A travel influencer has revealed why it can actually be cheaper to live full-time in an all-inclusive resort than to rent an apartment on top of daily living expenses in most major cities.

tiktok creator Ben Keenanof Seattle, compared his own monthly budget to the estimated cost of a month-long stay at several lower-priced resorts in Mexico and the Dominican Republic with all-inclusive booking options.

‘Have we ever considered that it is actually cheaper to live in an all-inclusive resort than to live in the apartments we currently occupy? “I was curious about this myself…and decided to try it,” she began in the clip of her.

Ben broke down how he pays $2,300 for his rent along with other expenses, including $300 for utilities, $320 for his car and insurance, $400 for food, and $600 for drinks and dining, among other recurring payments, bringing his total monthly expenses to about 4,000 dollars.

Ben Keenan explored his hypothesis that it might be more cost-effective to stay at an all-inclusive resort than to spend money on an apartment in major cities.

He shared his own basic monthly expenses, which amounted to approximately $4,000.

‘It’s definitely doable!’ Ben exclaimed after some cursory investigation.

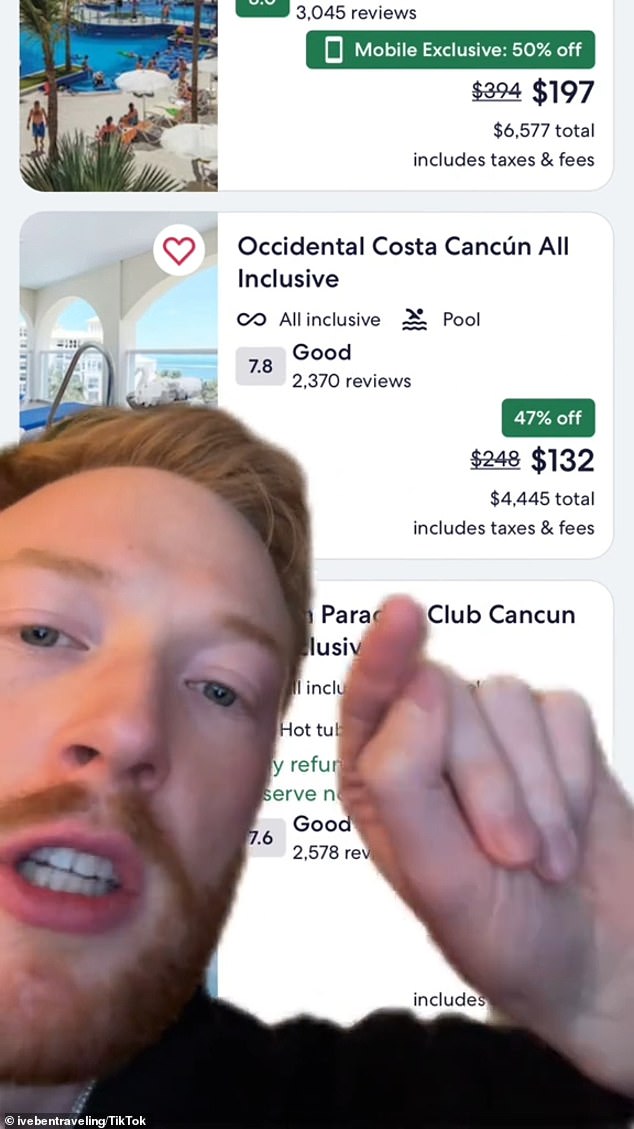

Ben then opened the search results for “all-inclusive resorts in Mexico” and began exploring the options.

When looking at resorts with availability for the month of April, many stays were priced in the range of $6,500 to $7,500 per month.

But an all-inclusive option, at the four-star Occidental Costa Cancun, priced at $132 per night through Expedia, worked out to a modest $4,445 for an entire month.

‘Yes, that’s $500 more than I normally spend on rent (and other monthly expenses). But keep in mind that I won’t be paying the most expensive rent out there. compared to what other people in Seattle might be paying, for example,” she said.

“Also, is it worth paying that $500 to not have to do a single bit of laundry, or cleaning, or whatever?”

He then explored options in the Dominican Republic.

One option, the all-inclusive package at the three-star Coral Costa Caribe Beach Resort, was $91 per night, which works out to just under $3,200 per month.

‘It’s definitely doable!’ -Ben exclaimed-.

She discovered a resort in Cancun that would cost just under $4,500 for an all-inclusive package during the month of April.

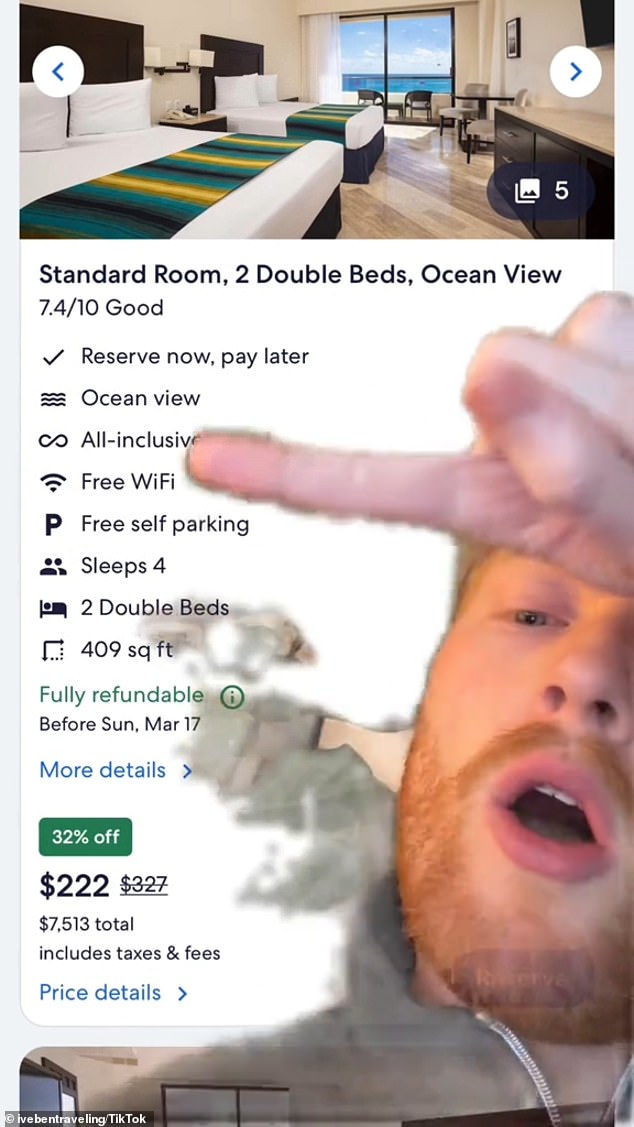

Ben reasoned that all the bells and whistles of more expensive all-inclusive stays might also make the cost worth it, especially with a roommate to split the bill.

For the “hot stuff,” meaning in the $7,500 to almost $9,000 range, Ben mused that, with a two-bed room, getting a roommate to split the cost of a month-long stay wouldn’t be the end result. . bill both to his bank account balance.

‘If you’re willing to split this, let’s say you want a roommate, a real roommate, but with all these benefits, $7,500 total, that’s less than what I would pay for my rent each month. I’d just have to share a room,’ he theorized as he pointed to a list of amenities that included ocean views, free WiFi, and free parking.

‘Do with this information what you want. I just thought it was really interesting that there was a possibility that I could actually live an all-inclusive lifestyle somewhere for about the same cost as all of my monthly expenses.

“And that’s crazy to me.”

Viewers flocked to the comments to share anecdotes that seemingly confirmed Ben’s hypothesis, as well as to imagine the possibilities in their own lives.

Viewers took advantage of the comments to fantasize about the possibilities of endless vacations as a lifestyle.

‘New retirement plan: rent our house and live in an all-inclusive resort with a butler until I die,’ one dreamed.

“All I can think of is how much time we would save without cleaning, cooking and shopping,” admitted a second.

“All alcohol, I don’t need my cleaning or lawn care staff anymore, there’s a pool… you’re onto something… and when you get tired of one place just move to another,” said a third supporting the idea.

Others shared anecdotes that seemingly confirmed that Ben’s theory had merit.

‘I met a guy on my cruise last year who LIVED on the ship. He pays for wifi and works remotely. He blew my head off,’ one claimed.

‘I work with a girl who did this. “She was working remotely and living at an all-inclusive resort in Thailand and then Mexico,” a second chimed in.

As someone succinctly put it: “You’re onto something, bro.”