Table of Contents

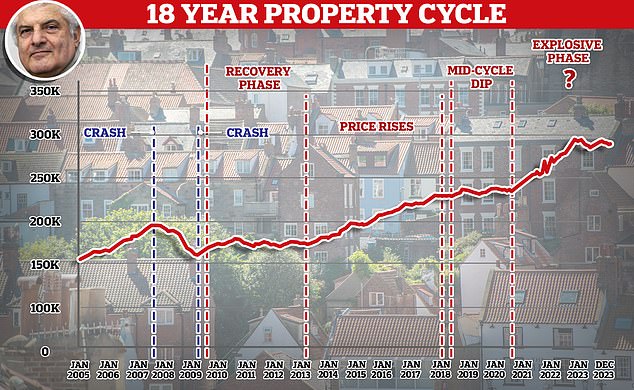

The house price prophet who predicted the last two housing crises years before they happened has warned of another boom and bust imminent on the horizon.

Fred Harrison, a British author and economic commentator famous for his theory of an 18-year housing cycle, predicts turbulent years for the housing market.

Speaking to This is Money, Harrison said house prices are about to skyrocket once again.

It expects the average UK house price to rise by around 20 per cent between now and the end of 2026.

However, Harrison expects a major crisis to hit and any progress made over the next two and a half years to be completely erased.

He believes Covid-19 caused house prices to rise higher and faster than they would have otherwise.

Property prophet: Fred Harrison believes house prices will rise by around 20% between now and 2026 before collapsing, with all gains wiped out

This is due to factors such as the 2021 stamp duty land tax exemption inflating property prices, as many sellers simply added more to the sale price of their homes.

The pandemic also caused a rush of real estate transactions, as many buyers looked for homes they could comfortably work in or with gardens.

The last year of house price declines has simply been a recalibration, Harrison says, and now the housing market is set to continue its upward trajectory.

“Prices are not falling,” says Harrison, “they are adjusting back to the long-term uptrend, after the pandemic-induced boom.”

‘They will continue to advance until the end of 2026.

“Between now and then house prices will start to skyrocket, and if history repeats itself, the increase will be roughly 20 percent above current levels.”

Harrison hopes the policy will provide the fuel that drives up housing prices, both here and in the United States.

“The general election in the UK, reinforced by the presidential election in the US, will ensure benign policies for house prices,” he says.

‘Politicians will do everything they can to please the owners. In the United Kingdom, all political parties have fine-tuned their policies so as not to damage the prospects of the coming boom.

‘If Donald Trump wins in November, major tax cuts will quickly follow. Those cuts will be capitalized on home prices.

“This will help raise confidence in global markets, giving a further boost to property prices.”

“As with the 2008 financial crisis, after the 2007 peak, it will end in tears.”

Harrison is also convinced that mortgage rates will likely continue to fall, encouraging investors, first-time buyers and movers to press ahead with their plans.

Fred Harrison developed the concept of the 18-year real estate cycle after mapping hundreds of years of data.

“Mortgage rates will fall”

Mortgage rates have generally been on a downward trajectory since August, when they peaked, and Harrison believes this is a trend that will continue.

It says: ‘Treasury bonds on both sides of the Atlantic will do everything they can to keep interest rates on a downward trend. “This will further reinforce the rise in house prices.”

He adds: ‘A Labor government would push for an increase in construction, which would convince people that all is well in the property markets.

‘So more people will take out 40-year eternal mortgages with a growing sense that prices are heading in the right direction. In a rising market people will borrow at any interest rate.

But with every boom, there must eventually come a bust.

Harrison is almost certain that this will arrive in late 2026, and the only potential obstacle that could alter his timeline is war.

It says: “The decline in house prices is projected for 2026, assuming there are no further military adventures in the Middle East and assuming Putin does not provoke NATO in Europe.”

“President Xi threatens to retake Taiwan in 2027, but housing prices will have peaked by then anyway.”

He believes the next recession could eclipse any housing collapse we’ve seen in the past.

He explains: ‘The economic crisis will cause the convergence of the existential crises that threaten our globalized society.

“If my worst fears come true, there’s no telling where the bottom of the housing market will be.”

So should you trust Fred Harrison?

Forecasting future home prices is a difficult task. Many have tried and failed in the past.

But while Harrison’s views may seem far-fetched to some, he has an uncanny knack for predicting drops in house prices.

In his book The Power in the Land, published in 1983, Harrison correctly predicted that real estate prices would peak in 1989, as well as the recession that followed.

In 2005, he published Boom Bust: House Prices, Banking and the Depression of 2010, in which he successfully forecast the 2007 peak in house prices and the subsequent depression.

According to Harrison, he had already predicted the 2008 crash at least a decade earlier.

When This is Money spoke to Harrison in 2021, he told us he warned the then Labor government about the 2008 crisis in 1997.

Harrison says he has sent a similar message to current Labor leader Keir Starmer in the expectation that Labor will emerge victorious in the next general election. However, he hopes that his advice will not be heeded once again.

He adds: ‘I have written to Keir Starmer to alert him to the prospects. Do you really want Labor to take the blame for another economic crisis? It is not surprising that the answer was evasive.’

“That was a repeat of my attempts to warn Tony Blair and Gordon Brown when they entered Downing Street in 1997.

“I wrote to them to warn them that they had 10 years to protect the UK economy against the collapse that would follow the peak in house prices in 2007. They did nothing.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.