Stocks are set for a drop of up to 12 percent after a stormy start to the year, a Wall Street veteran has warned.

Global stocks hit record highs on Wednesday, ahead of a day off in trading for the June 16 holiday yesterday.

Gains in the S&P 500 and Nasdaq were fueled by a rally in technology stocks that has also made artificial intelligence chip maker Nvidia the world’s most valuable company.

Overall, it’s good news for investors, including Americans whose retirement savings are largely invested in U.S. indices.

But analysts warn that stocks won’t continue to rise, or at least will need a “correction” before they do.

Sam Stovall, chief investment strategist at CFRA Research, warns of a stock market pullback

“I’m increasingly concerned that we may have to endure another decline of 5 percent or more before the year is out,” Sam Stovall, chief investment strategist at CFRA Research, told Yahoo.

He described the possible crisis as a “resetting of the dials” or “digestion” after a big meal.

The S&P 500 is up more than 10 percent in the first quarter, which Stoval said was the index’s 11th best first-quarter performance since World War II.

But he noted that 14 of the top 15 returns were followed by a decline of at least 5 percent or more, with some declines exceeding 12 percent.

A 5 percent drop would reduce the S&P from 5,487 points at Tuesday’s close to around 5,212, matching its level at the beginning of March.

A 12 percent drop would take the index to 4,828, where it was trading in January.

Stovall pointed to a “silver lining” in that, after a strong first quarter, the S&P 500 is trending to end the year up at least 20% on average.

That means any pullback acts as a breather before the market advances again.

Stovall, who served as S&P Global’s chief investment strategist for 27 years before joining CFRA in 2016, may also cause a pushback.

These are often unpredictable events, such as a war or a bank failure, markets rising too quickly and becoming overloaded – which many say has happened this year – or fears of a recession.

A decline would also affect American’s retirement accounts. Most have at least a portion of their 401(K) and IRA invested in the Dow Jones, S&P 500 and Nasdaq.

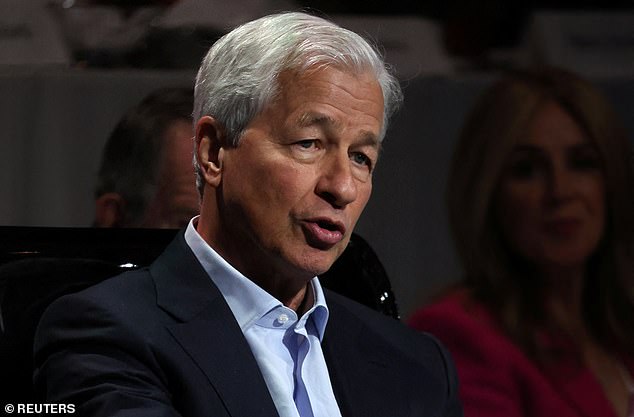

JPMorgan Chase CEO Jamie Dimon has said he cannot rule out a “hard landing” for the US.

In recent weeks, top bankers and even a prominent former CEO have issued chilling warnings about the U.S. economy.

In May, Jamie Dimon, head of the world’s largest bank, JPMorgan Chase, said that the worst result for the American economy It would be “stagflation.”

This is when inflation It continues to rise, but unemployment is high and growth is slowing.

Stagflation, last seen in the United States in the 1970s, is considered worse than a recession by economists. It would send stocks tumbling, hitting 401(K) plans and other retirement savings.