An Indianapolis woman, her boyfriend and her mother have been arrested in connection with the “horrible” death of the woman’s five-year-old daughter.

On Tuesday, police were called to a report of an unresponsive child around 5:15 p.m.

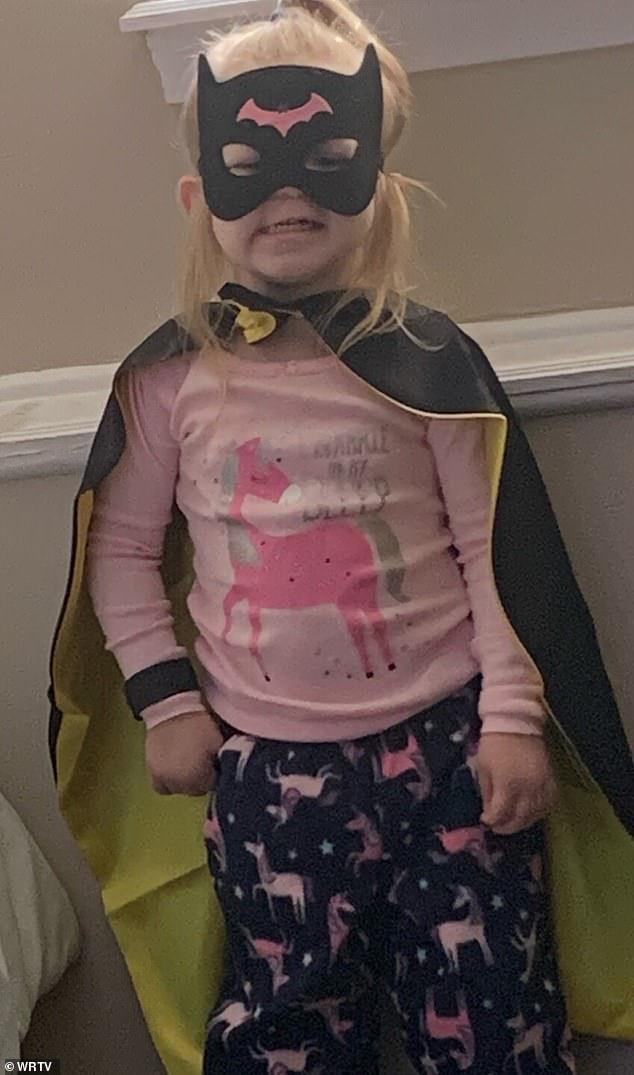

Authorities say when they found her, they found five-year-old Kinsleigh Welty looking malnourished and thin, with sunken eyes and feces on her feet and hair.

She was taken to a local hospital, where she was pronounced dead. The hospital they took her to said she weighed more at two and a half than at five.

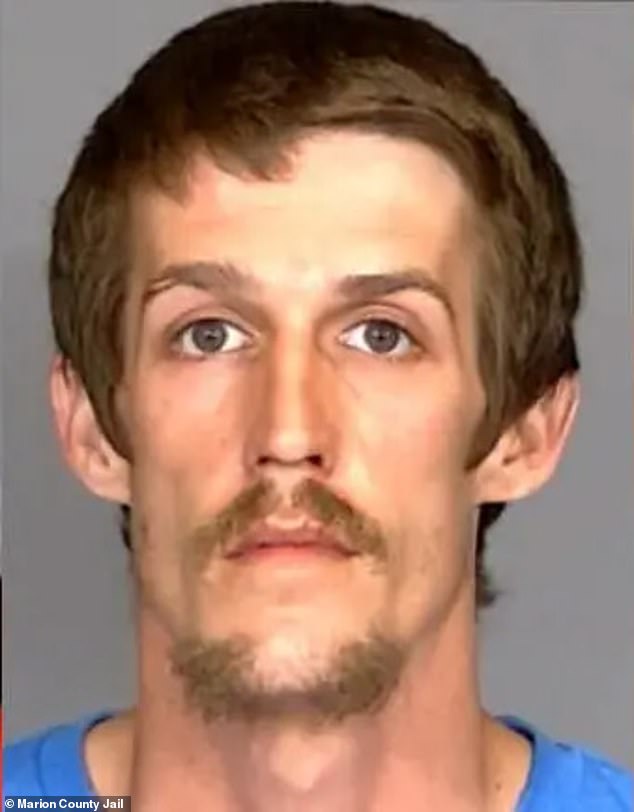

The girl’s mother, Toni McClure, 29, and her boyfriend, Ryan Smith, 27, were arrested for child neglect resulting in death, and McClure was charged with murder.

An Indianapolis woman with a history of abuse, her boyfriend and her mother have been arrested in connection with the “horrific” death of the woman’s five-year-old daughter, Kinsleigh Welty (pictured).

On Friday, Tammy Halsey, 53, Kinsleigh’s grandmother, was arrested for neglect of a dependent.

His death is being investigated by local child abuse detectives and Indiana Department of Child Services workers.

IMPD Chief Chris Bailey called the death “horrible” as court documents reveal McClure has had problems in the past.

In December 2018, McClure went to the hospital with a medical issue when Mooresville police were called to a home where he lived with several children.

A one-year-old boy and a baby just three weeks old were found with completely full diapers while the children ran and crawled on a floor full of garbage, dirt and cigarette butts. The bathroom had fecal matter that had never been cleaned.

The children also played with old potatoes near a “dirty couch, a dirty mattress and a full ashtray,” according to fox 59.

Worse still, they were within reach of expired, moldy food and sharp objects.

“It looked like the trash had never been taken out,” one officer reported. “The Nats were flying all over the kitchen and living room.”

The girl’s mother, Toni McClure, 29, has been arrested and charged with murder and neglect.

McClure’s boyfriend, Ryan Smith, 27, was also arrested and charged with neglect.

Authorities say when they found her, they found five-year-old Kinsleigh Welty looking malnourished and thin, with sunken eyes and feces on her feet and in her hair.

When officers found them, they declared the house to be “one of the worst living conditions.” [they’d] never seen’ and a ‘repulsive sight’.

They were “dangerous nightmares for an adult, let alone a small child and newborn.”

McClure was contacted about DCS’s presence at the time and began to “freak out.”

At that time, officers contacted Children’s Services to respond to the scene. When McClure was informed that DCS was at her home, she allegedly began to “freak out.”

The three-week-old girl, whose age would match Kinsleigh’s, was said to be malnourished at the time, with dirt on her head and hands and in a state of “failure to thrive”, even losing weight despite being only three weeks. .

McClure was arrested for the 2018 findings and charged with four counts of neglect, along with a man named Bradley Welty who received two counts.

She ultimately pleaded guilty to one charge and was sentenced to 900 days in jail.

McClure had his sentence suspended after just six weeks and was instead granted 540 days of probation.

In a 2018 incident that accused McClure of neglect, when officers arrived at his home, they declared it “one of the worst living conditions.” [they’d] never seen’ and a ‘repulsive sight’.

Tricia Welty (pictured right), Kinsleigh’s paternal grandmother, now feels guilty for returning the girl to McClure after living with her twice.

Tricia Welty, Kinsleigh’s paternal grandmother, now feels guilty for returning the girl to McClure after living with her twice.

Welty said she pleaded with the department of child services to do something about it, but her cries went unanswered and she is now demanding change.

‘We just don’t want his death to be in vain. We want a change. “We don’t want more children to have to die because of system failure,” she said.

“She was in our house and was safe, but she was returned to her abuser and is no longer here.”

It’s this information that has some members of the girl’s family wondering why the state didn’t intervene when it was clear McClure wouldn’t protect her children.

“As far as I was concerned, she wasn’t a mother, she was a monster,” said Kyla Welsh, Kinsleigh’s cousin. WRTV.

“It is unimaginable what we are facing now.” ‘

If parents are not going to love and protect them, and neither is the State, who is going to protect them?’ Welty asked.

Tributes paid for Kinsleigh Welty after she was pronounced dead earlier this week

“My heart breaks knowing what Kinsleigh went through in her short life and how she left this world,” Bailey said in a statement.

‘The circumstances of Kinsleigh’s death are horrific and beyond comprehension. No human being, much less a child, should be treated like her. These alleged suspects, if convicted, should never set foot outside prison.’

The law prevents DCS from commenting on these cases until a criminal investigation is completed.

Indianapolis City Councilman Joshua Bain calls for a full investigation.

“It blows your mind,” Bain said. fox 59 after writing a letter to the state department of children’s services. “It makes your stomach turn.”