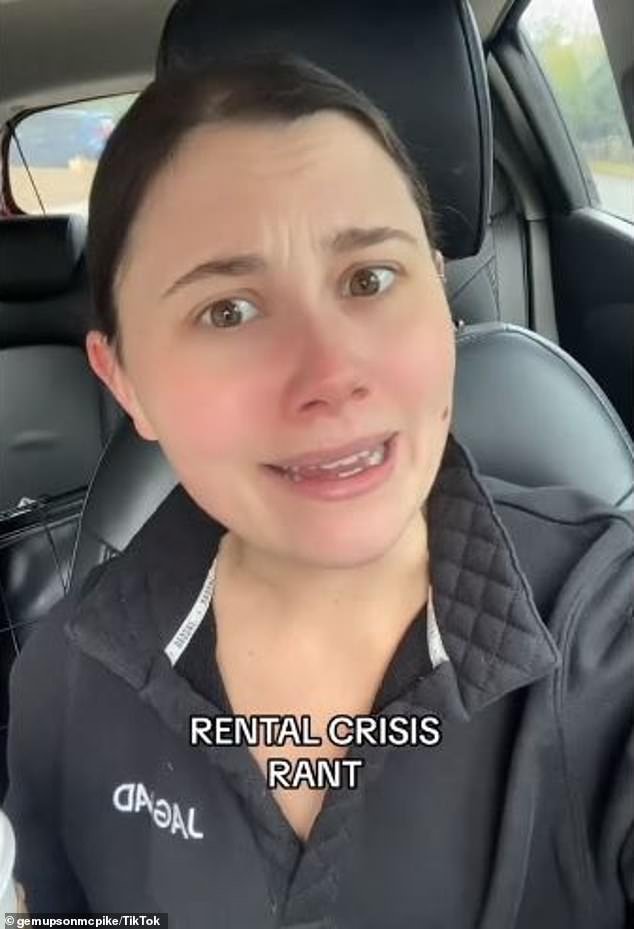

A young Australian woman forced to return to the family home has blamed the rental crisis for preventing her generation from getting ahead and owning a home.

Gemma Upson-McPike, 27, said moving in with her parents had been her only option after her landlord increased her rent from $390 to $450 a week.

The fitness trainer has lived for three years in a “small” one-bedroom apartment in Malvern, a suburb of Melbourne, and initially paid $280 a week.

‘I’m almost 27 years old and today I live with my parents again. “This isn’t the plan I had for 27-year-old me, but that’s how bad the rental crisis is right now,” Mrs. Upson-McPike fumed on social media.

The young Australian said her rent was “not worth” $450 a week and that, despite the high rent, there were cracks in the walls and no laundry service.

‘What are people supposed to do?’ she said.

‘I’m very lucky and very grateful to be able to live with my parents again, but not everyone can do that, so what’s your alternative?’ Do you like your homeless people?

“That’s why my generation can’t get ahead, that’s why we can’t buy houses.”

Gemma Upson-McPike, 26, said moving in with her parents had been her only option after her landlord increased her rent from $390 to $450 a week.

Upson-McPike said she was “99 percent sure” her landlord had paid off the mortgage on her home and owned two investment properties.

“So she’s just making money with what she can in the market,” he said.

‘I have been an exceptional tenant, rents have never been late, my inspections are always absolutely flawless and I have never caused any problems.

“I’ve been paying 20 grand a year in rent, but if I had to take out a loan on the house, they wouldn’t look at it as ‘she can pay 20 grand a year.'”

‘No. I have no savings because of how much I’ve been paying in rent and bills.’

Upson-Pike said the state of the rental market is “absolutely screwed.”

“The government really needs to take charge of this,” he said.

Dozens of tenants expressed solidarity with their situation.

The young Australian said her rental was “not worth” $450 a week and that, despite the high rent, there were cracks in the walls and no laundry service (pictured, queues outside a rental).

“Yesterday I saw a lady in her mid-twenties dressed in a nice corporate suit, take out her blanket and go to sleep in the middle of the city of Brisbane,” one woman wrote.

‘I am a 51-year-old divorced postman who pays child support for two teenage children. I have no choice but to live with my parents. Definitely emasculating,” said a second.

’27?! I am 34 years old and have 80k saved for a deposit. “Still not enough to get a house,” commented a third.

A fourth shared: “Our landlord doesn’t have a mortgage and is still charging us $900 a week for nothing out of the ordinary.”

However, others said the landlord had the right to raise the rent.

“Regardless of whether she has a mortgage, it is her house, her generation cannot get ahead because they spend, spend, spend,” said one.

“The homeowner would pay higher council rates, higher corporation rates and higher insurance rates,” a second commented.

A third shared: ‘So because they have worked hard and it has paid off, they should subsidize THEIR lifestyle? Would you do that if you were them? NO! Now is the time to enjoy a long-term income from your investment.”

It comes as record rental prices combine with record vacancy rates.

Advertised rental prices increased by 12.9 per cent in Sydney, 14.6 per cent in Melbourne and 18 per cent in Brisbane, according to the latest figures from Domain.

Vacancy rates are all below 1 per cent in Sydney, Melbourne and Brisbane.