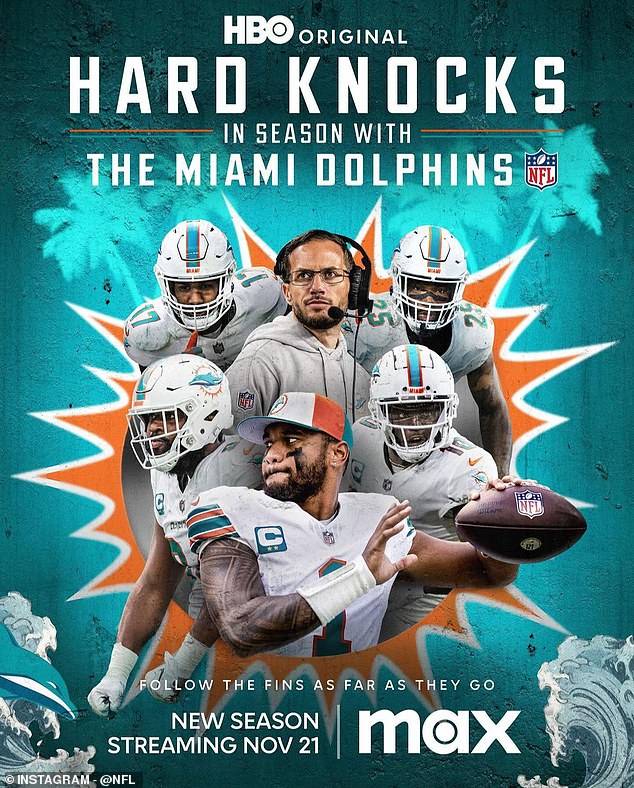

- The Miami Dolphins starred in the third edition of In Season Hard Knocks

- The NFL and HBO documentary series has featured half of the NFL’s 32 franchises.

- DailyMail.com provides the latest international sports news.

<!–

<!–

<!–

<!–

<!–

<!–

The NFL has announced that the In Season Hard Knocks docuseries will now feature an entire division instead of one team.

On Tuesday, Mike Garafolo reported that NFL Network CEO Brian Rolapp revealed the series’ new format. The first division to be introduced has not yet been chosen.

Since 2013, the NFL has required teams to appear in the preseason edition of the series if they do not meet three criteria: not having been on Hard Knocks in the last ten seasons, hiring a new head coach, or having appeared on the playoffs in either of the last two seasons.

As a result, the pool of eligible teams was drastically reduced. The series finally got the New York Jets for the 2023 preseason with the arrival of Aaron Rodgers.

Hard Knocks has split the receptions, prompting the NFL media team to propose changes to improve the program. The first significant change was to cover an entire division during the season, the criteria for which have not been revealed.

The NFL announced it will begin covering entire divisions for In-Season Hard Knocks

The In Season Hard Knocks edition began in 2021 and featured the Miami Dolphins last year.

Additionally, some teams did not feel comfortable being filmed during their preparations. Ahead of the 2023 season, the Jets reportedly limited HBO access, further amplifying the outcry over another bad season.

Rodgers, who suffered a season-ending injury in his first game with New York, said; “It was forced into us and we have to deal with it.”

After the Jets, the In Season edition came out in November, with the Miami Dolphins.

The series first aired in 2011, with the Baltimore Ravens starring in the debut season. In 2021 the In Season edition began with the Indianapolis Colts. The following year he featured the Arizona Cardinals before the Dolphins last year.

After more than two decades, 16 of the 32 NFL franchises have managed to avoid the HBO cameras. On the other hand, the Dallas Cowboys have appeared three times, while the LA Rams, Cincinnati Bengals and Jets have each made two seasons.