- One player shot with just 0.6 seconds left and gave his team a 1-point lead early.

- The referees ruled out the winning play, with Camden now in the final.

- DailyMail.com provides the latest international sports news.

<!–

<!–

<!–

<!–

<!–

<!–

A high school in New Jersey has taken legal action in an effort to overturn a playoff loss after replays conclusively showed that the officiating crew wrongly overturned the game-winning shot.

Manasquan High School, whose winning game against Camden on Tuesday in the state semifinals was overturned by referees even though the basketball was thrown before time expired, has filed a lawsuit in an effort to keep the championship game of Group 2 on Saturday against Arts. , since it seems that the result of the semifinal will be annulled, according to New Jersey.com.

Clark Law Firm represents the Manasquan Board of Education and will seek “injunctive relief” from New Jersey Superior Court Judge Mark Troncone. A hearing could now take place on Thursday, attorney Gerald Clark told the website.

“We are asking Judge Troncone to stop this game on Saturday pending a judicial review of what happened,” Clarke told NJ.com. “What we’re trying to do is hold the game back pending who the right team should be to be in that game and declare Manasquan the winner. We’ll argue that the NJSIAA rules would require them to use the videotape to get the result.” correct.’

The viral video on

Manasquan’s Griffin Linstra shot before the buzzer and with 0.6 seconds left, video shows.

Since the controversial ending to Tuesday’s game, the NJSIAA has admitted to receiving the wrong call, but is sticking to its bylaws that do not allow replay review. Therefore, the incorrect call stands even though the referee who said he thought the ball was still in Lindra’s possession when time expired agreed after watching the video that the basket should have counted.

The referees did not meet to discuss the decision until Camden coaches pleaded with them, according to NJ.com, and one of the referees told the outlet that the sequence of events that followed was unusual and that “that conversation should never have happened.” “. ‘

Before the last-second appeal, the tail referee on the play, named as Kevin Torres in the lawsuit, was seen leaving the field without objecting to the decision to score a field goal attempt.

Head referee David Niven made no motion to review the decision with center referee Jerome Starr, who was the referee who made the initial decision to count the bucket, according to NJ.com.

Manasquan’s Alex Kong celebrated too soon, thinking his team had advanced to the state finals.

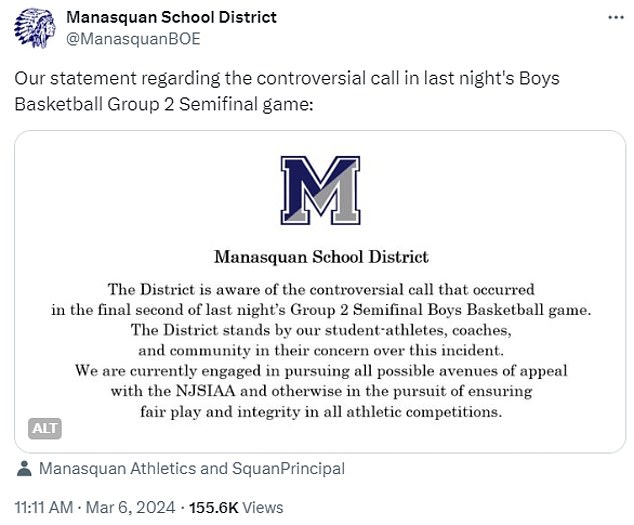

On Wednesday, Manasquan shared that he was considering legal action against the NJSIAA.

Ultimately, Manasquan’s appeal to the NJSIAA was denied.

“I’ve never seen anything like it,” Manasquan coach Andrew Bilodeau told the New York Post on Wednesday. “I’ve trained here for 16 years and 30 years total and nothing like this has ever happened.”

“Everyone recognizes this and the video shows that the original call was correct,” attorney Gerald Clark of the Clark Law Firm said in a statement obtained by NJ.com late Wednesday.

‘The correct decision was made, the game ended and the referees left the field, only to return and overturn the correct decision. The NJSIAA should follow its own rules under these circumstances and declare Manasquan the rightful winner. We have seen nothing to suggest foul play or ill will on the part of anyone in this matter and it is important to recognize that neither the coaches, players nor fans on either side had anything to do with this incorrect decision and referees make mistakes like everyone else. others. .

‘NJSIAA has the authority to correct this and it is our position that they should follow their own rules and do so. They should immediately declare Manasquan the official winner and authorize them to play Arts High School in the championship game.