden administration has been dealt another blow by the Supreme Court, which has rejected its request to reinstate a major student loan forgiveness plan.

The Supreme Court has refused to allow Biden’s $160 billion Saving on Valuable Education (SAVE) plan to move forward.

This comes after two federal judges last month sided with several Republican-led states and blocked Biden from moving forward with debt cancellations.

The plan, announced in June 2023, was designed to reduce monthly payments and speed up loan forgiveness for millions of Americans by tying monthly payments to a borrower’s income and family size.

The administration has already cancelled more than $168 billion in debt owed by some 4.8 million borrowers.

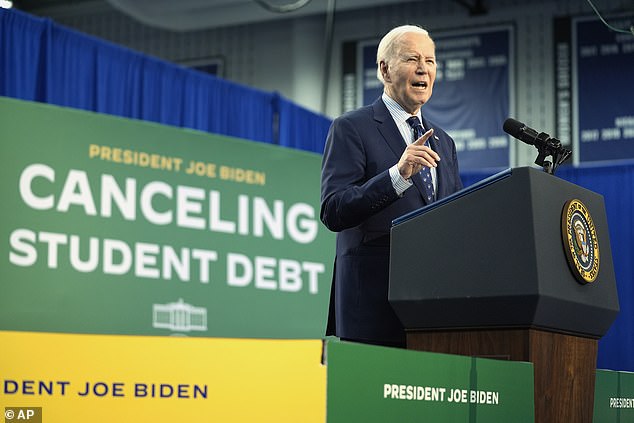

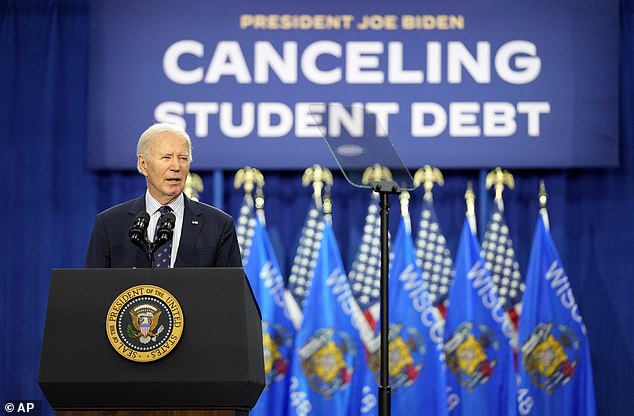

President Biden speaks about efforts to cancel student loan debt during an event in Madison, Wisconsin, on April 8.

Additionally, it was reported that more than eight million people have already used the SAVE measure to reduce more than half of their payments to $0.

Last year, the Supreme Court struck down the Democratic president’s first attempt to cancel a loan.

Since then, the Biden administration has been rolling out new loan forgiveness plans, including SAVE, that they believe circumvent court rules.

In late July, the Biden administration announced it will begin moving forward with next steps to cancel student loan debt for tens of millions of borrowers this fall.

The Department of Education has begun emailing borrowers who have at least one federal student loan with an update on potential student loan debt forgiveness available to them under rule changes being finalized this fall.

It’s the latest move in President Biden’s massive effort to wipe out billions of dollars in student loan debt.

If the rules are finalized, the total number of borrowers eligible for student loan debt cancellation would rise to more than 30 million, including those who have already had their loans canceled since Biden took office.

The Education Department estimated the changes would cost $150 billion, but an estimate by the Committee for a Responsible Federal Budget put it between $250 billion and $750 billion.

Critics argue the administration is unfairly burdening taxpayers with a massive debt transfer, and some Republicans have even accused the president of trying to buy votes ahead of the November election.

The Department of Education will provide additional information to borrowers once the rules are finalized, but this week’s emails will inform borrowers that they have until August 30 to opt out if they do not want the upcoming forgiveness.

“Today, my administration took another important step toward canceling student debt for nearly 30 million Americans,” Biden said in a statement.

“By providing borrowers with more information about how they can take advantage of our upcoming debt relief programs, borrowers will be prepared to benefit quickly once the rules are final,” he continued.

‘Despite attempts by Republican elected officials to block our efforts, we will not stop fighting to provide relief to student loan borrowers, fix the broken student loan system, and help borrowers get out from under the burden of student debt.’

In April, the Biden administration announced a set of rules giving the Secretary of Education the ability to cancel student loan debt for tens of millions of borrowers.

It was part of the administration’s ongoing effort to use the longer rulemaking process after the Supreme Court in June 2023 blocked its original $400 billion plan to cancel debt for about 40 million borrowers.

Protesters outside the U.S. Supreme Court on June 30, 2023. In a 6-3 decision, the court struck down President Biden’s original plan to cancel up to $20,000 in student loan debt for millions of borrowers.

If the rules are finalized, they will affect several groups of borrowers, including those who owe more on their loans now than when they began paying them because of the accumulation of extra interest. The administration estimated that this change would affect nearly 23 million borrowers.

The rules also apply to borrowers who have been paying back loans for decades. Those who have been paying back college loans for more than 20 years would be eligible, as would those with college loans who have been paying back loans for at least 25 years.

Other rules address borrowers who are eligible for loan forgiveness under other plans but have not yet applied, such as the Income-Driven Repayment (IDP) plan, and those who were enrolled in programs deemed to be of low financial value because they did not meet Department of Education standards.

Borrowers who want to opt out of having their student loans forgiven under the rules being finalized will need to contact their student loan servicer. The Education Department said those borrowers will not be able to opt back into forgiveness.

Biden announced efforts through the regulatory process to cancel student loan debt for more than 30 million borrowers by August 8, 2024

The latest actions by the Biden administration this week come after an appeals court earlier this month blocked implementation of the administration’s separate Saving Valuable Education (SAVE) plan.

Missouri’s Eighth Circuit Court of Appeals has blocked all aspects of the plan for now, and it’s unclear whether the court will issue a final ruling on the case.

The ruling was in response to one of two lawsuits filed by more than a dozen Republican-led states in response to the Biden administration’s launch of the SAVE Plan last summer.

The SAVE plan was expected to reduce payments for millions of borrowers, while those who had already been paying off their debts expected to see them eliminated after ten years.

According to the White House, more than eight million borrowers had enrolled in the program and about 400,000 had already had their debts forgiven under the plan.

After the ruling, the Education Department said borrowers who were enrolled in the SAVE Plan would be placed in interest-free forbearance until the legal case was resolved.