A cruise ship passenger shared an urgent warning after learning that Medicare would not cover her medical expenses after she broke her wrist on board.

Alice Springs woman Barbara Clifford had planned the trip of a lifetime with her son Brandon, 20, in March.

The couple were on a cruise leaving Sydney and heading to the Whitsundays Islands in Queensland when they fell just minutes after a stopover in Port Douglas.

“At the marina, while walking up the slight slope toward the trail, I tripped over my own feet and my entire body weight hit my wrist,” said the life coach and motivational speaker.

“I took a 45-minute taxi to the nearest hospital in Port Douglas for an x-ray, but I was worried I wouldn’t be able to get back to the ship before it sailed again.”

He was able to see a doctor at Mossman Hospital in Port Douglas, where he had X-rays and a splint put on his wrist before rushing back to port.

‘Fortunately, things came at the right time. But I had a lot of anxiety in that waiting room for the ship to leave,’ he said.

He rejoined his cruise before setting sail, but decided not to seek treatment at the onboard medical clinic after being told it was not covered by Medicare and would be a significant expense.

Barbara Clifford, 52, from Alice Springs, didn’t realize Medicare wouldn’t cover her while she was on a cruise to the Whitsundays.

Once home, Barbara discovered that her wrist had not healed properly and would require extensive surgery as a result.

He said that when he returned he went to a fracture clinic and was told that the splint on his wrist had seriously deteriorated and had healed crooked.

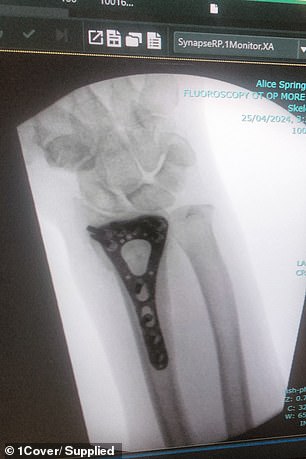

“It needed to be re-broken, operated on immediately and a titanium plate put in,” Mrs Clifford said.

“I’m still in my ninth week of rehab and recovery and I’m starting to get back to driving.”

According to the government’s Smart Traveler website, many cruise ships have no doctor or Medicare-covered medical facilities, even if they are based in Australia.

“Once your ship leaves port, even if sailing through Australian waters, Medicare or your private healthcare provider no longer covers medical or hospital expenses,” confirmed Natalie Smith from 1Cover Travel Insurance.

‘This means they will not cover any expenses incurred on board the ship.

“You are also not covered by Medicare or private health services when you are on land for cruise excursions.”

Ms Clifford fell and fractured her wrist, but because she did not want to pay the ship’s doctor’s bill, she went to the hospital after the cruise ended and was told her wrist would need to be rebroken and a titanium plate fitted.

Ms Smith said Ms Clifford should have taken out “cruise cover”, which would have entitled her to receive “onboard treatment”.

“If you had not been able to continue your cruise due to your accident, you would have also had your return home covered to receive appropriate medical care,” he said.

“Too many people assume they will be covered by Medicare, when in reality they are not covered by Medicare or their private health fund if they need medical treatment once their ship has sailed.”

In July, a woman aboard P&O’s Pacific Adventure complained she had been hit with an $8,000 medical bill after falling on a dance floor and breaking her ankle.