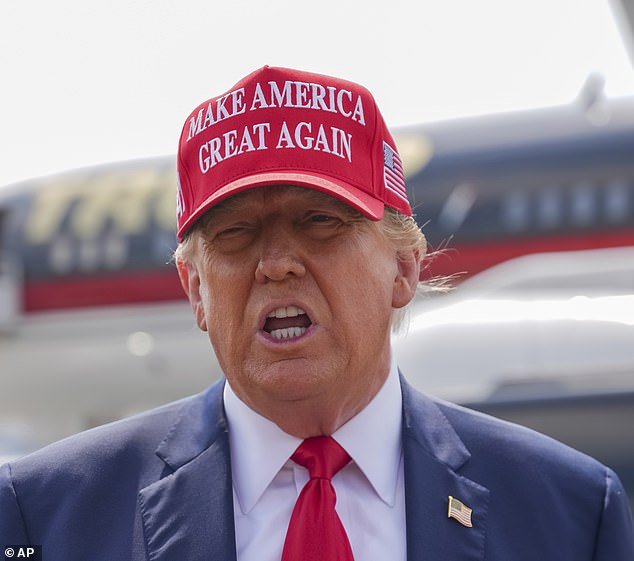

Donald Trump will be the first former president to go on trial Monday when he heads to a court in Manhattan to face felony charges related to porn star Stormy Daniels’ hush money scheme during his 2016 presidential campaign.

The eyes of the world will be on downtown New York as the 77-year-old presumptive Republican nominee faces the judge and sits in court while a panel of 12 jurors is selected.

Trump’s lawyers have been filing a series of motions seeking to delay the trial. But the former president has repeatedly failed in those efforts, setting an April 15 start date.

Donald Trump will go on trial Monday for serious crimes in New York state

Trump faces 34 felony charges in the case brought by Manhattan District Attorney Alvin Bragg, who accuses the former president of using his business records to conceal the payment of $130,000 to Daniels to keep quiet about an alleged affair.

It is the first criminal trial against a former president of the United States. Monday begins with jury selection, supervised by Judge Juan Merchán.

‘Jury selection is largely a matter of luck. It depends on who it is,” Trump said Friday at Mar-a-Lago.

Below, DailyMail.com has broken down all the details and answered all the pressing questions about the case:

THE BOTTOM

Stormy Daniels, whose real name is Stephanie Clifford, claims she had a sexual encounter with Trump in 2006, shortly after Melania gave birth to their son Barron.

It happened when the two met at a celebrity golf tournament in Lake Tahoe.

In an interview with CBS’ 60 Minutes that aired on March 25, 2018, Daniels said she and Trump once had sex. She also claims that she whipped him with a magazine that had him on the cover.

The former president has denied the matter and claims the trial is a politically motivated “witch hunt.”

THE PAY

On January 12, 2018, the Wall Street Journal reported that Trump’s then-fixer, Michael Cohen, paid Daniels $130,000 in October 2016, a month before the presidential election, to prevent her from discussing the alleged affair and thus harming Trump’s chances in the presidential elections.

Prosecutors argue that Trump reimbursed Cohen for a series of installment payments processed by his company, which prosecutors say were fraudulently disguised as corporate legal expenses in violation of New York law.

Cohen, Trump and the Trump Organization’s then-chief financial officer, Allen Weisselberg, reach a deal in which Cohen will be reimbursed a total of $420,000 for the payment to Daniels, prosecutors say.

That includes a bond of $60,000, $50,000 for a different expense and $180,000 to cover taxes, which would be made through 12 monthly payments of $35,000 each.

Cohen submitted invoices for the $35,000 payments, according to Trump Organization business records.

THE CHARGES

The 34 charges include 11 charges about checks to Cohen, 11 about monthly invoices Cohen submitted to Trump’s company and 12 involve entries in Trump’s trust ledger.

The lawsuit is related to $130,000 paid to porn star Stormy Daniels to maintain her silence.

WILL TRUMP BE AT THE TRIAL?

Under New York state law, Trump must attend the entire trial in person.

The trial is expected to last between six weeks and two months, and Trump’s courtroom requirement will hamper his ability to campaign for the presidency.

The court will set all weekdays except Wednesdays, meaning Trump could use the weekend half-week for campaign events.

While the proceedings will not be televised, photographs of Trump will likely be allowed in court.

In the past, television cameras were allowed in the courthouse hallway and Trump paused to address them.

Trump faces 34 felony charges in the case brought by Manhattan District Attorney Alvin Bragg, who accuses the former president of using his business records to conceal the payment of $130,000 to Daniels to keep quiet about an alleged affair.

WHO WILL WITNESS?

Daniels and Cohen have already indicated that they will testify for the prosecution.

Other witnesses could include Karen McDougal, a former Playboy model who was paid $150,000 by the National Enquirer for the rights to her story about an alleged affair with Trump that the publication did not publish in a move known as “catch-and-grab.” -kill.’

Former Trump aides could also testify, including his longtime aide Rhona Graff, his former director of Oval Office operations Madeleine Westerhout and former White House aide Hope Hicks.

David Pecker, former editor of the National Enquirer, is also expected to testify.

Trump says he will testify in his own defense.

“Yes, I would testify, absolutely,” he said Friday at Mar-a-Lago.

Former Playboy Playmate Karen McDougal may be called to testify

ADDITIONAL PAYMENTS

Prosecutors are expected to dive into two other hush deals involving The National Enquirer and Donald Trump.

The first involves the tabloid’s payment of $30,000 to a former Trump Tower doorman who claimed to know that Trump had fathered a child out of wedlock. The National Enquirer later determined the claim to be false.

The second involves McDougal, Playboy’s Playmate of the Year in 1998, who wanted to sell her story of an affair with Trump during the 2016 campaign.

Trump denies having an affair with her.

Bragg and his team will argue that those incidents demonstrate that the bounty on Daniels was not a one-time event, but part of a broader effort to influence the 2016 election.

Trump’s lawyers have said he made the payment to Daniels to spare him, his company and his family embarrassment, not to help his campaign.

TRUMP’S DEFENSE

The former president’s defense team is likely to try to portray Cohen as a Trump-hating liar.

The two men, who were once very close, fell out years ago.

Trump’s lawyers are also expected to point out that Cohen has pleaded guilty to a variety of federal crimes, including his role in the hush money.

In August 2018, Cohen pleaded guilty to five counts of tax evasion, false statements and campaign finance violations in federal court, stemming from his payment to Daniels.

He was sentenced to three years in prison, beginning in May 2019 and ending slightly early in November 2021, with part of his sentence spent under home confinement during the COVID pandemic.

Former Trump fixer Michael Cohen is expected to testify at the trial.

WHAT PUNISHMENT DOES TRUMP FACE?

If convicted, Trump could face up to four years in prison for each of the 34 charges against him.

Under New York law, falsifying business records is usually a misdemeanor, but can become a felony when there is an “intent to defraud” that includes the intent to “commit another crime or aid or conceal” another crime.

Bragg maintains that Trump was concealing a federal campaign finance violation, a crime against state election law and tax fraud.

WILL TRUMP GO TO JAIL?

If Trump is convicted, he could face a sentence of up to four years in New York prison on each count, a maximum of 136 years.

Since it is a state crime, only the governor of New York could pardon it. That position is currently held by Democrat Kathy Hochul.

However, given Trump’s age (77), his lack of prior convictions, and his status as a former president who can be president again, the judge could give him conditional release.

Most first-time offenders in nonviolent cases are typically sentenced to probation.

There are also the added complications of his secret service. Provisions would have to be added to house his protection team if he were imprisoned.

He could be placed under house arrest at one of his homes, including Mar-a-Lago, which is the center of his classified documents case.

Manhattan District Attorney Alvin Bragg leads prosecution against Donald Trump

WHAT OTHER TESTS DOES TRUMP FACE?

Several.

There are two federal lawsuits: one for trying to overturn the 2020 election and another for allegedly misappropriating White House documents.

There is also a state case in Georgia looking at his attempt to overturn the election results there.

Trump has pleaded not guilty to all charges.

The secret money case is so far the only one with a specific trial date, as Trump has tried to delay the others.

His federal election case is on hold until the Supreme Court rules on Trump’s motion to dismiss (citing presidential immunity), which could take until June.

His docs case had its scheduled May trial date postponed after Trump-appointed U.S. District Judge Aileen Cannon pushed back deadlines in the case.

The Georgia case also does not have a trial date, although prosecutors have requested that it begin in August.