The Body Shop collapsed into administration just 24 hours ago, but savvy eBay sellers are already profiting from its demise.

Created in 1976, founder Dame Anita Roddick went from selling just 25 products in her hometown of Brighton to supplying beauty products to teenagers around the world and sitting on a multi-million pound empire.

But yesterday the brand introduced the FRP Notice to manage the insolvency process, which affects staff and stores in the UK.

However, as stores prepare for possible closure, eBay sellers have prepared to sell their vintage The Body Shop items to those mourning the loss on the high street.

And the value has soared, with sellers selling their 90s scents at premium prices, including a retro perfume oil for £230 and an old make-up bag for £69.99.

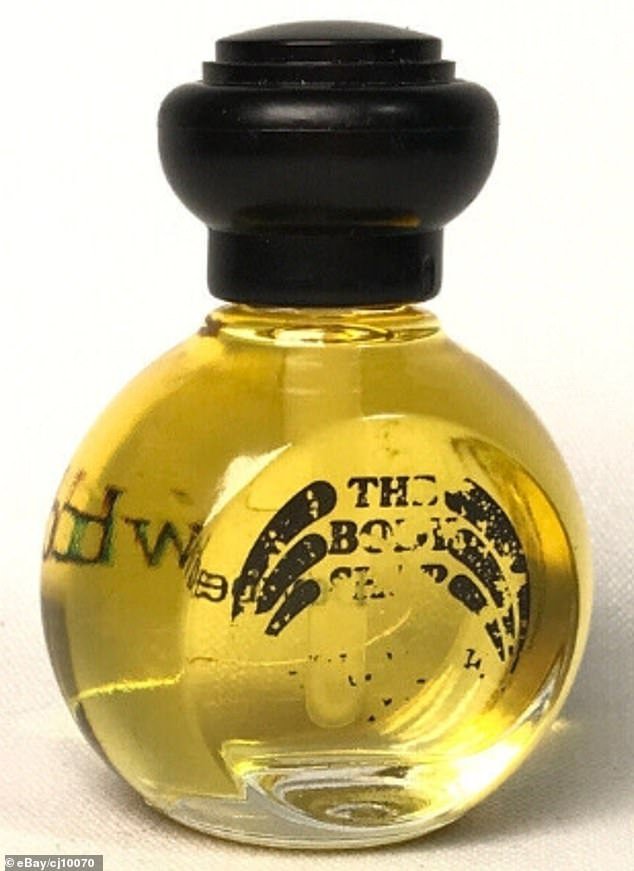

Fans of the Dewberry scent can get the scented oil distributed in the 1990s for £160 on eBay.

A range of innovative items propelled The Body Shop into the spotlight, from fruit-shaped soaps to body butters with scents so delicious you’d be tempted to eat them.

However, the store gradually phased out the extravagant items in favor of more conventional products, leaving fans disappointed.

Observant eBay sellers have noticed the public’s desire for old-school items and have brought out their vintage products to flog on eBay.

A quick search at the secondhand retailer shows hundreds of The Body Shop items for sale, many of which are from the 1990s.

But the items come with eye-watering prices, meaning fans of The Body Shop have to shell out a small fortune to smell a little more like White Musk.

For example, one seller has priced Dewberry perfume at a staggering £160, with an extra £40 if you want the gift bag to go with it.

Elsewhere, another seller has listed an “ultra rare” vintage perfume oil from the brand for a whopping £231 – and it’s already been used.

Meanwhile, a bar of soap with the much-loved white musk scent will set shoppers back £40.

Jennifer Mary Green, from Carlisle, has put a pack of vintage items from The Body Shop on sale for £100, including two scented oils, a shampoo and a body cream.

Another UK seller is selling a 100g bar of “sealed” and “ultra rare” white musk soap for £40.

A ‘rare’ and ‘new’ Dewberry purple gift bag from The Body Shop is available to buy on eBay for £40

Another eBay seller managed to keep a bundle of items and priced a body cream, two miniature scented oils and a shampoo at £100.

And if you want to save the product, shoppers can score a vintage makeup bag from the brand for £69.99, along with a couple of badges to decorate it.

It comes after the network issued a statement to address the recent news, iHe said: “The administrators will now consider all options to find a way forward for the business and will update creditors and employees in due course.”

The business will continue to operate both in-store and online while plans are made for the future of the much-loved high street brand.

The troubled chain, which has faced stiff competition from suppliers such as millennial and Gen Z-friendly bath bomb purveyors Lush and luxury brand Rituals, had also just closed its Avon-style home business division , The Body Shop At Home.

FRP said: ‘The Body Shop has faced a long period of financial challenges under previous owners, coinciding with a difficult trading environment for the wider retail sector.

“Having taken swift action in the last month, including closing The Body Shop At Home and selling its business in most of Europe and parts of Asia, focusing on the UK business is the next important step in the restructuring of The Body Shop”.

A seller in the US has listed an ‘ultra rare perfume oil’, which has been used, for a staggering £231 ($290).

Elsewhere, a ’90s retro vintage The Body Shop Animals in Danger Extinct is Forever makeup bag’ is on sale for £69.99

The administrators added: ‘The Body Shop continues to be guided by its ambition to be a modern and dynamic beauty brand, relevant to customers and able to compete over the long term.

“Creating a more agile and financially stable British business is an important step towards achieving this.”

As well as threatening thousands of jobs, the news could spell trouble for the many suppliers of Body Shop products around the world, who have been carefully sourced by the ethically minded company for decades.

Set up in 1976 by the late Dame Anita Roddick, the company became famous for its no-nonsense, ethical business ethos and its refusal to test products on animals.

Popular products that helped establish the brand name included bath bombs, white musk fragrance, and hemp hand cream.

However, in recent years it has seen its popularity decline in the UK among shoppers due to the rise of rivals Lush, Holland and Barrett, and a growing online market for cheaper alternatives.

The company also fell out of favor with some buyers after Dame Anita sold it to L’Oreal for £675 million in 2006, a move that surprised many who saw the sale to a large corporation as contrary to the company’s values. .

The Body Shop changed hands again in 2017, when the French cosmetics giant sold it to Brazilian cosmetics manufacturer Natura&Co for €1 billion.

It was then bought by private equity firm Aurelius just a few weeks ago for £207 million.

After purchasing the brand, Aurelius said that “despite the challenging retail market, there is an opportunity to revitalize the business to enable it to take advantage of positive trends in the high-growth beauty market.”

But the move to keep up with the likes of Lush and Rituals has also seen the company seemingly move away from its do-gooder origins.