The UK stock market may be overshadowed by its Big Tech-dominated counterpart across the Atlantic, but these are pretty good times for investors who have remained loyal to UK plc.

A combination of lower inflation and future interest rate cuts have helped push the FTSE100 index to record levels.

And while nothing is guaranteed when it comes to investing, UK fund managers believe there is more to come as company valuations readjust upwards to move more in line with both historical levels and other markets. key stock markets.

Alex Wright is the long-standing lead manager of Fidelity Special Values, a £924 million investment trust that invests 80 per cent of its assets in the UK.

Among its key holdings are FTSE100 shares Imperial Brands (which pays attractive dividends), Aviva (another income-friendly company) and NatWest.

“If you’ve invested in the UK stock market over the last three years, it’s done quite well in absolute terms,” he says.

‘The FTSE All-Share Index has delivered an annual return of around seven per cent, the FTSE100 Index slightly better.

“However, when investors see what they could have gained from some of the big American technology stocks, [the likes of Meta, Microsoft and Nvidia]UK figures look relatively unappealing.

“It is understandable, therefore, that they are attracted to the American market.”

Wright’s view is that the US stock market looks expensive. And while the UK doesn’t have any compelling tech businesses to pique investor interest, it is a stock market that derives a significant portion of its profits from abroad. In other words, this is not simply a game with the UK economy.

“Aviva is not just a UK life insurer,” says Wright. He owns a Canadian general insurance company. Similarly, our largest holding company, DCC, is a diversified business serving companies in the energy, healthcare and technology sectors around the world.’

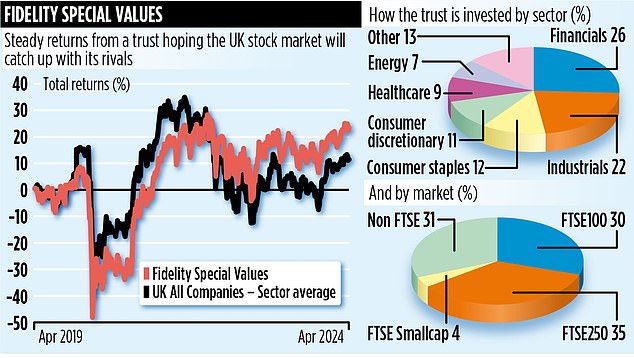

The trust has a portfolio of 100 companies with market sizes ranging from £100 million to over £100 billion. Its largest sector position (more than a quarter of the trust’s assets) is financial, mainly because many of the banks have cheap prices compared to the rest of the market.

“It’s a diversified approach,” Wright says. ‘We have eight bank holdings, but they all bring something different to the party.

‘For example, NatWest is a UK national bank, while Standard Chartered is largely a bet on the Asian economy.

“We also have Irish bank AIB and Kaspi, based in Kazakhstan, which is expanding its banking operations into Uzbekistan and is very much in growth mode.”

The trust offers a combination of capital and income yield. This means it has a mix of division-friendly stocks and more growth-oriented companies, such as airline Ryanair, that pay no income to shareholders.

The result is a dividend equivalent to an annual income of three percent; Income payments have grown by double-digit percentage terms each year for the past three fiscal years.

The trust’s annual charges total 0.7 percent; its stock identification code is BWXC7Y9; and its symbol is FSV.

Over the past one, three and five years, it has earned respective returns of 8, 13 and 25 percent. The shares, which are trading at around £2.93, are at a discount of around 9 per cent to the value of the trust’s assets.