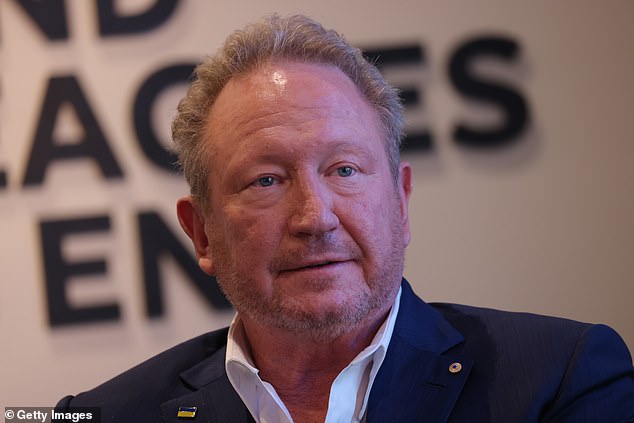

Andrew ‘Twiggy’ Forrest was a big winner in the Federal Budget, following the introduction of generous tax incentives for his public and private business interests.

Treasurer Jim Chalmers was set to present his third budget on Tuesday night as a “cost of living” intervention designed to help Australians who are “doing it tough”.

But it was widely criticized as a “Budget for billionaires” after it emerged that every Australian household will receive a $300 rebate on their energy bills, no matter what they earn.

It means Dr Forrest, who is Australia’s richest man, will receive $300 from the government for each of his many properties – a taxpayer-funded bill that could run into thousands of dollars.

But it will also benefit from a host of other measures in the budget that were almost tailor-made for its green hydrogen side hustle.

Forrest is among Australia’s richest men with an estimated fortune of $13.5 billion since separating from his wife Nicola, according to the AFR Rich List 2023.

Andrew ‘Twiggy’ Forrest (pictured) was a big winner in the federal budget, following the introduction of generous tax incentives for his public and private business interests.

Treasurer Jim Chalmers said on Tuesday his budget “invests in our renewable energy superpower ambitions” (pictured with his wife Laura and Prime Minister Anthony Albanese in the background)

The Western Australian mining magnate was a big winner in other ways.

Under the Treasury’s ‘Future Made in Australia’ plans, Dr Forrest’s listed Fortescue Mining Group will benefit from a generous hydrogen production tax incentive.

It is estimated to cost the government’s coffers $6.7 billion over 10 years, at $2 per kilogram of hydrogen – or “green iron” – produced.

Speaking in his capacity as Chief Executive of Fortescue on Wednesday, Dr Forrest hailed the intervention as a “unique opportunity to ensure Australia fulfilled its potential to become the Saudi Arabia of energy production”.

“Through the $2 per kilo tax credit for green hydrogen production, the Government has captured this opportunity for the Australian people,” Dr Forrest said.

He claimed it would “bring about full employment and decades of income growth for Australian workers” and warned oil giants would try to derail the legislation because it would promote an alternative fuel source.

“The Government has sent a clear message: the business as usual for the fossil fuel monopoly that raises the cost of living and destroys our environment is over,” he added.

“Of course, the fossil fuel sector, which, compared to the rest of us in heavy industry, is not a big employer but is adept at shifting revenue away from paying fair tax in Australia, will use its profits to try to complicate this legislation until it becomes unviable.

Speaking in his capacity as chief executive of Fortescue on Wednesday, Dr Forrest (pictured) hailed the hydrogen intervention as a “unique opportunity to ensure Australia achieves its potential to become the Saudi Arabia of energy production” .

It comes just days after it was revealed that former Victorian Premier Daniel Andrews (pictured) had teamed up with Dr Forrest to sell “green” iron to China.

‘The Government should be fully prepared for this lobbying effort, which will seek to prevent a cheaper competitor to fossil fuels from being manufactured here in Australia, taxed right here in Australia and enjoyed by Australian parents and job seekers .

“This is a historic moment that, if introduced quickly, will stimulate the establishment of new green industries such as green hydrogen, green ammonia and green iron, creating tens of thousands of new jobs directly for Australians, hundreds of thousands of new indirectly. jobs across Australia, while reducing our emissions.’

It comes just days after it was revealed that former Victorian Premier Daniel Andrews had teamed up with Dr Forrest to sell “green” iron to China.

Dr Andrew’s consultancy, Forty Eight and Partners, is teaming up with Andrew ‘Twiggy’ Forrest’s company Fortescue.

The two companies have committed to delivering 100 million tonnes of “green” iron to China after recently meeting at the Boao Forum for Asia in Hainan province in March.

Andrews, who gave a speech at the event, has not shared any specific details about the partnership with Forrest, who was also present as a title sponsor.

The billionaire mining magnate has been touting the importance of hydrogen in the fight against climate change in recent years.

Dr Forrest’s private business interests will also benefit from Tuesday’s budget

“Fortescue will use green hydrogen to decarbonize our company’s mining and maritime fleet,” its official website states.

He adds that green hydrogen has the power to “revolutionize the way we fuel our planet.”

The government clearly agrees because, in addition to the tax break for hydrogen production, it is investing another $1.8 billion in a further round of the Hydrogen Headstart program and several million in a National Hydrogen Strategy.

Herald Sun columnist Andrew Bolt criticized the government’s pursuit of hydrogen rather than nuclear power as an alternative energy source to coal and gas.

He also called Dr Forrest “the iron ore magnate, who has pushed green hydrogen like a green Jesus, selling it as our great green salvation.”

“Forrest is the fanatic who warns that global warming will cause ‘lethal humidity’ that could kill ‘many millions’, and we must back green hydrogen to save us,” Bolt wrote.

Dr Forrest’s private business interests will also see a big boost in Tuesday’s budget.

Wyloo, its nickel mining group, will benefit from a $7 billion tax incentive over the next ten years “to support the refining and processing of Australia’s 31 critical minerals.”

These critical minerals include rare earth elements, such as lithium, cobalt, silicon and nickel, all essential for clean energy technologies such as solar panels, wind turbines and electric vehicle batteries.

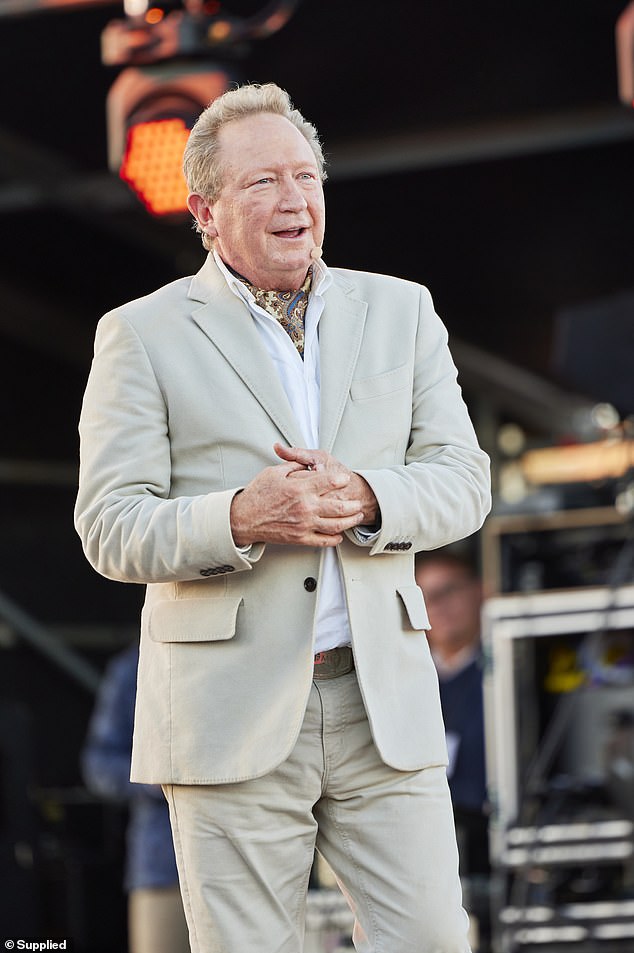

Forrest told guests at a lavish party in Western Australia’s Pilbara Desert to celebrate his mining company’s 20th anniversary last year that mining giants like him had a duty to lead the fight against “lethal damp.” “caused by climate change (pictured: Dr. Forrest at the event)

Wyloo and other nickel mining companies lobbied hard for tax breaks after they were forced to lay off staff in the wake of a slump in the price of nickel after foreign producers flooded the market with supply.

The $7 billion incentive, which will reimburse about 10 percent of the costs of processing and refining critical minerals, was designed “to improve supply chain resilience,” according to Budget documents.

This is an attempt to level the playing field with the Chinese-owned producers that now dominate the market.

Treasurer Dr Chalmers said on Tuesday his budget “invests in our renewable energy superpower ambitions”.

“We know that the global energy transformation represents a golden opportunity for Australia,” he said.

‘The world is changing, the pace of that change is accelerating and our approach to growth and investment must change too.

“If we fall behind, the opportunity for a new generation of jobs and prosperity will elude us, and we will be poorer and more vulnerable as a result.”