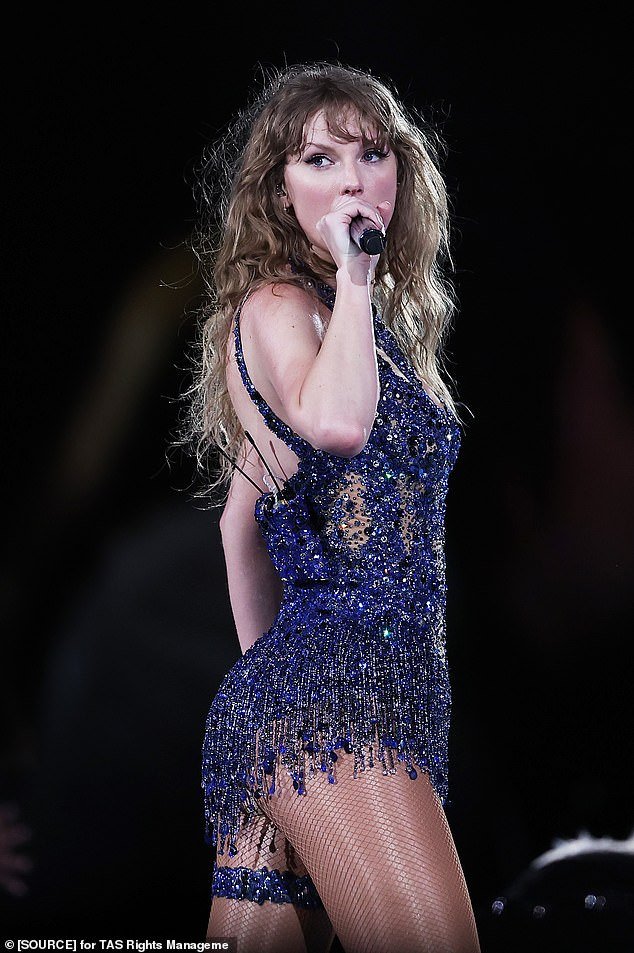

Taylor Swift is the most popular woman in the world, so it should come as no surprise that neighboring countries are preparing to clash due to the exclusivity of a small nation in her appearance on the Eras Tour.

Politicians in the Philippines and Thailand are talking about a deal struck by Singapore that limits Swift’s Eras Tour in Southeast Asia to wealthy city-states only.

The 34-year-old singer, who is currently in the middle of her six-show sold-out tour in Singapore, was He received a scholarship to perform in the country.

But it will be their only stop in Southeast Asia.

Singapore authorities reportedly negotiated a deal banning Taylor from performing in other territories in the region, under the assumption that Swifties would be forced to relocate en masse to Singapore.

Taylor Swift Was Allegedly Paid Millions to Make Singapore Her Only Tour Stop in Southeast Asia

Thai Prime Minister Srettha Thavisin said the Singapore deal makes sense, as he has long questioned why Swift has disparaged Thailand.

The Prime Minister of Thailand, one of the countries scorned by Swift’s one-stop island trip, said at the iBusiness Forum 2024, held recently in Bangkok, that the Singapore government offered Swift up to $3 million. dollars per show in exchange for the exclusivity of the Eras Tour. .

Filipino politician Joey Salceda also speaks out on the perceived economic snub. He has asked his country’s Foreign Ministry to protest the subsidy given to Swift.

He told local media that neighboring governments must be allies, work together to strengthen the region and that the deal brokered by Singapore is a painful betrayal.

Thai Prime Minister Srettha Thavisin called Singapore’s move “shrewd”, adding that he had long wondered why Swift had not opted to play in Thailand.

“If I had come to Thailand, it would have been cheaper to organize it here and I think it could attract more sponsors and tourists to Thailand,” he said.

‘Although we would have to subsidize at least 500 million baht ($14 million), it would be worth it.

‘If I had known this, I would have brought the shows to Thailand. Concerts can generate added value for the economy.’

The Singapore shows will likely be a boon for the economy. Swift has sold out six nights at the 55,000-capacity National Stadium this month.

Singapore’s tourism board and Ministry of Culture did not reveal the amount of the subsidy, but referred to the economic benefits that Swift’s concerts will bring around the world.

They said the ministry had worked with concert promoter AEG Presents to get Swift to perform in Singapore.

Philippine lawmaker Joey Salceda said the Singapore government’s deal with Swift was a betrayal by a government that was supposed to work together with other regional powers.

Singapore’s tourism board and Ministry of Culture did not reveal the amount of the subsidy, but referred to the economic benefits that Swift’s concerts will bring around the world.

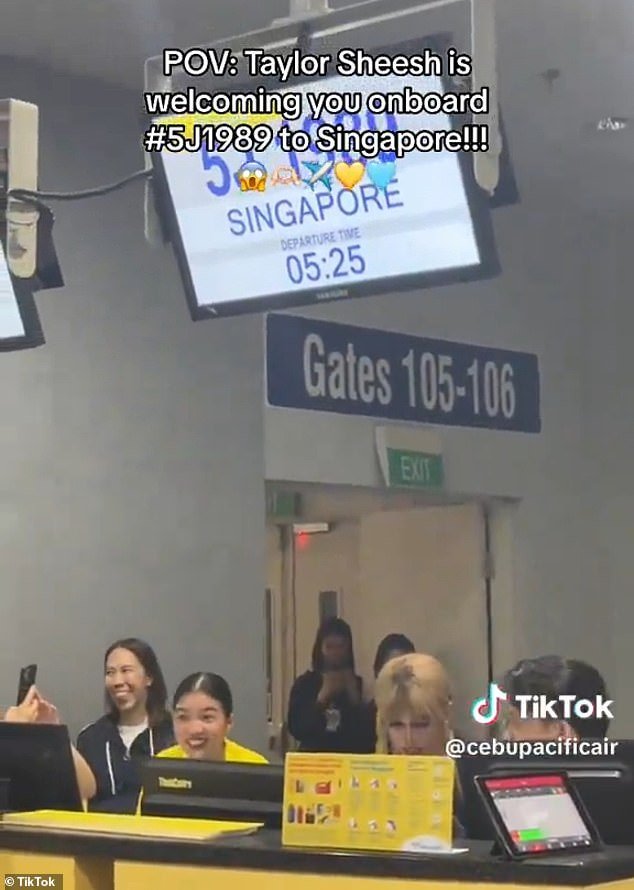

Swift fans flock from Manila, the capital of the Philippines, to Singapore for Swift’s Eras Tour stop.

Swift will perform at Singapore’s National Stadium from March 2 to 9.

More than 300,000 tickets were sold to fans who waited overnight in the tropical heat.

“It is likely to generate significant benefits for Singapore’s economy, especially for tourism activities such as hospitality, retail, travel and restaurants, as has occurred in other cities where Taylor Swift has performed,” they said in a statement. released last Tuesday.

Singapore has seen a boom in concerts since pandemic lockdowns ended, with big names like Blackpink, Coldplay and Ed Sheeran playing sold-out shows.

The Singapore government has not commented on the exclusivity clause, although AEG has said the only stop for Swift’s concert in Southeast Asia will be in the island nation, with VIP tickets priced at S$1,228 (A$1,395). .

On the Asian continent in general, Swift also performed in Tokyo in early February.

Their concerts in Singapore will run from March 2 to 9.

More than 300,000 tickets were sold to fans who queued throughout the night in the scorching tropical heat.