President Joe Biden on Wednesday called climate change an “existential threat” to humanity as he met with a small group of supporters in San Francisco and said it was more dangerous than a “son of a bitch like Vladimir Putin.”

He also criticized former President Donald Trump for comparing his legal problems to the plight of Alexei Navalny, the Russian opposition leader who died in prison last week.

Biden made his comments during the second day of a three-day fundraising tour of California.

On Wednesday night he spoke to a high-level group of activists called the Climate Leaders Group at the Pacific Heights hall.

“We have a crazy son of a bitch like that guy Putin and the others and we always have to worry about nuclear conflict, but the existential threat to humanity is the climate,” he told them.

President Joe Biden is on the second day of a three-day fundraising trip to California. He gave a speech on debt forgiveness in Culver City before flying to San Francisco.

He arrived in San Francisco on Wednesday afternoon, where he was greeted by former House Speaker Nancy Pelosi. They traveled together on Marine One to a campaign reception.

His administration plans to impose a new round of sanctions on the Russian leader after Navalny’s death in a Siberian penal colony.

At the same time, fears are growing that Putin is about to launch a nuclear weapon into space.

However, Biden has repeatedly warned that climate change and extreme weather are now the biggest threat to humanity.

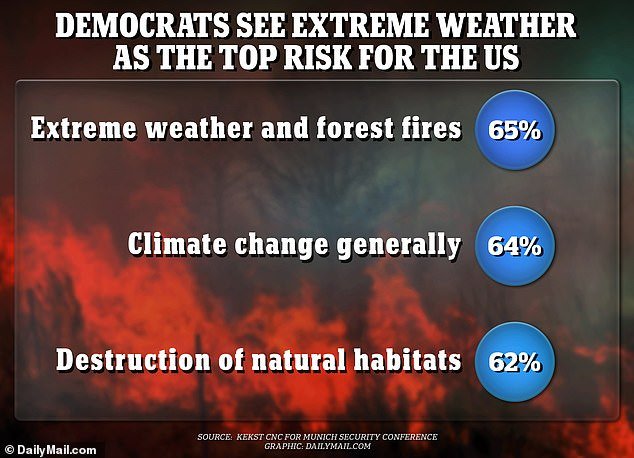

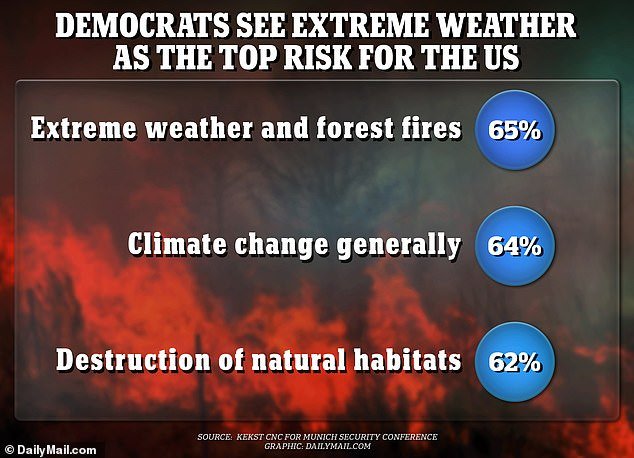

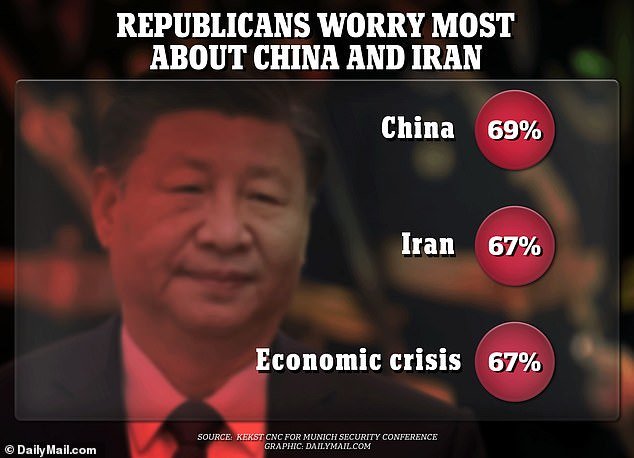

A recent poll found that Democrats agree, but Republicans see a much greater threat from China and Iran, suggesting the country is polarized over even its nightmares.

Biden also used the occasion to ridicule former President Donald Trump, who has repeatedly claimed that his plight, pursued by the courts, is similar to that of Navalny.

“You hear some of the things this guy has been saying, comparing himself to Navalny saying that this country has become a communist country, and he’s being persecuted just like Navalny was persecuted,” he said.

‘I don’t know where the hell this is coming from.

“If I was here 10 or 15 years ago and said any of this, everyone would think I should get engaged.”

He spoke to an intimate gathering of about 25 people, sitting in chairs arranged next to shelves with books such as ‘Beyond Oil’ and ‘Field Notes from a Catastrophe’.

Biden said he had seen the impact of climate change in the wildfires that have ravaged the nation.

Biden plans new sanctions against Russian President Vladimir Putin and his regime following the death of opposition leader Alexei Navalny in a Siberian prison colony.

Data from a risk perception survey conducted for the Munich Security Conference reveals deep divisions in the United States over what keeps people awake at night.

So while Democrats see the danger of extreme weather and wildfires as the most concerning,

Protesters gathered outside the Supreme Court when the court blocked President Biden’s previous student loan relief plan last June.

Former House Speaker Nancy Pelosi and her husband Paul were at the event, just blocks from his home where he was attacked with a hammer in October 2022.

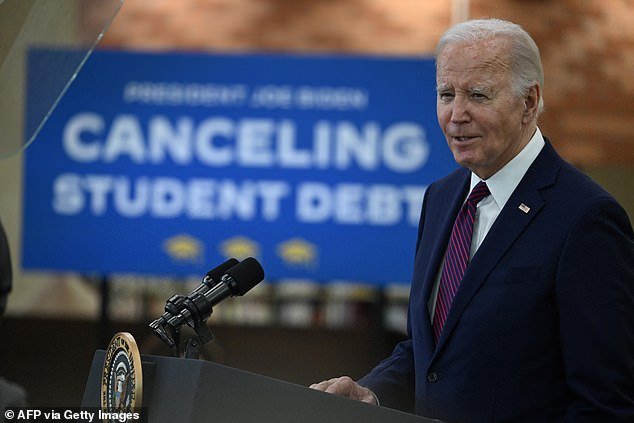

Earlier in the day he highlighted his work to forgive loans for people burdened with student debt and said even the Supreme Court I couldn’t stop him for acting.

Officials said they would automatically cancel federal student loans for nearly 153,000 borrowers as part of a faster repayment plan. This adds another 1.2 billion dollars of the 138 billion dollars canceled so far.

“Friends, I’m glad we were able to forgive these loans because when we free Americans from their student debt, they are free to pursue their dreams,” he told a small audience in front of the stacks of the Julian Dixon Library. in Culver City.

The administration sent emails to some of the borrowers who will benefit from what the White House has called its SAVE program.

To qualify, they must have been making payments for at least ten years after taking out loans of less than $12,000 for college.

Cancellations were originally supposed to begin in July, but management says they were able to start six months earlier.

More than 7.5 million people have enrolled in the plan.

Pelosi joined Biden on Marine One as they flew from the airport to the campaign reception.

Biden made an unannounced stop at CJ’s Cafe in Baldwin Hills on Wednesday before continuing on to Culver City to deliver his speech at the library.

Biden, with Los Angeles Mayor Karen Bass, posed for selfies with clients and staff.

It represents an alternative solution after the Supreme Court last year struck down a massive debt cancellation plan.

Biden expressed frustration with opponents who tried to derail his efforts.

“My Republican friends in Congress, elected officials and special interests stepped in and sued us and the Supreme Court blocked it, blocked it,” he said.

“But that didn’t stop me.”

Biden said they were wrong to think it was just the 800,000 people who had already had their loans forgiven.

‘This is a type of relief that can change the lives of people and their families. and it’s good for the economy as a whole,” he said.

‘Freeing millions of Americans from the crushing debt of student loan programs means they can finally get on with their lives.

“Instead of putting their lives on hold, they can think about buying a house or starting a family.”

After finishing his speech he was asked if he was worried that the courts would try to block his SAVE program.

“I don’t have any worries,” he said.

Biden made the announcement during a three-day campaign fundraising trip through California.

Before his speech he stopped by CJ’s Café, a Mexican restaurant, where he shook hands and posed for selfies with his followers.

He ignored a shouted question about whether he needed a strong State of the Union address to win re-election.

Los Angeles Mayor Karen Bass vouched for him. “Anyway, he’s going to win re-election,” she said, to cheers of support.