Table of Contents

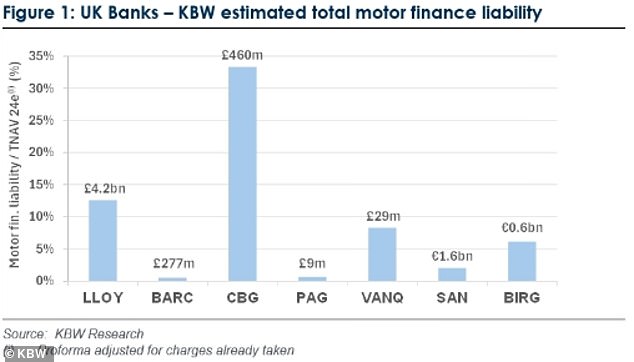

- KBW now predicts Close Brothers Group will pay £460m, up from £350m

- Meanwhile, Lloyds Banking Group is expected to pay a ‘conservative’ figure of £4.2bn.

Car finance lenders could be left with a £28bn compensation bill linked to historic loan mis-selling, according to the latest forecast from an investment bank.

Stifel-owned Keefe, Bruyette & Woods (KBW) has raised its estimates of the liabilities facing many lenders following the Court of Appeal’s recent Hopcraft ruling.

It now predicts Close Brothers Group will pay £460m, up from £350m, while Vanquis Banking Group will receive £29m in repayments instead of nothing.

KBW has also more than doubled the expected liabilities facing Black Horse’s owner, Lloyds Banking Group, from £2bn to a “conservative” £4.2bn.

In total, the New York-based company expects the car finance sector to end up spending around £28bn on compensation.

In October, the court declared it illegal for lenders to give vehicle sellers a commission on financing arrangements if the vehicle buyer had not given “fully informed consent” to payment.

Hefty payouts: Car finance firms could be left with £28bn compensation bill linked to historic loan mis-selling

The landmark decision could pave the way for the auto finance industry to pay tens of billions in damages to drivers.

KBW believes this figure could be around £28bn, just below ratings agency Moody’s prediction of up to £30bn.

A senior Financial Conduct Authority lawyer has gone so far as to say global compensation could surpass the PPI scandal, which cost UK banks £50bn.

However, last month the Supreme Court granted Close Brothers and MotoNovo owner FirstRand permission to appeal the decision.

Barclays had previously failed in its bid to overturn a January decision by the Financial Ombudsman Service (FOS) to rule against the bank in a car finance case.

The FCA welcomed the “additional clarity” brought by the High Court ruling, but Barclays said it would appeal.

Analysts at KBW said: “It is perhaps not surprising that UK banks have expressed uniform disbelief at the findings of both the Financial Ombudsman and the Court of Appeal regarding sales practices in the car finance market. “.

Last April, the FCA urged car finance groups to ensure they had “adequate financial resources at all times” to cover the costs of paying remuneration.

Close Brothers had already suspended dividend payments by then, but a few months later agreed to transfer its equity unit to investment firm Oaktree Capital Management to boost its capital position.

The FCA launched an investigation into the car finance sector in January 2024 following complaints from consumers who claimed lenders were unfairly rejecting their compensation for so-called “discretionary commission arrangements”.

Until they were banned in January 2021, DCAs allowed auto dealers and brokers to choose the interest rate in a vehicle buyer’s financing agreement, regardless of factors such as the value of the loan or the customer’s credit score.

Regulators have given auto finance companies until December 4 to issue a final response to complaints about commission payments.

KBW estimates of compensation claims faced by lenders as a percentage of their tangible net asset value

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.