- Santander raises fixed rates starting tomorrow for the second time this week

- Fixed interest rate operations will increase up to 26 basis points

- It follows similar moves by NatWest, Nationwide, HSBC and others.

Santander has announced it will increase mortgage rates for the second time this week, as lenders continue to increase interest on their home loans.

Starting tomorrow, the bank will increase the number of its fixed-rate operations aimed at home buyers and remortgages by up to 26 basis points.

Homeowners have until the end of today to secure Santander’s 4.4 per cent five-year fixed rate deal aimed at those remortgaging with at least 40 per cent equity.

It is currently the second lowest five-year fixed rate on the market, but starting tomorrow it could increase by up to 26 basis points.

Two rate hikes in one week: Santander raises mortgage rates again tomorrow

Anyone buying with a 25 per cent deposit may also be affected by Santander’s rate changes.

Its lowest two-year solution with a 75 per cent loan-to-value ratio currently charges 4.83 per cent with a fee of £999, making it one of the best deals on the market. All that could change starting tomorrow.

In addition to its homeowner mortgages, Santander is also increasing rates on its buy-to-let solutions by up to 22 basis points.

Last week, more than 20 lenders raised rates, including TSB, Halifax, HSBC and Barclays.

This week more joined them. NatWest and Nationwide raised mortgage rates on Monday and Tuesday, with Santander also raising some of its rates at the time.

Mortgage brokers took to the streets today citing concerns about rising interest rates after two weeks of continued rate hikes.

Ranald Mitchell, director of Charwin Private Clients, told news agency Newspage: “Santander raising rates for the second time in a week is a good barometer for market sentiment and mortgage borrowers will suffer serious consequences if this trend continues. “.

Stephen Perkins, managing director of Yellow Brick Mortgages, added: “The current market feels like a chaotic game of pass the parcel, with lenders scrambling to avoid keeping the rate lower when the music stops.”

“With rates increasing multiple times in the same week, advising clients becomes a real challenge in this ever-changing landscape.”

Many expect the Bank of England to cut the base rate when it meets next week, on May 9.

Gary Bush, financial adviser at MortgageShop, said: ‘It is becoming very difficult to discuss mortgages with customers following this week’s seemingly endless rate rises.

“All we can hope or pray is that the Bank of England saves UK mortgage account holders with a base rate cut at the next monetary policy meeting, as the mortgage rates environment turns very sour. “.

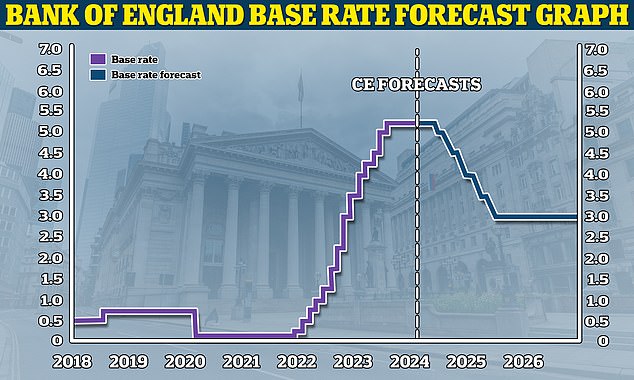

About to fall? Capital Economics forecasts the Bank of England will cut the base rate to 3 percent by the end of 2025

However, a base rate cut seems unlikely at this point.

Inflation is 3.2 percent in March and remains above the central bank’s target of 2 percent.

Financial markets are also now forecasting only two or three base rate cuts this year and the first could happen in August, although there are still some who think it could happen in June.