Ford could limit new petrol models in the UK to increase its share of electric vehicle sales and avoid major fines on manufacturers from this year.

Martin Sander, managing director of Ford Model e Europe, said restricting the availability of new petrol cars by the UK’s second most popular car brand would also likely drive up prices for buyers.

It comes as carmakers face the difficult task of meeting binding electric vehicle sales thresholds, which rise from 2024 until a planned total ban on sales of new petrol and diesel passenger cars in 2035.

The latest UK vehicle sales data released this week shows that public demand for electric vehicles has fallen in recent months, with only one in six electric cars registered in April being purchased by private buyers.

Ford, the UK’s second most popular car brand, could limit the availability of new petrol models in the UK to increase its share of electric vehicle sales and avoid fines.

Speaking in the Financial Times Future of Car Summit to be held in London on TuesdaySander also said Ford would delay its plans to sell only electric vehicles in Europe by 2030.

He said the target was now “irrelevant” because electric car sales were “below expectations”.

While Prime Minister Rishi Sunak made the decision last year to delay the ban on sales of new combustion engine cars in the UK from 2030 to 2035, the government’s zero-emission vehicle (ZEV) mandate has put pressure on manufacturers to increase their participation in electric vehicles. sales.

The mandate, dubbed by ministers as “the world’s most ambitious regulatory framework for the transition to electric vehicles,” was officially enacted in January.

Martin Sander, managing director of Ford Model e Europe, said the restriction on the availability of new petrol cars would also likely drive up prices for buyers.

The ZEV mandate is designed to force automakers to sell increasing volumes of electric vehicles by 2035.

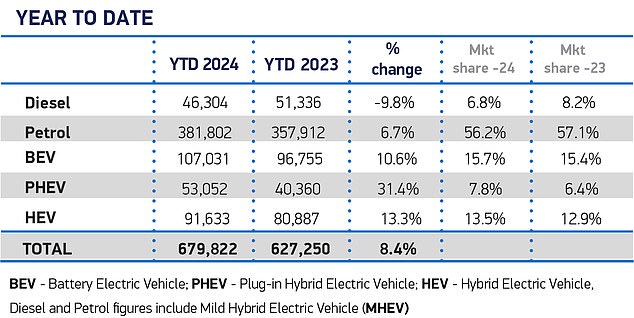

These official SMMT registration figures, up to the end of April, show that just 15.7% of all new car sales in the UK so far in 2024 are electric vehicles, well below the mandatory 22% requirement. for ZEV.

The law means that 22 percent of car registrations of each major brand in 2024 must be electric, rising to 28 percent by next year and 80 percent by the end of the decade, before rising to 100 percent. cent from 2035.

Failure to meet sales targets under the ZEV mandate can result in huge fines for car manufacturers of £15,000 per model sold below the required threshold.

After the first four months of 2024, it is clear that many manufacturers are far behind the 22 percent requirement for this year.

At the end of April, only 15.7 percent of all UK registrations were electric vehicles.

Sander told the summit panel on Tuesday that Ford The only option to avoid fines was to divert sales of gasoline cars to other countries.

While several automakers have said the goals of the ZEV mandate are challenging, Ford is the first to say it could restrict the availability of gasoline models to increase its share of electric vehicle sales.

Sander (pictured) told the FT’s Future of Car Summit in London: “We can’t push electric vehicles into the market against demand. We’re not going to pay penalties. We’re not going to sell electric vehicles at huge losses just to buy compliance’

In 2023, the American brand sold 144,072 new cars in Great Britain (only VW sold more with 162,087 registrations) and the first deliveries of its new electric Explorer will arrive in September after a six-month delay.

We will not sell electric vehicles at huge losses just to buy compliance

Last July, it also ended production of the Fiesta, Britain’s best-selling car, to focus on new electric vehicle models.

Sander told the audience: “We cannot introduce electric vehicles to the market against demand. We are not going to pay penalties. We are not going to sell electric vehicles at huge losses just to get compliance.

“The only alternative is to take our (combustion engine) vehicle shipments to the UK and sell them elsewhere.”

Yesterday, the SMMT cut its electric vehicle sales forecast for this year amid falling demand for electric cars in Britain.

While 107,031 electric vehicles have been registered so far in 2024 (an increase of 10.6 percent on sales in the first four months of last year), data shows that fewer than one in six electric cars purchased in April were For the general public.

Part of this is because cars bought under labor wage sacrifice schemes boosted fleet sales, but it also reflects lower-than-expected demand.

As such, the trade body has lowered its EV market share forecasts to less than one in five new cars (19.8 percent), which is well below the 22 percent requirement of the ZEV mandate. .

Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, said an “absence of government incentives for private buyers” is having a marked effect on demand for battery-powered cars.

“Although there are attractive deals on electric vehicles, manufacturers cannot finance the transition to the mass market on their own,” he explained.

“Temporarily cutting VAT, treating electric vehicles as fiscally conventional rather than luxury vehicles, and taking steps to instil consumer confidence in the charging network will boost market growth on which Britain’s net zero ambition depends.” “.

In 2023, Ford sold 144,072 new cars in Britain (only VW sold more with 162,087 registrations) and the first deliveries of its new electric Explorer will arrive in September

Sue Robinson, chief executive of the National Franchise Dealers Association (NFDA), which represents car showrooms across the country, added: “With the Government disappointingly ruling out the introduction of price incentives for electric vehicles on Last month, the NFDA calls on the Government to take an urgent decision to “Rethink this, especially as many OEMs look to meet the ZEV mandate targets for this year and as private demand has declined in recent months.”

The mandate includes a permit for manufacturers to sell non-ZEV vehicles up to a certain percentage of their fleet of new cars and trucks, with the intention that ZEVs account for the remaining sales.

Any excess non-ZEV sales can be covered by purchasing allowances from other manufacturers, using allowances from past or future trading periods during the initial policy years, or offsetting with credits.

Manufacturers that fail to meet the targets face fines of £15,000 for each non-ZEV car and £18,000 for each non-ZEV van.

Additional credits are offered for vehicles displayed at car clubs or those that are wheelchair accessible.

Last month, Carlos Tavares, chief executive of Stellantis, parent group of Vauxhall, Citroen, Peugeot and other major automotive brands, said the UK’s ZEV mandate could mean Stellantis drastically cuts the number of cars it sells in Britain, even refusing to rule out the total interruption of sales of some models.

But a source close to the company said the most likely option was to restrict sales or raise prices to compensate.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.