Table of Contents

Trainers, sneakers or trainers. Whatever you call this type of footwear, almost everyone wears it, leading to predictions that the global market could be worth £92bn by 2032, up from £70bn today.

The sector will be under more scrutiny than usual in the coming weeks as teams at the Paris Olympic and Paralympic Games compete for glory, sporting the leading brands.

And shoe makers will battle for dominance as the pace of the “sneaker wars” heats up.

Team GB to wear Adidas at Paris Olympics this summer

The British team will be wearing German brand Adidas, while the French team will compete with Le Coq Sportif, owned by Swiss company Airesis.

The US team will be on Nike, a brand that hopes advertising can reverse its decline. Sales have plummeted as the US giant faces competition from brands such as Hoka, which makes running shoes, and privately held New Balance. Nike’s classic Jordan style, named after basketball player Michael Jordan, no longer resonates with Gen Z customers.

Following a 33 percent drop in Nike shares over the past year, questions are being raised about the strategy of CEO John Donahoe, who joined the company in 2020 with a background in technology rather than sportswear.

Adidas has been doing much better of late, with its stock up 30 per cent in 12 months. Its Samba trainers are worn by Bella Hadid, Harry Styles and many fashionable women, who pair them with a long dress with floral prints.

At US giant Nike, sales plummet due to tough competition

Model Hailey Bieber shows off Nike Air Force sneakers in Los Angeles

When then-Prime Minister Rishi Sunak was photographed wearing a pair of them earlier this summer, fashion fans were left dismayed. But somehow, the sambas just got even cooler.

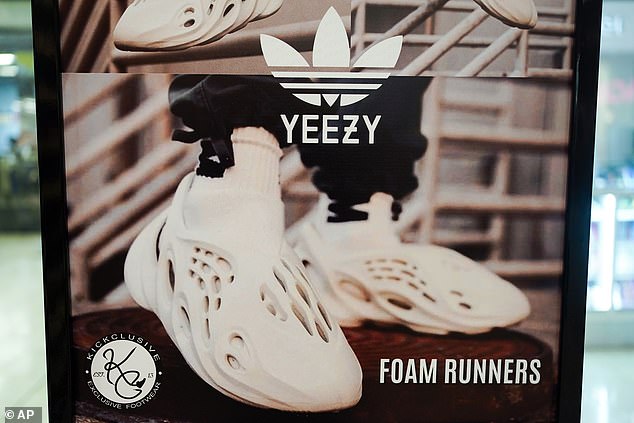

Adidas may have been mired in controversy over its partnership with Kanye West to release Yeezy, a deal that came to an end in 2022 when the parties feuded over the rapper’s public comments and conduct. But the company has managed to turn a corner, perhaps thanks to its powerful social media presence. This presence was illustrated this week by the storm of protest over its use of Palestinian-American model Bella Hadid in the campaign for its relaunched SL72 sneaker line, named in honor of the 1972 Olympics. At those games, 11 members of the Israeli Olympic team were killed by Palestinian terrorists. Adidas is reconsidering the ads following the outcry over Hadid’s stance on Palestine, but has also issued a broader apology to her and all stakeholders.

The internet has a powerful influence on the sneaker wars, as do popular TV shows. As the Wall Street Journal reported, there is a whole world of “status sneakers” for those who want the casual style of the fabulously wealthy protagonists of HBO drama Succession. At £900 a pair, the Zegna Triple Stitch exemplifies this aesthetic.

Skechers, another American brand, has signed a lifetime contract with footballer Harry Kane. His shoes will be used by the Malaysian Olympic team. Skechers shares are up 20% compared to last year.

Reebok has become a casualty of the sneaker wars. Founded in Britain, the company was bought by Adidas in 2005 for $3.1 billion before being sold to investment firm Authentic Brands Group in 2021 for just $2.5 billion. The company sits firmly in the shadow of Nike and its former parent company.

Puma is another victim, with its shares down 20% in the past year. The German company once sponsored star sprinter Usain Bolt, but its appeal has waned.

So is it too late to back Adidas? Or could a bet on Puma or Nike be a winning bet? We also assess the stocks of the sneaker war’s competitors, manufacturers and retailers. You can buy them through most investment platforms.

Singer Rita Ora wears white Reebok sneakers in New York

Adidas has been embroiled in controversy over its partnership with Kanye West for Yeezy

Nike

Nike shares have fallen 32% in a year to $73, with a market value of $110 billion. In five years, they are down 18%.

The brand remains instantly recognisable around the world and as one star endorsing the company’s products fades away, another is sure to emerge. The recently seen drop in the share price represents a good buying opportunity if you believe in its long-term prospects.

According to Nasdaq.com, the consensus rating for Nike stock is Buy. The average 12-month price forecast is $92, based on estimates from 33 analysts.

Adidas

Adidas shares have risen 30 percent in the past year but are down 18 percent in five years, raising its market valuation to 40 billion euros.

The sharp rise in the share price should offer some reasons to be cautious, but the fundamentals that have made the company successful over the long term and the power of its brands mean it is a relatively solid investment to make at any time.

Adidas has a consensus rating of Buy among a group of 30 analysts, with an average 12-month price forecast of €224, according to Investing.com.

Model Bella Hadid shows off Adidas’ hugely popular Samba sneakers in New York

Cougar

Puma shares fell by 20 percent in one year and 28 percent in five years to 43 euros, giving a market value of 6.6 billion euros.

It may struggle to compete with the celebrity power of Nike and Adidas, but it is significantly leaner than the two giants. This means costs are lower and it has to sell far fewer shoes to make a profit.

Puma has a Neutral rating from a group of 21 analysts with a 12-month target price of €54, according to Investing.com.

JD Sportswear

JD Sports is closely involved in the sneaker wars, with Nike and Adidas products accounting for a large proportion of its stock

JD Sports shares have fallen 21 per cent in the past year and 8 per cent in five years to 113 pence. Its market value is £5.9bn.

The retailer is closely involved in the sneaker wars, with Nike and Adidas products making up a large proportion of its stock. If people buy more trainers because of the latest trend or celebrity endorsements, there’s a good chance JD Sports will benefit.

JD Sports has a consensus rating of Buy from a group of 15 analysts with an average 12-month target price of 164p, according to Investing.com.

Under the armor

Under Armour shares have fallen 11 percent over the past year and 74 percent over five years to $7, giving it a market valuation of $3 billion.

Aside from the two major sneaker manufacturers, Under Armour is one of the most popular brands, especially in the United States. The firm has an endorsement deal with basketball star Steph Curry and has collaborated with wrestler-turned-movie star Dwayne “The Rock” Johnson.

Under Armour has a consensus rating of Buy with a 12-month average price forecast of $7.4 among 23 analysts, according to Nasdaq.com.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.