The huge discount to the net asset value of FTSE 250-listed HarbourVest Global Private Equity (HVPE) shares could finally narrow after an overhaul of shareholder payouts.

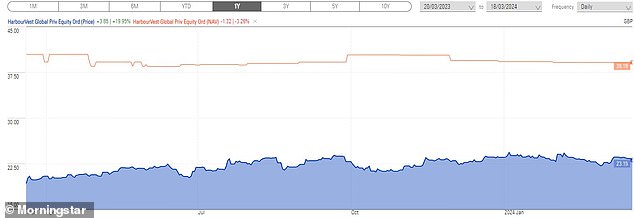

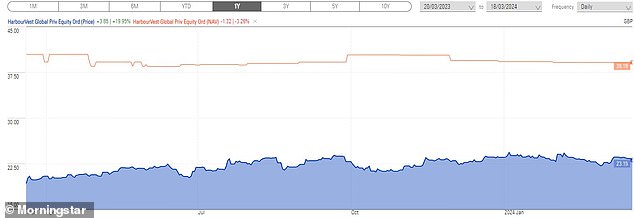

The investment trust, which hosts a portfolio of private equity funds managed by HarbourVest, has traded at a discount to a net asset value hovering around or below 40 percent since the start of the year, after trading closer to 50 percent for much of 2023, Morningstar. the data shows.

Private equity-focused listed trusts, like other companies invested in illiquid assets, have struggled to cope with significant haircuts as interest rate rises prompt investors to be cautious over the rising debt costs, long-term portfolios and the possibility of a sharp deterioration in asset valuations.

FTSE 250 HVPE hopes to reduce big haircut with shake-up of shareholder distributions

Discounts widen as the value of holdings exceeds the implied valuation of the trust’s share price. HVPE’s net asset value has held up relatively well throughout the last year, with net asset value per share up 3 percent to $49.67 over the 12 months to January 31.

To combat the discount, HVPE last month launched a new shareholder distribution pool, which will see 15 per cent of cash realizations released to bolster shareholder returns via buybacks and possible special dividends.

Peel Hunt said the move “is expected to improve returns for shareholders” and “help reduce the discount”.

HPVE chief executive Richard Hickman told This is Money: “The distribution pool is certainly an effort to improve shareholder returns.

“Clearly, there are forces at work in the markets that are beyond our day-to-day control. But overall, we hope investors see this work in the coming months, helping to generate more enthusiasm for the stock and maintaining our shareholders’ confidence in the company’s future prospects.

The green shoots of investor optimism

Analysts at Peel Hunt noted that discounts on direct private equity funds and funds of funds widened to “levels last seen during the global financial crisis” last year, but have declared that “as the macroeconomic situation improves through 2024”, its “preferred trusts” will benefit from a strong revaluation”.

Analysts said HVPE’s discount remains “statistically significant and is beginning to show signs of diminishing as buying interest returns and transactional activity increases.”

All but one of the companies in the Association of Investment Companies’ private equity sector currently sit at a discount to their net asset value as an industry giant. Group 3i bucking the trend with a premium of 36.6 percent.

HVPE stocks are struggling at a steep discount to their net asset value

But Hickman said the market environment had improved, with U.S. public equity markets surpassing highs set before the interest rate hike cycle began in early 2020, “which bodes well for valuations on private markets.

He added: “Private market valuations tend to look like a damped version of the curve: they don’t rise as much (as public markets) and they don’t tend to fall as much over a short period of time .”

Hickman also noted that US private equity giants KKR and Carlyle have seen their stock prices rebound since the fourth quarter of last year, rising about 51.5 and 39.1 percent, respectively, “this which should tell us something about investor sentiment” towards the sector. .

But even though central banks are expected to begin easing monetary policy again soon, interest rates are highly unlikely to return to the lows of the post-financial crisis year, which helped fuel a boom fueled by cheap debt for the private equity industry.

Diversification of HVPE by strategy, geography and sector of activity as of January 31

Hickman admits that businesses will “inevitably” face a higher cost of capital than they perhaps expected, but he expects the industry to adapt.

He added: “We are seeing better credit availability today than in recent times, supported by the private credit sector, which now accounts for almost 70 percent of total private equity transaction volume. Banks have become less important as providers of capital for transactions.

“It’s also worth remembering that private equity actually generated some of its best returns before the global financial crisis, when interest rates were at levels similar to today and even higher at certain times .”

Potential Shein listing offers a boost

HVPE provides shareholders with exposure to more than 1,000 global private companies, which are typically only accessible to institutional investors, through allocations to funds held by HarbourVest.

Mired by discount frustrations, HVPE stocks have returned 12.9, 64.1 and 262.7 percent over one, five and 10 years, respectively.

Shein is HVPE’s largest individual business exhibition

Its sector peers have gained an average of 148.44 per cent over the past five years, while the FTSE 250 has remained flat over this period.

Its biggest asset by far, with 2.1 percent of the portfolio, is Chinese fast-fashion giant Shein, which is rumored to be planning a blockbuster IPO in London this year.

Shein boss Donald Tang has reportedly met with Chancellor Jeremy Hunt over a London IPO that could value the Chinese firm at £70bn, a potential boon for 85’s stake, $2m (£67m) of HVPE.

Hickman said: “Shein is obviously an important individual company in the portfolio.

“Sometimes we see individual companies progress to become significant holdings at this level, but that’s quite unusual because we’re very diversified.

“This tends to be the result of very rapid growth in the value of some of the companies that have become household names – previous examples are Facebook and Uber, which emerged from our portfolio in a similar way.

“If the IPO goes ahead and is successful, then HVPE will receive cash as part of the proceeds and that stake will decrease in terms of concentration.”

HVPE creates exposure to private companies through investments in underlying fund managers

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. This helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.