Table of Contents

The average cost of living in Britain is £32,000 more than what the average worker earns, according to the data.

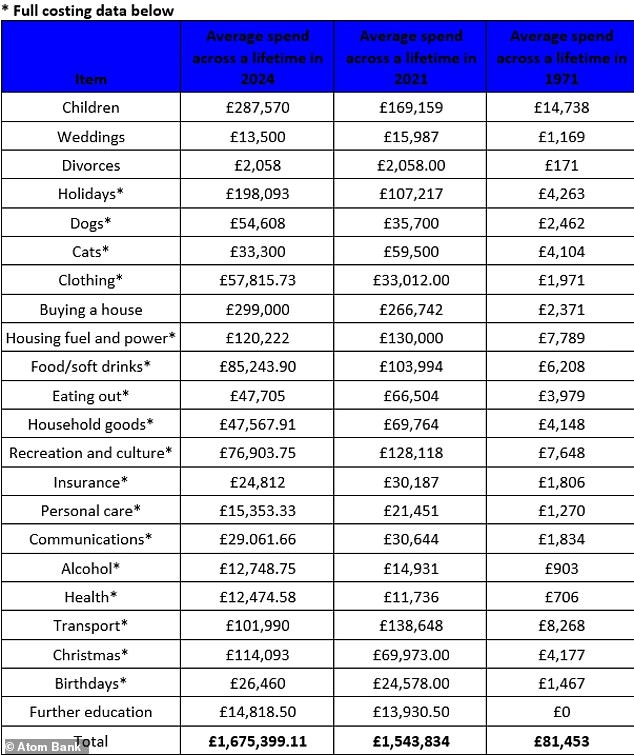

According to research by Atom Bank, the life of a typical British citizen will cost just under £1.68 million, or £1,675,399 to be precise.

Thanks to high inflation in recent years, the total has risen from £1.54 million in 2021, an increase of around £140,000.

In 1971, the typical lifetime cost was less than half what it costs today, at £81,453.

The factors that contribute most to the average cost of living are buying a home, raising children and vacations.

Expensive: According to Atom Bank, the average British citizen’s lifetime will cost them a total of around £1.68m, with the biggest contributors including holidays, housing and their children.

Over the past 50 years, house prices have risen by more than 5,704 per cent. This year, the average home costs £299,000, which is more than eight times the average salary of £34,963, and £32,258 more than 2021 figures, Atom Bank said.

According to the research, raising a child costs around £287,570 per child over a lifetime, an increase of £118,411 on 2021, highlighting the impact of inflation.

According to the research, holidays account for £198,093 of our lifetime spending. The data suggests Britons will spend £90,876 more on holidays over their lifetime than when figures were last calculated in 2021.

Research claims Britons will spend around £140,533 over their lifetime on birthday and Christmas presents.

However, many people have reported spending much less on gifts in recent years as they have struggled with rising bills.

Prices rose 2 percent in the year to June, unchanged from May, which was the lowest figure in almost three years, recent figures from the Office for National Statistics showed.

Interest rates will remain at 5.25 percent, but the Bank of England is expected to start cutting them later this year.

Working from home reduces transportation costs

It will come as no surprise to frequent travelers that transportation costs account for a considerable portion of many people’s total lifetime expenditure.

According to recent data, Britons will spend around £101,990 on transport over their lifetime.

But the rise of hybrid working and working from home means that lifetime transport spending is likely to be £36,658 less than it would have been in 2021.

The cost of owning a pet has risen dramatically in recent years. Atom Bank claims that the average person will spend £54,608 on their dogs and £33,300 on their cats over their lifetime.

This means that if a person owns a cat and a dog, their lifetime pet spending could be around £87,908.

Cat costs: Feline friends now cost the average Briton £33,000 over their lifetime

Life’s ups and downs can be costly too.

On average, Britons spend around £13,500 on weddings over their lifetime, and in some cases, divorce costs also add to the expense. However, the cost of weddings and divorces can vary significantly and be much higher or lower than stated.

According to Atom Bank, the lifetime cost of eating out for the average Briton will be around £47,705, up from £3,979 per lifetime in 1971. Many service sector businesses have been forced to raise prices in the face of higher costs.

Compared to 2021 data, Britons are spending more over their lifetime overall, but have cut back in certain categories as a result of the current cost of living crisis and high inflation over recent years.

The average lifetime spending calculations were based on an average life expectancy in the UK of 81 years, Atom Bank said.

On the rise: The biggest contributors to the average cost of living are buying a home, raising children and vacations, Atom Bank said

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.78% savings

5.78% savings

You have 365 days’ notice

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.