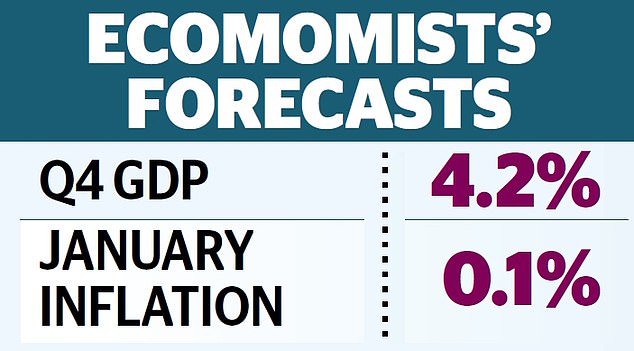

- The figures are expected to show inflation rose to 4.2% in January, up from 4% in December.

- GDP appears to have contracted 0.1% in the fourth quarter after a 0.1% contraction in the third

- Blow to hopes of reviving growth and ending cost of living crisis

The British economy looks set to suffer a double whammy this week, with figures expected to confirm a recession at the end of last year and a rise in inflation in early 2024.

That would be a blow to ministers’ hopes of reviving growth and ending the cost of living crisis as the election approaches.

However, experts believe the setbacks will be temporary. And a business survey by accountants BDO suggests output rebounded earlier this year to its strongest level in 18 months.

Figures from the Office for National Statistics, to be published on Wednesday, are expected to show inflation rose to 4.2 per cent in January as energy bills rose, up from 4 per cent in December.

Separate ONS data on Thursday is expected to show GDP contracted 0.1 per cent in the fourth quarter of last year after a difficult December of poor retail sales, public sector strikes and miserable weather.

Flying the flag: The British economy seems headed for a double whammy: figures are expected to confirm a recession at the end of last year and a rise in inflation in early 2024.

This comes after a 0.1 percent GDP contraction in the third quarter.

Two consecutive quarters of negative growth are defined as a recession and this would be the first since the pandemic broke out in 2020.

Prime Minister Rishi Sunak acknowledged in a newspaper interview over the weekend that “we want growth to be higher” but noted that the long, deep recession feared when he came to power had not occurred.

By contrast, Britain’s performance – albeit slow – has so far stayed away from a recession and outperformed that of struggling Germany.

Paul Dales of Capital Economics said Britain looks set to enjoy a so-called “soft landing”, meaning inflation falls without the economy collapsing.

“The good news is that any recession will be small and may already be coming to an end,” he added.

“We believe the economy will recover in the coming quarters.”