As I scan the room, I see lists of the most detailed banking records suspended in the air in front of me. They include thousands of transactions made over the past year. Welcome to the brave new world of banking, where, with a flick of the wrist, it will be possible to apply for a mortgage agreement in principle within ten minutes.

I’m at NatWest’s headquarters on Liverpool Street, London, to try out its new virtual reality (VR) banking app, which went live two weeks ago.

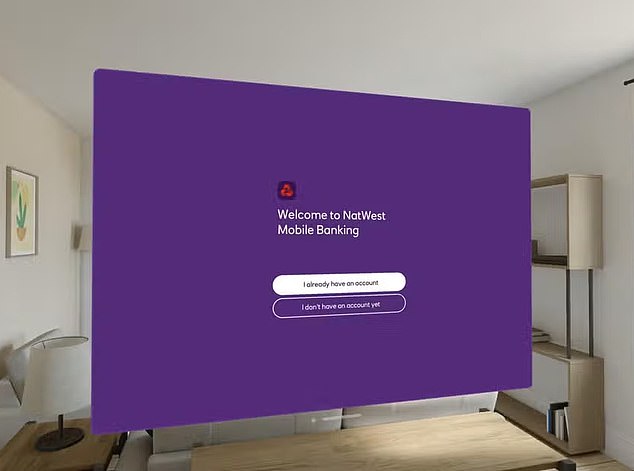

Through the VR headset, a series of bank statements, direct debits and account balances sit in the centre of my field of vision. The centre of the screen looks exactly like the NatWest iPad app.

VR technology has been popular among video game players for a long time, but it’s not exactly the ideal option for managing your finances.

However, NatWest assures me that the technology will give its customers, as well as those who save at Royal Bank of Scotland and Ulster Bank, a new way to manage their money at a time when banks continue to direct customers online.

The right direction?: Adele Cooke tried out NatWest’s new virtual reality banking app

This marks another step towards in-person banking. Almost every month, a high street bank announces plans to close hundreds more branches as online services continue to replace face-to-face contact.

Lloyds, Barclays, Halifax and NatWest closed 40 branches last month as they pushed customers to use live chat, digital assistants and mobile phone apps.

The VR app even offers more competitive savings rates than customers can get over the phone, by mail or even in a branch, although these rates are also available online and through the app.

Wendy Redshaw, chief digital information officer at NatWest Group, believes VR banking will provide “a glimpse of what the future of banking could look like”.

NatWest is the first of the High Street banks to use it in this way. “It’s fantastic to be pioneering such a new and exciting technology,” he says. It takes a few minutes to set up the headset and after a couple of attempts to log into one of NatWest’s test accounts, the app is up and running. I can see a test bank account suspended on a translucent 3D screen in front of me.

It is smooth and does not fail.

The virtual and real worlds merge seamlessly, and I place the rectangle with my banking information to the left of my body so I can still see my surroundings.

At first, it feels like I’m wearing a heavy pair of ski goggles and a wave of nausea washes over me as my eyes adjust to the goggles’ inner shield.

I take my headphones outside to check how they work there, but a sharp turn takes me straight into a tree, hidden behind my banking information.

After getting my bearings, I slide my right index finger in a bottom-up motion at shoulder height in the air in front of me to scroll through a list of all the debit card payments on the test account from the past few weeks.

Thanks to the glasses’ motion sensors, I can control the screen with a simple flick of my wrist. It takes me a few minutes to learn each hand gesture and the commands they correspond to, but once I’ve mastered them, I can open and close windows and navigate between web pages on the Internet in seconds.

Swiping left brings up another window where I can divide my spending into 12 categories, including transportation, eating out, and groceries, and set budgets for each. I then hover over a purple button on the left side of the page that opens a menu of products I can order.

I was surprised to find that I can take out a credit card, a loan, and even apply for a mortgage in less than ten minutes using the headset. All it takes is a slight pointing in the air or pinching of the fingers to close the screens.

I need some advice and ask NatWest’s virtual assistant Cora to help me close a savings account that no longer offers a competitive rate. Typing my question on a virtual keyboard at waist level is difficult and takes much longer than typing it on my computer.

Banking from home: what the virtual reality screen looks like to the viewer

Apoorva Varma Mehta, who developed the VR banking app, suggests I try to control the keys by moving my eyes, but this only works for those who don’t wear glasses or contacts, and unfortunately I need one of the two at all times.

Several features of the mobile banking app are not yet available in the VR version, including the ability to scan a check with the camera to deposit it into the bank account. Some security measures are also missing from the VR banking app, so users must log in with a passcode.

While the technology is impressive, Apoorva admits that it is unlikely to become popular overnight. “In the first week we had ten downloads,” he admits.

“Only a small group of people will be able to use the headsets for banking as they are very expensive. For the time being, we believe that most wealthy people and tech bloggers will want to use them.”

The software can only be used on an Apple Vision Pro virtual reality headset, which costs £3,499. Apoorva stresses that although adoption is slow, the device could pave the way for future developments in the banking sector.

“We are still in the early stages of experimentation as we work to understand what opportunities this new technology may present,” he said.

“It is by no means something that is going to replace telephone banking.”

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.