Britain should scrap its “absurd” smoking ban after New Zealand U-turned on its pioneering policy, experts said today.

New Zealand was preparing to progressively raise the legal age for purchasing tobacco, in what would have been a world first.

Introduced under former prime minister Jacinda Ardern, the darling of the global left, the radical plan would have banned children born after 2009 from being able to legally buy cigarettes.

But new Prime Minister Christopher Luxon, head of a newly elected Conservative coalition government, has confirmed his plans to formally repeal it next week.

Now critics of Rishi Sunak’s plan to introduce England’s own generational smoking ban have urged MPs to abandon their “vanity project”.

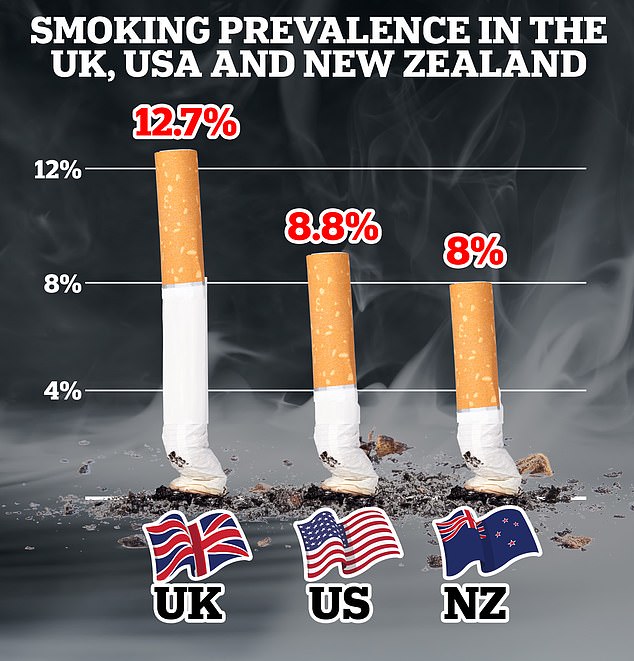

The Organization for Economic Co-operation and Development’s 2023 health report showed that 12.7 per cent of Britons aged 15 and over smoke cigarettes daily, higher than the United States and New Zealand. The latter was due to implement its new smoking ban from July.

Critics of British Prime Minister Rishi Sunak’s plan to impose England’s own generational smoking ban have urged MPs to abandon their “vanity project” following New Zealand’s abandonment of its policy.

Christopher Snowdon, head of lifestyle economics at the conservative Institute of Economic Affairs think tank, said this showed how reckless the UK’s pursuit of a similar ban was.

“In New Zealand, the generational tobacco ban was an authoritarian holdover from Jacinda Ardern’s left-wing government,” he said.

‘The new government realized that prohibition doesn’t work and rightly abandoned it.

“The UK is now the only country in the world taking this absurd idea seriously.”

Snowdon urged MPs to end what he called Sunak’s “vanity project”.

“Mr Sunak is unlikely to be Prime Minister when the damage caused by his ban begins to show,” he said.

“Sensible MPs should take the opportunity of a free vote in Parliament and put an end to their vanity project.”

Maxwell Marlow, research director at the Adam Smith Institute think tank, added: “New Zealand’s first smoking ban should have been, at most, the last smoking ban in the world.”

‘We should not be surprised that it has been completely repealed.

“Quite apart from the infringement on our freedoms that the UK’s proposed generational ban represents, it is far more likely to increase, rather than reduce, harm to public health by driving smokers into the arms of criminals who They operate in the black market and its potentially far more dangerous products.

‘The New Zealand Conservative government realized the errors of this approach; we must hope that it is only a matter of time before ours does the same.’

Sunak announced his bold plan to eradicate smoking in England at the Conservative party conference in September last year.

Their proposal, similar to that of the Kiwis, is a progressive increase in the legal age to purchase tobacco products, so that a person born after 2009, who is now 14 years old, would never be able to legally buy cigarettes.

The government announcement that followed boasted that this would essentially eradicate smoking among young people in England by 2040.

While celebrated by health charities, the policy was fiercely criticized by think tanks, as well as some within Sunak’s own party, for being a notably unconservative and nanny-state attack on people’s freedoms.

They also warned that this would only drive future smokers into the arms of the black market.

Charities and experts said Sunak’s smoking ban will save tens of thousands of lives from preventable smoking-related causes such as cancer, heart attacks and strokes.

Cancer Research UK chief executive Michelle Mitchell said in November: “Smoking rates fall when leaders take decisive action – that’s why we support the UK Government’s commitment to change the tobacco sales age announced today in the King’s speech”.

‘The Government should take steps to bring this legislation before Parliament in early 2024, and we call on MPs from all parties to support it.

‘I’ve never met anyone who wants their child to start smoking. Cancer Research UK estimates that there are currently around 885,000 young people aged 16 to 24 who smoke in the UK.’

The Government itself claims that, if enacted, the gradual ban will result in 1.7 million fewer people smoking by 2075, saving tens of thousands of lives and preventing up to 115,000 cases of stroke, heart disease, lung cancer and other diseases. lungs.

The new coalition government elected in October confirmed that the repeal will occur on Tuesday as a matter of urgency, allowing it to repeal the law without soliciting public comment, in line with previously announced plans. In the photo: Prime Minister of New Zealand, Christopher Luxon.

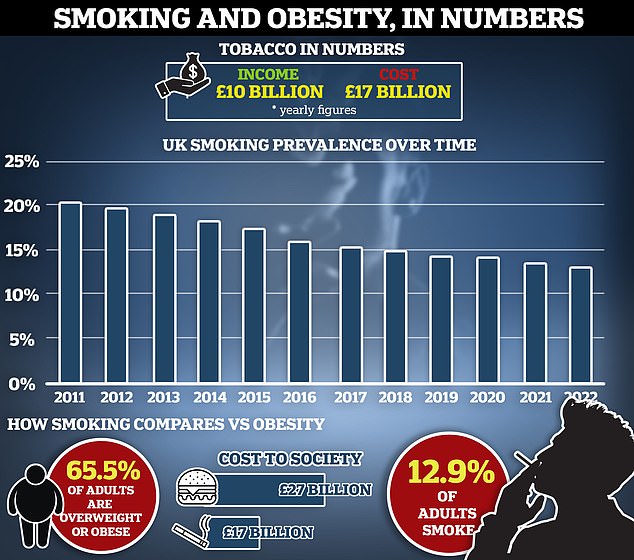

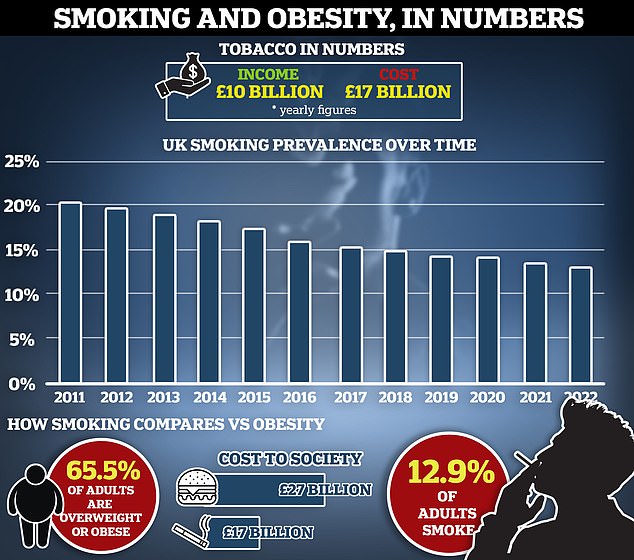

To further justify the policy, the Government also brandished statistics claiming that smoking costs the economy £17 billion a year due to lost productivity and knock-on effects for the NHS.

But one potential casualty of the policy is tobacco taxes, which officials estimate will raise £10.4bn for the Treasury this year. That amount will inevitably decline under the Prime Minister’s plan.

The phased smoking ban is part of the Government’s efforts to make England “smoke-free” by 2030 – meaning less than 5 per cent of the adult population smoke.

It was originally touted in a major 2022 review led by Dr Javed Khan to reduce smoking in England, but met with a lukewarm reception.

New Zealand Deputy Health Minister Casey Costello said the new coalition government was still committed to reducing smoking in New Zealand.

But he added that a different regulatory approach was being taken.

“I will soon present to Cabinet a package of measures to increase the tools available to help people quit smoking,” he said.

The decision has been heavily criticized for its likely impact on health outcomes in New Zealand, and has also drawn criticism over fears it could have a greater impact on Māori and Pasifika populations, groups with higher rates of smoking.

It is well established that smoking increases the risk of several serious lung conditions, as well as diseases such as cancer.

The habit is linked to 64,000 deaths each year in the UK.

Regarding cancer, specifically cancer represents a quarter of all deaths from this disease and 70 percent of all cases of lung cancer.

The impact of smoking on the cardiovascular system also increases the risk of heart attacks and strokes.

The latest data from the Office for National Statistics shows that traditional smoking is already declining in the UK.

It found that only 12.9 percent of adults, about 6.4 million people, smoked cigarettes in 2022.

This is the lowest proportion of the adult population since records began in 2011.

People aged 25 to 34 were the most likely to be smokers last year, at 16.3 per cent, while Britons aged 65 and over were only 8.3 per cent.

Historically, overall smoking rates in the UK are much lower than their peak in the 1970s, when around two in five adults were smokers.