Elon Musk has labeled Don Lemon a ‘pompous fool’ after the two men spectacularly fell out following an interview for the former CNN star’s new X show.

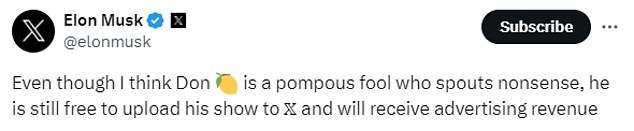

Musk took to X on Friday, writing: “While I think Don (lemon emoji) is a pompous jerk spouting nonsense, he is still free to upload his show to X and will receive advertising revenue.”

The billionaire wrote shortly after Lemon appeared on The View to detail their broken relationship and their upcoming sit-down interview.

Musk approached Lemon to debut a new chat show on X following his dismissal from CNN in April 2023.

But the Tesla and SpaceX tycoon canceled his contract after a tense interview for the same show that was filmed recently.

Musk has shared his thoughts on Don Lemon after Lemon dished on their strained relationship during Friday’s episode of The View

Don Lemon revealed Elon Musk was discreet with him about his private chats with Donald Trump before the ‘tense’ interview resulted in the Tesla billionaire deciding to ax his show

It saw Lemon grill his former boss over a proliferation of hate speech on X since Musk bought the social media platform formerly known as Twitter.

The show will still air on X, but Musk and Lemon no longer have an exclusive contract, meaning it will also air elsewhere.

“I think being fired by Elon Musk is something you should wear as a badge of honor,” host Ana Navarro told Lemon.

Despite the rift, Lemon revealed he was able to glean some more information about Musk’s relationship with Donald Trump, which has been in the spotlight following reports the two billionaires had met.

Lemon appeared on The View on Friday to plug the upcoming show, which is still going on through other platforms, taking comfort in the cancellation

Lemon was supposed to partner with Musk’s X before things turned sour after the former CNN anchor asked him about the rise in hate speech on his app

‘Did he show his hand whether he would support Trump?’ asked host Alyssa Griffin.

“He talked about the meeting, why he went down, the context and the meeting place, and he talked to me about what the former president had to say,” Lemon responded.

Musk met with Trump in Palm Beach, Florida, fueling speculation that he may be about to provide a much-needed cash injection to the presidential hopeful’s campaign.

Few details have been released about the meeting, although Musk publicly denied he would endorse a candidate soon after.

The South African CEO invited Lemon to bring his show to X after the former CNN host was dumped by the network in April 2023 following allegations of misogyny.

But Musk rejected the multimillion-dollar deal hours after the sit-down, during which Lemon asked him about hate speech on Twitter and his drug use.

In a clip played on The View, Lemon asked Musk about X-users and hate speech, including the ‘great replacement theory’ that Musk himself has reinforced.

The ‘Great Replacement Theory’ preaches that white European populations are demographically and culturally replaced by non-white peoples – especially from Muslim countries.

Musk rejected the multimillion-dollar deal hours after the sit-down, in which Lemon asked him about hate speech on Twitter and his drug use

Speculation was sparked that Musk might endorse Trump after the two met in Florida. Pictured: President Donald Trump speaks with Tesla and SpaceX CEO Elon Musk at the White House on February 3, 2017

But the billionaire was unimpressed and refused to answer the question directly, telling Lemon he didn’t have to agree to the interview.

‘I don’t have to answer questions from journalists. Don the only reason I’m doing this interview is because you’re on the X platform and you asked for it. I’m constantly criticized, I couldn’t care less.’

The exchange prompted The View co-host Joy Behar to label Musk a ‘snowflake’ and ask Lemon if he knew what he was getting into with the controversial billionaire.

‘There’s an old saying in the south, you knew I was a snake when you picked me up. I’m not saying he’s a snake, but it’s in relation to this situation that I went into it with my eyes open.

‘I really went into it with the best of intentions. I’m an independent, no matter what people think, Elon Musk thinks, I’m on the left, I’m an independent.

‘I believe in freedom of speech. I believe people have the right to say what they want to say, but you suffer the consequences of it.

“Twitter or X is one of the biggest information platforms in the world, so why hand it over to extremists? I wanted to get on their side and fight it so everyone could have a voice.’

Lemon revealed that he was able to gather some more information about Musk’s relationship with Donald Trump, which has been in the spotlight following reports the two had met.

Musk has stated that he is not endorsing any candidate in the upcoming election

Lemon has previously claimed he is unaware of why Musk got ‘so upset’ about the interview, the billionaire countered that he got the show canned after finding out Lemon’s approach was ‘basically just CNN, but on social media’.

“And instead of it being the real Don Lemon, it was really just Jeff Zucker speaking through Don, so lacked authenticity,” he wrote on Twitter.

In the clips that emerged from the piece, which Lemon described as “tense at moments,” the pair covered a wide range of topics, including Musk’s drug use, his lack of support for Joe Biden and questions about X’s moderation.

CNN aired footage showing Lemon questioning Musk about his recreational use of the horse tranquilizer ketamine.

The Tesla founder’s use of the drug has been widely publicized, and he himself has admitted to taking it.

‘The reason I mentioned prescription ketamine on the X platform is because I thought, “Maybe this is something that could help other people.” That’s why I mentioned it.

“Obviously, I’m not a doctor, but I would say that if someone has depression issues, they should consider talking to their doctor about ketamine.”