Martin Lewis has revealed how energy users can save more than £200 on their energy bills each year.

The British money-saving expert, 52, spoke about the advice on Tuesday night’s episode of The Martin Lewis Money Show Live on ITV.

He urged Britons to abandon capping energy prices, which are currently still used by eight in 10 households in England, Scotland and Wales in the UK.

Audience members who compared their prices found they could save up to £240 a year on their energy and electricity prices if they switched to a fixed tariff instead of the default maximum price.

Martin told the live audience: “Everyone will have to pay an arm and a leg this winter, but I’m trying to reduce that charge.”

Martin Lewis has revealed how energy users can save more than £200 on their energy bills each year.

“We haven’t missed the boat yet and there is still a huge opportunity to save,” he said.

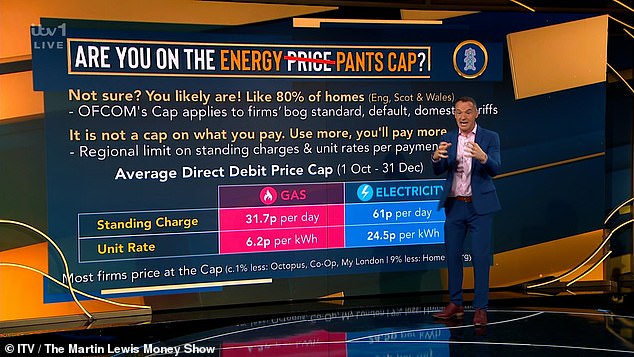

Are you the energy price cap or, as I call it, the energy “pants” and, frankly, my job tonight is to get most of you off that cap?

‘If you are subject to the energy price cap, as most of you are, you are paying too much.

“If you’re not sure you’re on it, you probably are since it applies to 80 percent of households.”

The energy price cap is a limit on the maximum amount that energy suppliers can charge for each unit of energy and standing charge. It is set every three months by Ofgem every January, April, July and October.

Martin explained that Ofcom’s price cap applies to businesses’ standard default national rates in England, Scotland and Wales, and revealed that many are under the price cap without even realizing it.

He continued: ‘If you’ve never changed, you have a price ceiling. If you had a flat rate or a special rate that ended and you did nothing, you are at the maximum price.

‘If you have a fixed rate or a special rate that you have actively tried to obtain other than the normal rate, it is not in the maximum price and the maximum price does not apply.

Martin urged Britons to abandon the energy price cap, which is currently still used by eight in 10 households in England, Scotland and Wales in the UK.

Martin calls the energy price cap the “pants” cap and says his job is to get people off it.

‘EDF, Scottish Power and British Gas call their fixed price limit the standard variable tariff. Octopus and E.ON call their capped price tariff the flexible tariff and OVO calls their capped price tariff the simpler energy tariff.’

“It’s not a limit on what you pay; it’s actually a regional limit that depends on where you live, the ongoing charges, the daily charges you pay just to have the facilities, and the unit rate – how much you pay for each unit of gas. or electricity you use.

“And it depends on the payment method you use.”

Martin explained that most companies will set the price based on the limit set by Ofgem.

‘The reality with most companies is one solution. It changes every three months and they put it in Ofgem,’ he said, adding that some companies are an exception to this rule.

According to the money expert, the simplest alternative to a price cap is to move to a fixed rate “where the rate is fixed.”

A ‘fixed price’ energy tariff means that the unit price of gas and electricity will not change over the course of the plan, unlike the maximum price which is subject to change in the wholesale market.

“A fixed rate has been set that is about 6 percent cheaper than the current maximum price and 7 percent cheaper on average than it will be over the next year,” Martin explained.

According to the money expert, the simplest alternative to a price cap is to move to a fixed rate “where the rate is fixed.”

“That’s where I’d be looking,” he urged.

‘With a solution, it gives you peace of mind about what you are going to pay over a given period although, of course, if you use more, you pay more.

‘What you are doing is setting the standing charges, you are setting the unit rates that are paid for each unit of gas and electricity, so the fixed charge will be the daily charge.

“But the other part is not fixed because it depends on how much you use,” he explained to viewers.

“Its price depends on its use and its location, so you should do a comparison,” he said while explaining to viewers how they can search for the best deal.

He explained that consumers should specifically use a “default market-wide comparison website” to automatically display rates immediately.

Audience members who compared their prices found they could save up to £240 a year by ditching their price caps.

The money expert admitted that a few weeks ago customers could have paid even less with a fixed rate, but that it is “not too late” to change.

“For every moment you don’t do it, you’re paying more,” he urged audience members.

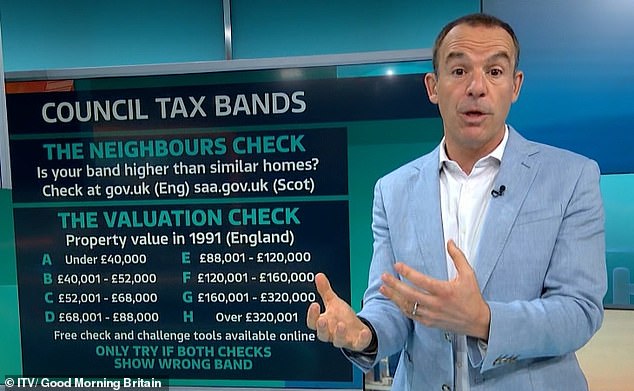

This comes after Martin revealed a quick and easy method to check if you are overpaying your council tax.

Council tax is a payment made to fund local services including garbage collection, schools and street repairs. Each home is placed in a band from A to D, which is based on the property’s valuation.

A viewer messaged the ITV show to ask Martin how to check if they are overpaying council tax.

The money-saving expert revealed two easy ways to do it, but warned: “Don’t complain unless you pass both checks.”

First, Martin said compare your band to your neighbors to see if your payout is higher.

Martin explained: ‘(I have) two checks for you. First, the neighbors. Consult with preferably identical homes, but if not, similar. You don’t have to ask them. Go to gov.uk to check your council tax band and saa.gov.uk if you’re in Scotland.

Martin Lewis (pictured) previously revealed how to check if you are overpaying council tax on Good Morning Britain.

Next, Martin recommended comparing your council tax band to the price of your property in 1991, with each price range falling into a different council band.

‘The second check you must do is not evidentiary, but you do it for your peace of mind. You have to calculate how much your house was worth in 1991 and what band it was in.

‘What it does is find when you bought your property… and convert it to 1991 prices. It sounds complicated, but there are free tools online that will do it for you.’

However, Martin warned: “Don’t complain unless you pass both checks.” Only make the appeal if both checks are clearly winning; If it’s just the neighbors’ check, it’s not safe to appeal.’