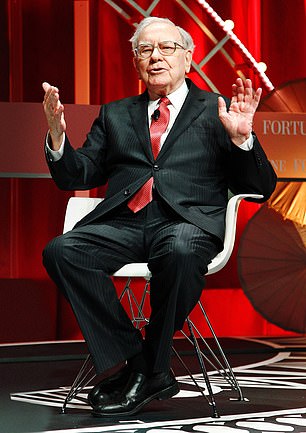

Phenomenal: Since Warren Buffett started in 1965, it has generated returns of 4,384,749 percent for savers at Berkshire Hathaway.

Warren Buffett is the Goliath of the investing world. Since he started in 1965, he has generated returns of 4,384,749 percent to savers in his Berkshire Hathaway investment vehicle.

That means someone who put in $100 at the start would now be left with $4.3m (£3.4m).

It’s no surprise that the 93-year-old is honored around the world, and that his annual shareholder meeting – taking place this Saturday in Buffett’s hometown of Omaha, Nebraska – looks more like a festival than a typical and discreet Annual General Assembly.

Surely no one tops this? Well not exactly.

Wealth has partnered with investment platform AJ Bell to identify investment funds and trusts that have outperformed Berkshire Hathaway over the past 20 years.

There have been so few funds since 1965 that it is difficult to find any that have surpassed it during that period. However, over 20 years, 41 of 973 investment funds and trusts available to UK investors have beaten Buffett, according to AJ Bell (see table above).

Berkshire Hathaway posted an impressive 555 percent dollar return over 20 years. This means a return of 855 per cent for UK investors as the value of the pound has weakened over the period.

If a UK investor invested £1,000 in Berkshire Hathaway 20 years ago, it would be worth £9,549 today. The strategy is impressively simple. Berkshire Hathaway has built a portfolio of more than 40 blue-chip companies, including Apple, Bank of America, American Express and Chevron. Buffett is concerned with finding great companies at a good price, rather than worrying too much about the outlook for economies and financial markets. He then he stays long term.

However, if you had invested £1,000 in FSSA Indian Subcontinent, which is the best performing fund, you would have earned much more – an impressive £25,081.

Ben Yearsley, director of Fairview Investing, says there are very good reasons for the fund’s “surprising” performance. “India is the world’s largest democracy and one of the most dynamic economies, something that has been driven by Prime Minister Modi,” he says.

However, he cautions that since India is one of the best-performing markets, it is now also one of the most expensive. This reduces the possibility that such a fund could produce such a spectacular return over the next 20 years.

Jason Hollands, CEO of the investment platform Bestinvest by Evelyn Partners, points out that of the top ten, five are technology funds: AXA Framlington Global Technology, Polar Capital Technology, Fidelity Global Technology, Janus Henderson Global Tech Leaders and Allianz Technology Trust. .

He says it is not surprising that such funds have generated high returns, as technology companies have seen phenomenal growth.

“Tech stocks and technology-based companies like Amazon and Meta, which owns Facebook, have been the highlight of global stock markets for the past 20 years,” he says. ‘Twenty years ago, technology was battered and bruised by the burst of the dot-com bubble, but it has since risen to become 30 percent of the US stock market. Now it has benefited from the artificial intelligence mania.’

He adds that the trusts and funds that have outperformed Berkshire Hathaway are specialized funds and have a much smaller portfolio.

These top-performing funds and trusts may be winners now, but there’s no guarantee they will produce equally great returns over the next 20 years.

Of course, their fund managers can claim some credit, but a good part of their success is due to the fact that they benefited from the rising markets in the area in which they invested.

By contrast, Berkshire Hathaway has achieved strong returns not by growing one sector in particular, but by investing widely in several. It has outperformed in all market conditions.

So what can investors take away from this? Arguably the trick is to pick up the ideas of the so-called Sage of Omaha, rather than trying to defeat him. He has dropped many pearls of wisdom over the years.

The first of them will be long term. One of Buffett’s most famous quotes is: “Our favorite holding period is forever.” Berkshire Hathaway’s portfolio confirms this. He has owned shares of Coca-Cola for more than 34 years, American Express for 29 and credit rating agency Moody’s for 22.

But long-term holding does not mean holding indefinitely or cutting losses when an investment is not performing. Meddling with your portfolio often increases the risk of buying and selling at the wrong time and incurring trading fees.

Another Buffett strategy is to use tracking (or index) funds. In 2016, he wrote in his Berkshire Hathaway report that “both large and small investors should stick with low-cost index funds.” These are funds where the holdings are not personally selected or selected by an active fund manager, but simply track an index such as the FTSE 100 or S&P 500.

Since these funds follow the market, they do not outperform. But they are usually cheaper because investors do not pay for a manager.

Laith Khalaf, head of investment analysis at AJ Bell, says this doesn’t seem to make sense “for a man who has made a fortune through active money management.” However, look at the numbers and you’ll see the logic. According to AJ Bell, less than a third of actively managed equity funds in the UK have outperformed passive alternatives in the last decade.

Investors don’t have to choose between active and passive funds, but they can build a core of low-cost passive funds and then use actively managed options when they think they can add value.

A third rule of Buffett’s is to never invest in what you don’t understand. He says: “Risk comes from not knowing what you are doing.”

It is for this reason that he avoids things like cryptocurrencies and instead invests in familiar brands with easy-to-understand business models.

Khalaf says this tip can prevent you from losing money and experiencing buyer’s remorse.

However, savers often put off investing because they feel they don’t know enough, but sometimes the best way to learn is to start.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.