Suspicion that the recent easing of mortgage rates is “likely to stagnate” has triggered continued “caution” in the property market, according to the Royal Institution of Chartered Surveyors (Rics).

Nervousness over mortgage rates and “uncertainty” over the speed and timing of the Bank of England’s interest rate cuts are hampering the short-term outlook for the sector, he said.

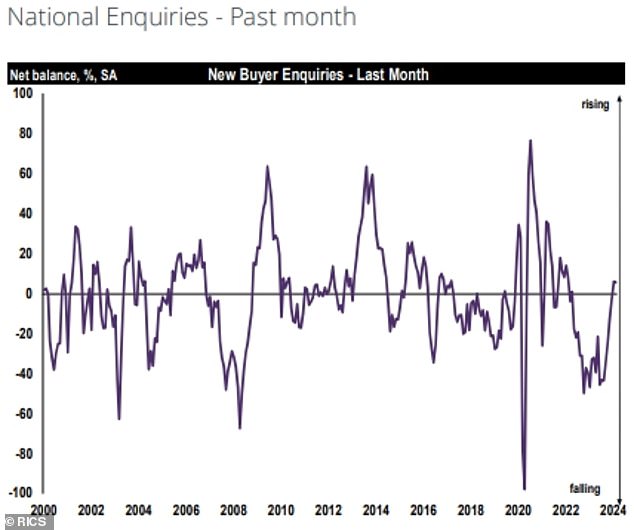

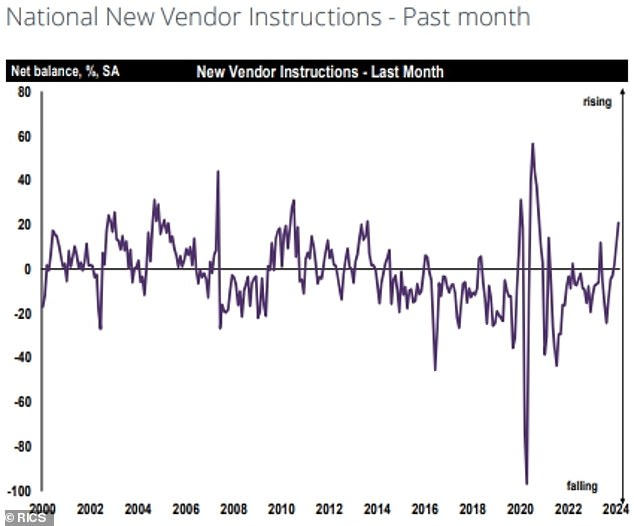

However, new listings and buyer inquiries are increasing, the Rics said, claiming a “more positive trend” was emerging. The decline in real estate prices also appeared to have “stabilized,” he added.

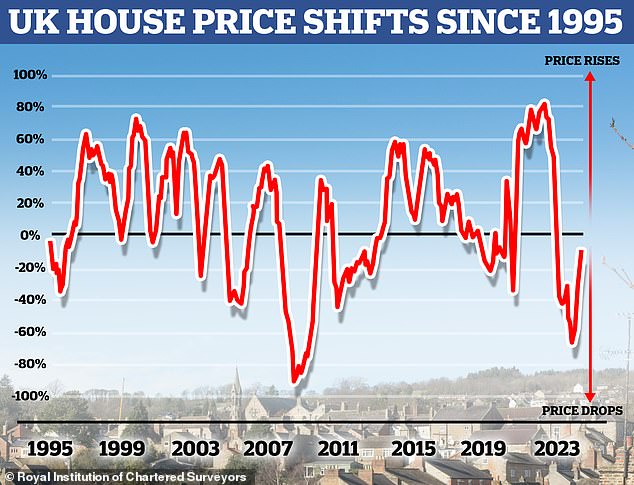

Fluctuations: UK house price fluctuations since 1995, according to Rics

This week, several of the UK’s biggest mortgage lenders announced plans to increase their mortgage rates, as interest on home loans continues to rise again.

Santander, NatWest, Co-op Bank and Principado Building Society announced that they will increase home loan rates.

But there was also a “sharp increase” in new listing instructions from sellers in February, the Rics said.

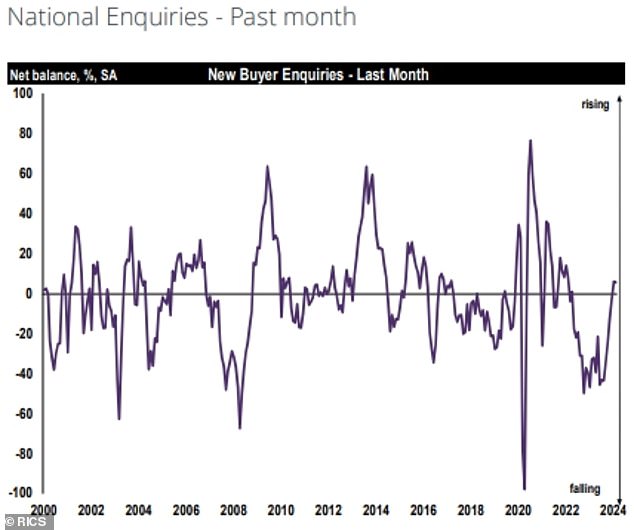

He added: “The latest net balance of +21 percent represents the strongest reading since October 2020, which is in stark contrast to the continued negative outlook cited throughout 2023.”

The net balance figure means that the difference between the number of Rics members who reported an increasing number of buyer inquiries was 21 per cent greater than those who reported fewer buyer inquiries.

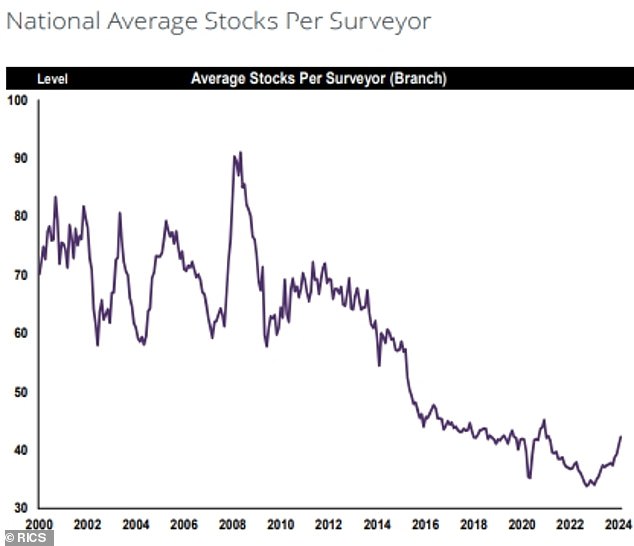

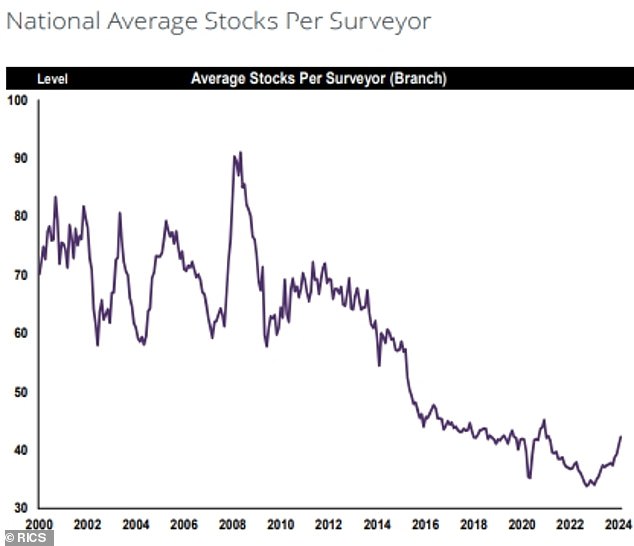

And he adds: “Consequently, the average level of stock on the books of estate agencies now stands at 42 properties, the highest level since February 2021”, although he admitted that the figure is still quite low in a comparison to more long term.

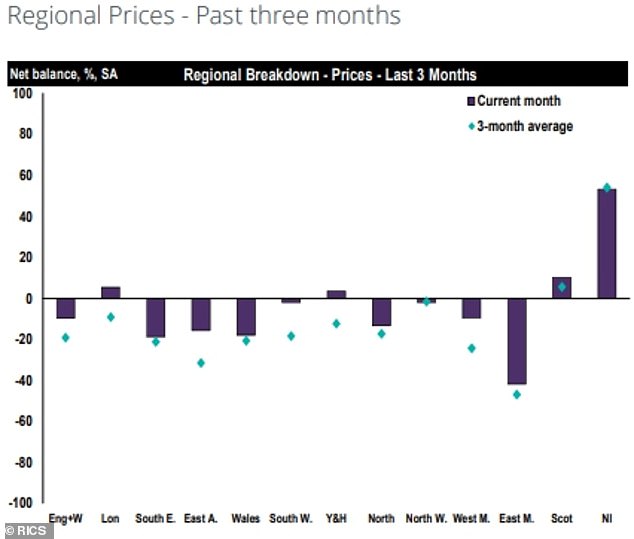

Prices: a graph showing regional changes in property prices over the last three months, according to Rics

Interest: Buyer inquiries increased in February, Rics said in its latest survey results.

Sellers: New instructions from sellers increased last month, Rics said

Stock: Chart showing average real estate agent stock levels since 2000.

House prices fall “stabilizing”

On house prices, the Rics said: ‘With respect to the survey’s measure of overall house prices, the latest net balance of -10 percent indicates that the downward trend evident over the past year is more or less stabilizing.

“In fact, February’s reading is the least negative figure since October 2022, having been as low as -67 percent in September last year.”

This means that 10 percent more respondents thought house prices were falling than the number who said they were rising.

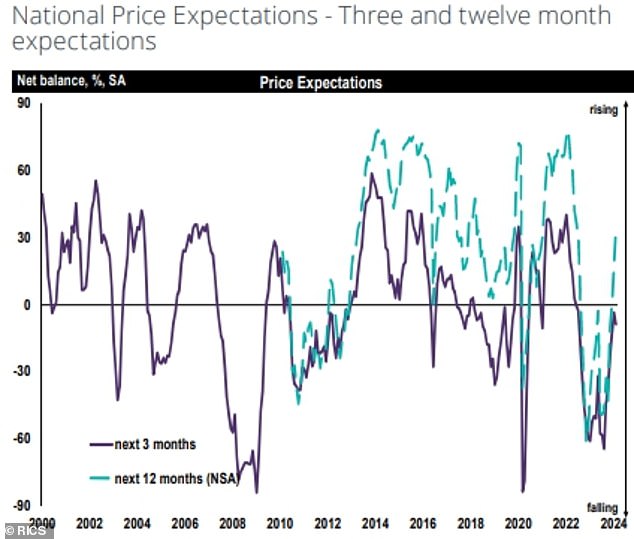

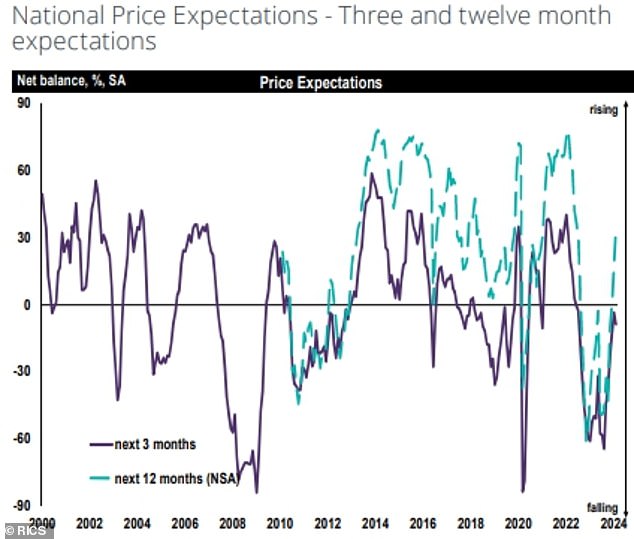

Looking ahead, a net 36 per cent of respondents in England and Wales now expect house prices to return to growth within twelve months, up from a reading of 18 per cent the previous month.

Inquiries from potential buyers increased for the second consecutive month in February. One real estate agent surveyed said he had received more than 20 offers for a single apartment in Scotland, which sold for 31 percent more than

Grant Robertson, of Allied Surveyors Scotland in Glasgow, said it was “testament to a market under pressure”.

Meanwhile, Paul McSkimmings, director at Edward Watson Associates in Newcastle Upon Tyne, said: ‘The continued lack of supply means demand for all types of properties remains strong. Sellers are more realistic when asking for prices.’

Buyer sentiment varies depending on location, and one real estate agent experienced a bleaker outlook in February.

Ian Williams, surveyor and estate agent at Robert Oulsnam & Co in Birmingham, said: “Market activity in B31 remains at a relatively low level and there is no urgency.”

The Rics said: “When broken down, most of the UK has seen a recovery in buyer inquiries over the past two months.”

Sales were “softer” than the previous month, but well above last year’s average.

The report adds: “Looking ahead, near-term sales expectations are marginally positive, recording a net balance of +6 percent.” This figure is lower than previously forecast, but activity is expected to recover further as the year progresses.

Simon Rubinsohn, chief economist at Rics, said: “The February Rics survey provides some reasons to encourage the sales market, as not only buyer interest remains positive for the second month in a row, but also rising new instructions to agents.

“Whether or not the increase in stock returning to the market is sustained will likely be a critical factor in explaining how things will play out over the rest of the year, especially given that new construction is likely to remain limited.”

Whats Next? A chart from Rics showing UK house price forecasts for next year.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.