Table of Contents

First it was our kitchens, when we succumbed to the pleasure of a prim sink skirt. Then our living rooms were invaded by Liberty prints, chintz and floral tea sets.

Now grandma’s favorite style has moved into our wardrobes, bringing stylish, occasion-appropriate dressing to the everyday.

But forget moth-eaten tweeds, librarian twin sets and delicate pearl necklaces. This is a modern manifestation of dressing for dinner and everything else.

Keep it tongue-in-cheek and think pure nostalgia with a colorful twist. But how to achieve it without looking disheveled? Read on for my guide…

Put a pin in it

Kristin Scott Thomas on the catwalk at the recent Miu Miu show

Gloves, £135, corneliajames. com (L) and Brooch, £50, royalcollection shop.co.uk (R)

Brooches are back. Go big, bold and unmissable, pinned proudly to your lapel like Kristin Scott Thomas on the runway at the recent Miu Miu show.

It doesn’t have to be real, and at this size, it’s not likely to be.

Grandma was always a fan of jewelry and anyway. Finish the look with a pair of elegant opera gloves, preferably ones that extend to the elbow.

You can blame the Princess of Wales for that; She owned the look on the Bafta 2023 red carpet.

Modern non-minimalist

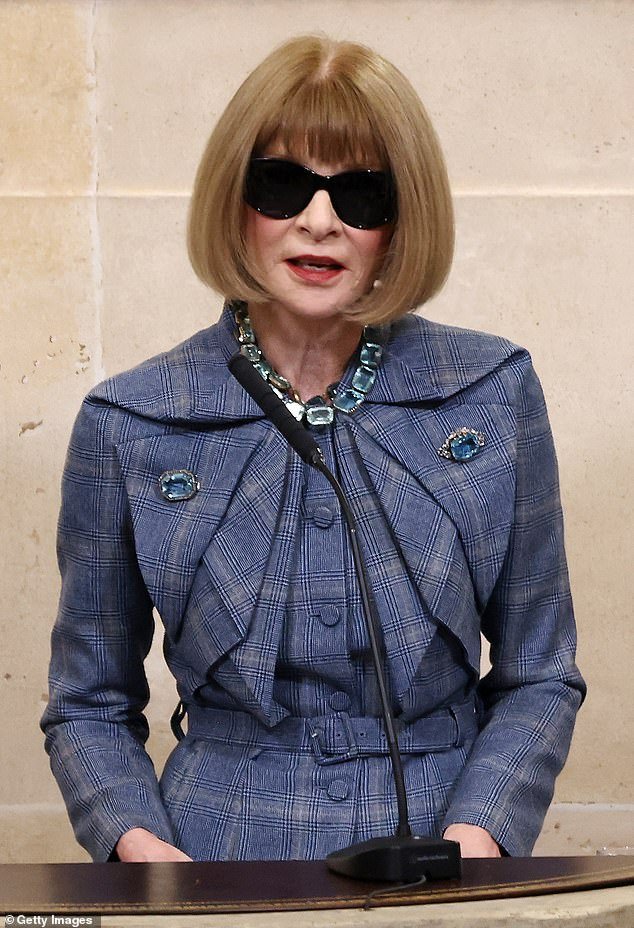

Anna Wintour speaks during a ceremony on March 20, 2024 in Paris

Earrings, £85, susancaplan.co.uk (L) and necklace, £25, oliviadivine.com (R)

Have you ever seen Anna Wintour do something delicate? No. Follow her lead and leave women’s jewelry where it belongs: in the past.

Stacking thick pieces has been her signature style for years. Think bold layers and go colorful: heavy chains and rocks in bright hues.

The look is modern, not minimalist.

The only pearls that can be used are fake or large ones. Head to Zara and Olivia Divine for the best.

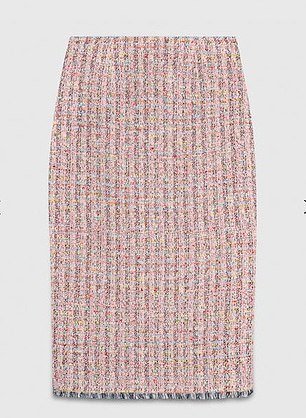

Tweed, not corny

Naomi Campbell attends the Chanel Womenswear Fall/Winter 2024-2025 show as part of Paris Fashion Week on March 5, 2024 in Paris

Dressing head to toe in tweed is one thing if you’re Chanel (like Naomi Campbell) or royalty.

The rest of us should give this very traditional fabric a tougher edge with a denim injection or sturdy metal details and buttons.

Stay away from loose, boxy or shapeless styles and switch to a jacket with a contrasting belt to create a ’50s waist.

If you opt for a tweed pencil skirt, keep the blouse casual with a white t-shirt. Are

opt for polishing with an edge, not with the (grandmother) mother of the bridge, no matter how loaded it may be.

Rent the rich look

Dress, hire from £77, self-portrait at hurrcollective.com (L) and Gucci scarf, £125, from a selection at Hardly Ever Worn It amazon. United Kingdom (R)

If your budget is struggling to keep up with the need for elevated nostalgia, simply rent the look for instant kudos from Rich Granny.

Try Hurr and Hardly Ever Worn It for fabulous dresses and coats.

A classic Gucci silk scarf will transform your usual look.

Just don’t pair it with a Mackintosh and avoid a top-handle bag unless you don’t mind looking like you’ve been rummaging through the dress-up box.

Not too sensible with your shoes.

Billie Eilish attends the 96th Annual Academy Awards on March 10, 2024 in Hollywood, California, wearing Chanel.

Cream, £299, lkbennett.com (L) and Gold, £89, johnlewis.com (R)

Mary Janes have never been like this now. But there are rules to do it right.

If you go there, you need something tall like Billie Eilish or more schoolgirl than chic.

Billie, 22, can rock a baggy sock, but can you? Unfortunately, very few of us can get away with a flat Mary-Jane.

The way they cut into the foot without a flattering heel makes them difficult to wear unless you have long legs and a tiny ankle.

A safer bet may be a pointed tip; Ideally, a kitten heel, the perfect chic complement to all those wool and floral pieces.

Be careful with the color

Model on the Prada catwalk show, Runway, Fall Winter 2024, Milan Fashion Week, Italy, February 22, 2024

Cardigan, £89, marksand spencer.com (L) and skirt, £295, thefoldlondon. is (R)

Prada reigns supreme when it comes to Granny Chic: there’s nothing stuffy about mixing pastels with bold hues like lime and deep purple.

Talking about purple, lilac (or ‘menopausal mauve’ as Queen Camilla calls it) is a big no unless it’s in small doses.

Too many overtones of rinses and Yardley English Lavender have killed this shade for good.

If you’ve opted for pastel tweeds, then the look calls for a pop of bright color to keep it modern and fresh.