Table of Contents

What are you doing?

This £30.5bn FTSE 100 company may not be a household name, but it does offer such well-known products as Panadol painkillers and Sensodyne toothpaste.

The group was formed in 2018 from the merger of the consumer healthcare arms of British pharmaceutical giant GSK and US titan Pfizer.

In 2022, it was spun off from GSK into the largest European listing for more than a decade and renamed Haleon.

GSK and Pfizer maintained a stake in the new company.

All GSK shareholders received one Haleon share for each GSK share they owned.

Why was GSK happy to get rid of the business?

At the time, he was under pressure from New York activist investor Elliott Investment Management, led by the feared Paul Singer. Later, Emma Walmsley, GSK’s chief executive, made peace with him.

How did the name Haleon come about?

“Hale” suggests health and “lion” derives from the Greek word meaning nobility and strength. The aim, presumably, was to suggest that it is the undisputed leader in its areas of operation, which are pain relief, respiratory health, therapeutic oral health and vitamins. Its “power” brands include not only Panadol and Sensodyne, but also Advil, Centrum and Otrivin.

Is debt a problem?

At the time of the split, Haleon borrowed heavily, largely to distribute around £10bn in dividends to GSK and Pfizer. As part of a strategy to become more “agile”, it will move Sensodyne production from Berkshire to Slovakia. The move, which involves job losses, is a setback for the government’s plans to boost British manufacturing.

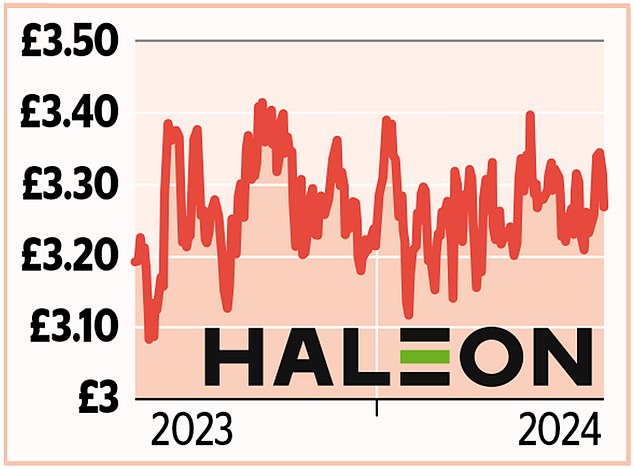

Has the stock price been healthy?

Not really. The stock has risen just 5% since its stock market debut in July 2022. It has been blamed on a number of factors, including the cost of living, lower incidence of COVID and flu, and increased attention. insufficient to marketing. There have also been murmurs about management culture.

Any other reason?

GSK has reduced its stake to 4.2 percent. Pfizer has a 24 percent stake, which it intends to reduce. This excess is a drag on Haleon shares, according to some. If the previous owners were to break all ties, this would unlock more value for shareholders.

Berenberg analysts are enthusiastic about Haleon, citing the prospects of the US launch of Eroxon, a treatment for male erectile dysfunction. The broker is targeting a price of 407p, up from 334p currently. Berenberg also says the stock is trading at a tempting 17 per cent discount to other personal care product groups.

Most other analysts are equally optimistic, although the average price target is 364p.