Philip Sillars is a solicitor at the law firm Winckworth Sherwood.

Many people are worried about the potential inheritance tax bill that their estates or those of their families will face following the changes revealed in the Autumn Budget.

A common question is whether gifting the family home to children can reduce inheritance tax, but doing so is fraught with risks.

As a reminder, the Government made three major announcements in relation to the inheritance tax regime. In general:

1. Starting April 2026: A limit of £1 million will apply to the value of assets against which 100 per cent inheritance tax relief can be claimed on agricultural and commercial properties.

Qualifying assets above this threshold will benefit from reduced 50 percent relief.

Philip Sillars: Messing with family property brings with it a host of potential problems

2. From April 2027: inheritance tax will apply to all transferable pension assets.

3. The £325,000 nil rate band rates and £175,000 residency nil rate band rates have been frozen until 2029/30.

While the finer details have yet to be released, the broadest strokes we’ve given already paint a clear picture: more estates will pay more inheritance taxes.

It’s no surprise then that people are analyzing their assets and considering ways to mitigate their potential liability.

The family home is likely to be one of the most valuable assets in your estate.

This begs the question: ‘Can I gift the house to my children now to avoid paying inheritance tax?’

Apparently a significant sum would be subtracted from the inheritance tax equation.

Unfortunately, this is not a silver bullet. Messing with family property brings with it a host of potential problems.

1. Such a gift (if effective) is likely to be classified as a Potentially Exempt Transfer (known as a PET).

This means that the value of the gift will be subject to some degree of inheritance tax if you die within seven years of making it.

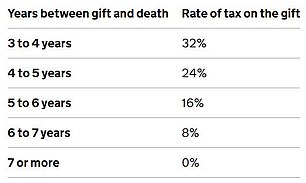

If you died within three years of making the gift, the value of the gift would be taxable (subject to any available nil rate band) at the full 40 percent (and the rate would decrease each year thereafter ).

Seven-year rule: how inheritance tax is reduced in the years after the gift (Source: Gov.uk)

2. You must also take into account the Gift with Profit Reservation rules.

For inheritance tax purposes, transferring title to your property is not necessarily sufficient to make a valid gift.

Simply put, if you continue to make a benefit from the property without paying full market value for the benefit you continue to receive after the gift (for example, you continue to live there rent-free), it will be considered ineffective for inheritance tax purposes. .

3. Tax issues aside, giving away your property leaves you especially vulnerable to changes in your personal circumstances (and not just yours).

As with so many things, everything may look good on a sunny day, but when it rains, it pours.

If you give your assets to your children and one of them gets divorced, those assets could become part of the marital estate that will be divided between them and your ex-spouse.

This could mean that your son’s ex becomes one of your owners or that the property has to be sold.

Bankruptcies and fights can also cause major problems.

4. Between 2021 and 2023, the average cost of a care home in the UK increased by 19 per cent.

As the population continues to live longer with more complex care needs, this trend is unlikely to change.

Donating your home, or a portion of it, limits your options regarding downsizing, which is a common strategy to free up funds to pay for care needs.

Worse still, councils are allowed to ignore gifts for the purposes of the means test if they consider the gift to be a deliberate deprivation of assets.

In conclusion, donating your primary residence or a portion of it to mitigate a potential estate tax liability can have serious unintended consequences.

If you are considering making a substantial donation, it is important that you seek professional advice to determine the most appropriate options available to you.

Do you have any questions? financial planning@thisismoney.co.uk