Calls for Texas to secede from the United States are growing louder, and advocates say it could then stem migration flows from Mexico without being crippled by the federal government.

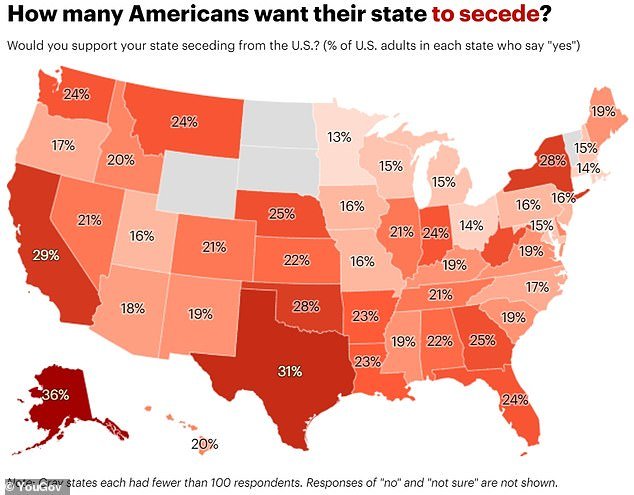

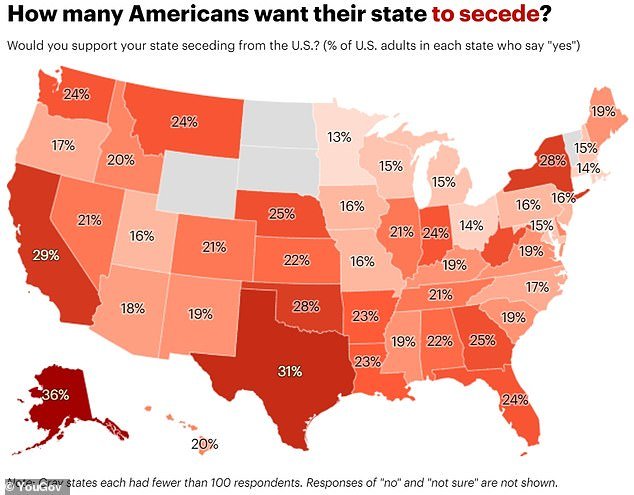

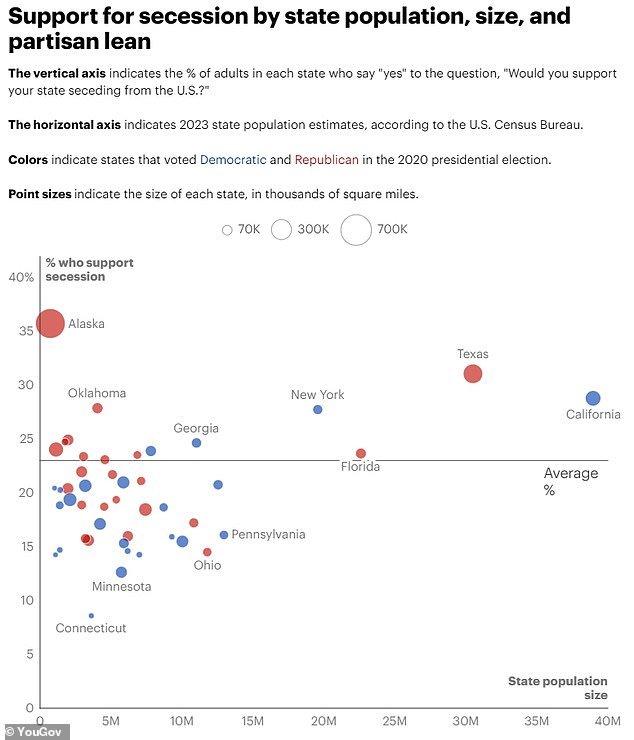

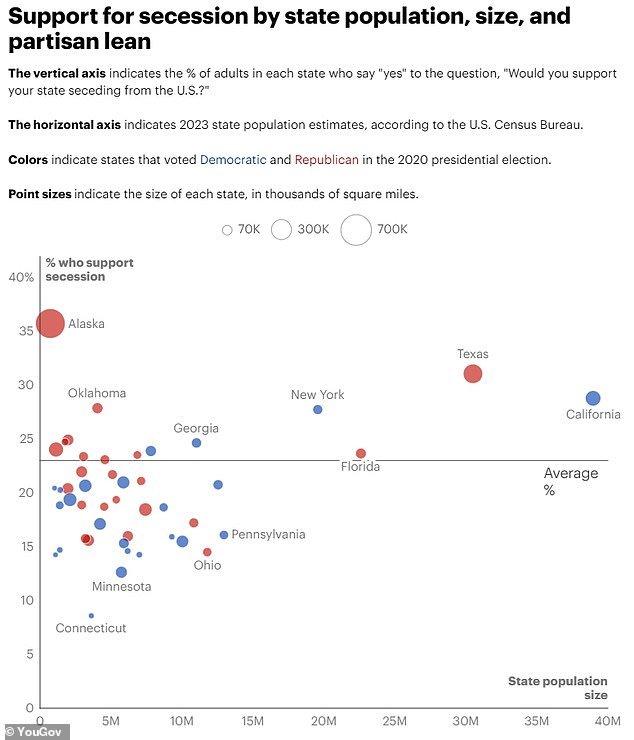

The Lone Star State may have the loudest secessionist movement in the country, but it is not the most popular.

That label is for Alaska, a new survey shows.

Researchers found that more than a third of Alaskans (36 percent) want the Last Frontier to end and leave the union.

Only Alaskans are more interested in leaving the union than Texans. Pictured: A Texas Nationalist Movement meeting in February

Alaska is the most secessionist state in the United States. It joined the country in 1867.

This is a more popular movement than the 31 percent of residents seeking a ‘Texit’, as the exit from Texas is known.

It’s not just Republican-leaning states that want out, says pollster YouGov.

Democratic-run California and New York are next to abandon ship, with 29 percent and 28 percent of residents favoring secession, respectively.

Oklahomans (28 percent), Nebraskans (25 percent), Georgians (25 percent), Florida residents (24 percent) and Washingtonians (24 percent) are also eyeing the door.

At the other end of the spectrum is Connecticut, with only 9 percent of its relatively content residents looking for a way out.

Pollster Taylor Orth said last month’s survey of about 35,000 adults revealed “significant support” for dividing the country.

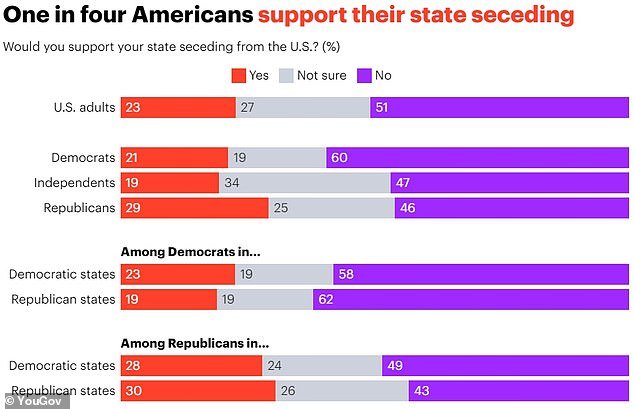

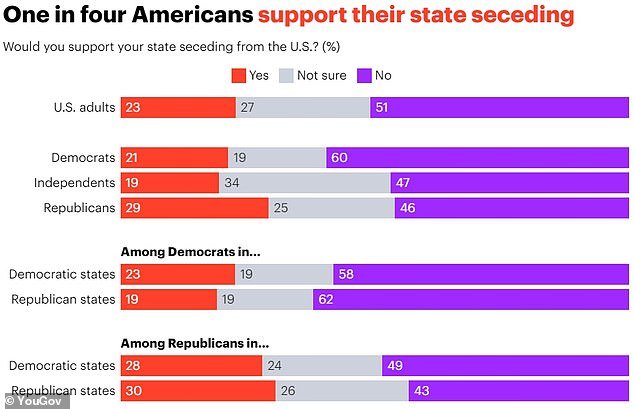

Nationally, 23 percent of respondents said they wanted their state to opt out.

About half (51 percent) opposed secession and 27 percent were unsure.

Americans have taken to TikTok to ask the big questions about secession and what happens if they separate.

Republicans favor secession more than Democrats, regardless of whether they live in a red or blue state.

Paul Roberts, a writer for the Seattle Times, said the secessionist star was on the rise.

He attributed this to “political polarization, growing urban-rural tensions, and divisions between the states…and the federal government on issues such as immigration and border security.”

The researchers found that younger adults are more interested in secession than their elders.

And Republicans are stronger supporters of division than Democrats, regardless of whether they live in red or blue states, Orth wrote in his report.

The states with the highest proportion of secessionists are not directly involved in politics, he said.

It has more to do with the size, population and perhaps even the economy of a state, the researchers said.

Alaska, Texas, California and New York, with secessionist tendencies, occupy high positions in terms of population and land mass.

Texas Nationalist Movement President Daniel Miller leads a pledge of allegiance at a barbecue restaurant in Cypress, Texas.

Americans from as far away as California, Texas, and Washington post about secession.

They also have enough economic clout to be able to go it alone, Alaska aside.

Still, the Last Frontier already has enough cash from oil and mining to pay its residents more than $1,300 each a year.

The state’s influential Alaska Independence Party has pushed for decades for a referendum in the state, while calling for gun rights, home schooling, small government and fighting abortion.

But popular support alone is not enough for states to secede, as the split of the Confederacy in the Civil War demonstrated.

Many legal scholars say the U.S. Constitution does not allow states to opt out.

The pollster found that Americans were less sure of this.

About a quarter said the states could secede under the Constitution, while a third said they could not.

Another four in ten were unsure.

Support for secession is more related to the landmass and population size of a state than to politics.

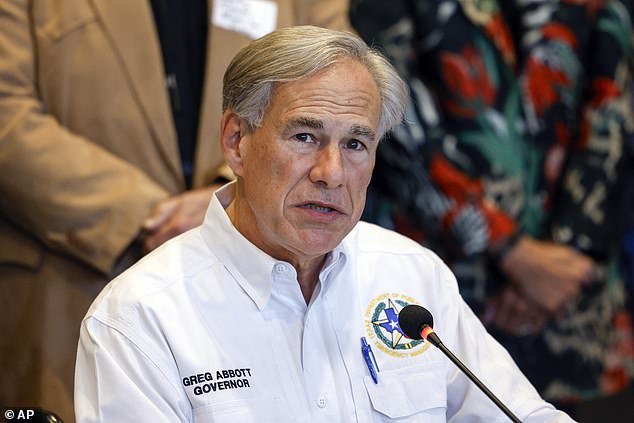

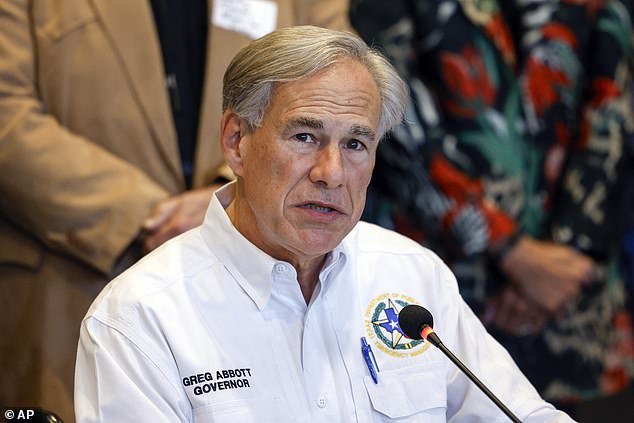

Texas Governor Greg Abbott says claims he supports Texit are ‘false narratives’

Texas Republicans are among the most passionate secessionists in the United States: 44 percent of them support Texit.

Supporters say the dramatic move, loosely inspired by Britain’s Brexit from the European Union, would help resolve a turbulent immigration border crisis and a fight with Washington over who controls the border with Mexico.

That fight, between President Joe Biden, a Democrat, and Republican Gov. Greg Abbott, has exposed a rift in the United States.

Daniel Miller, president of the Texas Nationalist Movement, says leaving the union is the only way to achieve a “sense immigration system.”

He recently told AFP that his movement, created in 2005, had never been so close to achieving its goal.

But Abbott poured cold water on the plan this weekend.

Speaking to 60 Minutes, he said claims that he was a Texit fan were “false narratives.”

His deployment of Texas National Guard members to the border was not an effort to usurp the federal government, but simply a form of “law enforcement,” he added.