Pepsi nearly won its bitter battle to take the number one spot from Coca-Cola in the 1980s.

It has now fallen behind Dr Pepper, which has become America’s second favorite soft drink. Coca-Cola, of course, remains in the lead.

Just 20 years ago, Dr Pepper’s sales were less than half those of Pepsi. At the time, one in nine soft drinks purchased in the United States was Pepsi, and Dr Pepper was only the sixth most popular behind Sprite.

But 139-year-old Dr Pepper has increased its market share with advertising pushes, new flavors and the boost of TikTok trends.

At the same time, consumers have shifted from standard Pepsi to lower-sugar versions and rivals like Dr Pepper.

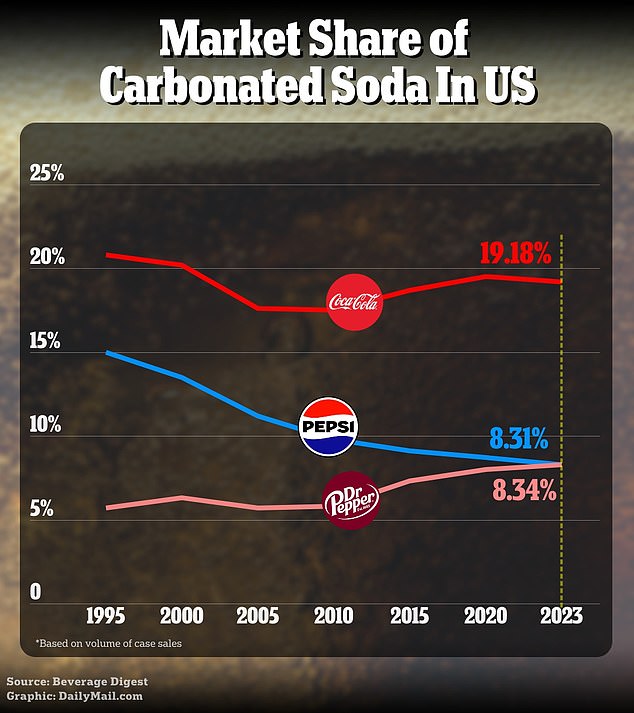

The chart belowbased on a Beverage Digest reportshows how the market share of both has converged, with Dr Pepper slightly ahead.

Dr Pepper is now the country’s second favorite soft drink along with Pepsi.

Coca-Cola remains the undisputed king of the $97 billion U.S. soft drink industry, with more than double the market share of any of its rivals at 19.18 percent.

Pepsi’s market share is 8.31 percent and Dr Pepper is now 8.34 percent.

The Pepsi brand remains the No. 2 soft drink overall, when taking into account diet and sugar-free versions.

Dr Pepper, invented in 1885 by Charles Alderton in Texas, is older than Coca-Cola, which arrived a year later, and Pepsi, in 1893.

Despite coming in first, Dr Pepper struggled against its rivals who fell further away during the cola wars.

The bitter battle began in the 1960s, when Pepsi launched its Generation Pepsi campaign, presenting the drink as a modern alternative to Coca-Cola for younger people.

Pepsi, which also ran ads featuring Michael Jackson in 1984, never caught Coca-Cola. But it came very close in the 1980s.

And aside from three years starting in 2010, when Diet Coke took over, regular Pepsi has maintained the No. 2 spot since Beverage Digest began collecting data in 1985.

Dr Pepper has been helped by the rivalry between Coca-Cola and Pepsi, which tend to have exclusive deals with national restaurant chains, so they only have one type of cola.

For example, McDonald’s is Coca-Cola but KFC, Pizza Hut and Taco Bell are Pepsi. Meanwhile, Subway will switch from Coca-Cola to Pepsi in 2025.

But Keurig, owner of Dr Pepper, has agreements with both parties, so it involves fountain drinks, whether branded Coca-Cola or Pepsi.

This distribution quirk has allowed the brand to be introduced to more and more consumers, Dr Pepper chief marketing officer Andrew Springate told the WSJ.

Springate has pushed the brand to make a major advertising effort, including investing in college football campaigns.

The brand is now growing faster among Gen Z drinkers, he explained.

Dr Pepper has been quick to join the trend of younger drinkers becoming interested in more unusual flavors. It has introduced variations such as its strawberries and cream flavor.

Some of these younger consumers also become fans of the brand’s original product, according to Springate.

A bottle of Dr Pepper from 2005, when the drink had only half the market share of Pepsi.

Old Dr. Pepper advertising sign on a building in downtown Pittsburg, Texas

The original drinks Pepsi and Dr Pepper are now tied in market share by volume.

Coca-Cola remains the undisputed dominator of the US $97 billion soft drink industry.

Dr Pepper has also benefited from popularity on TikTok, where the trend of people filling popular Stanley cups with ice and Dr Pepper has gone viral.

TikTok also introduced Dirty Doctor Pepper, a soda mix with lime juice, coconut-flavored coffee creamer, and optional liqueur.

The brand has tried to capitalize on its popularity on social media by launching its own Dr Pepper Creamy Coconut drink.

“Dr Pepper has used compelling marketing and exceptional market execution to capitalize on consumers’ growing desire for flavored soft drinks,” Duane Stanford, editor of Beverage Digest, told DailyMail.com.

“Dr Pepper has gone from a Southern staple to a national competitor.”