A Columbia student with an extensive resume in the art of protest posted a livestream of himself in which he stated that “Zionists don’t deserve to live.”

Khymani James, a senior at Columbia University, who uses ‘he/she/they’ pronouns, is currently one of the leaders of the Gaza Solidarity Camp that has taken over the New York City school campus. York.

In a recording of the broadcast published in X by Kassy Akiva, Daily Wire journalistJames meets with employees of Columbia’s Center for Student Success and Intervention over an Instagram post of his that warned Zionists in his direct messages that he “fights to kill.”

An employee asked him, “Do you see why this is problematic?” He replied: ‘No.’

He continues to defend his position that all Zionists “don’t deserve to live,” with laughter and changes of tone throughout the video.

A rally in support of Israel takes place outside the gates of Columbia University on April 25, 2024 in New York City. Israel supporters are reacting to the growing number of college campuses across the country whose student protesters are setting up pro-Palestinian tent camps on school grounds; Police threatened Wednesday to evict the group by Friday.

Reasoning through his logic to university employees, James said: ‘I believe that taking someone’s life in certain scenarios is necessary and better for the world at large. I have personally never killed anyone.

‘Thank the Lord that no one has put me in that situation.’

It’s not the only time in the video that James compares the Zionists to Hitler and Nazi soldiers, as well as to Haitian slave owners, whose slaves had to be killed “to gain their independence.”

‘These were teachers who were white supremacists. What is a Zionist? A white supremacist. So let’s be very clear: I’m not saying I’m going to go out and start killing Zionists.

‘What I’m saying is that if an individual who identifies as a Zionist threatens my physical safety in person, i.e. puts his hands on me, I will defend myself and, in that case, it may reach a point where “No.” “I know when to stop,” he added, recounting the logic he would apply to a situation in which he could potentially kill a Zionist.

‘Zionists do not deserve to live comfortably, much less Zionists do not deserve to live.

‘In the same way that we feel very comfortable accepting that Nazis don’t deserve to live, fascists don’t deserve to live, racists don’t deserve to live. “Zionists should not live in this world,” he said, after calling the meeting “institutional violence” and “a joke.”

“I feel very comfortable, very comfortable, asking for those people to die,” he said just before the broadcast ended.

According to the Daily Wire report, James appears to still be a student at the Ivy League university and a spokesperson for the Columbia University group Apartheid Divest.

On Wednesday, he publicly announced that the school had confirmed it would not call authorities to dismantle the camp.

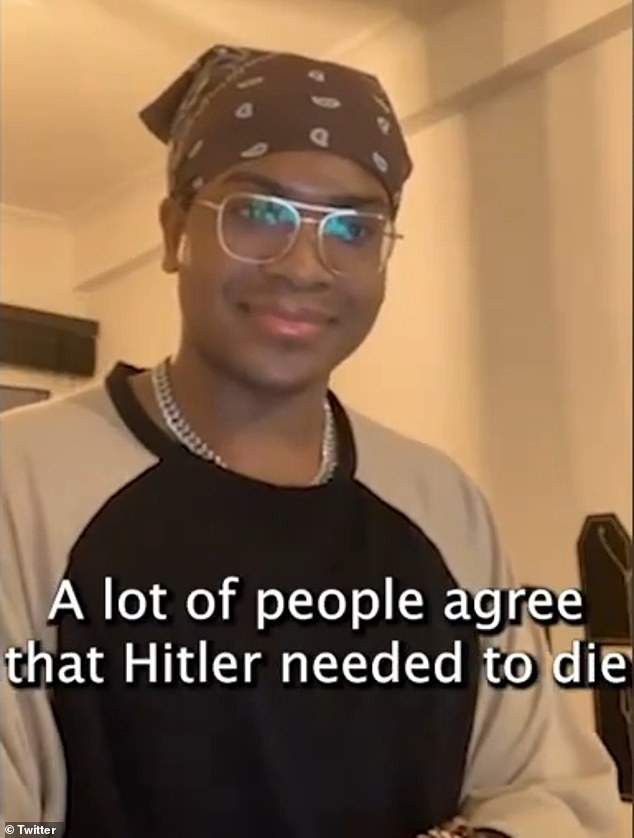

Khymani James, who uses he/she/they pronouns, repeatedly said during a recent livestream that Zionists don’t deserve to live and that the world would be better if they weren’t in it.

James (left) with progressive Congresswoman Ayanna Pressley; She previously said that she hopes to eventually be in Congress.

Student protesters occupy the pro-Palestinian ‘Gaza Solidarity Camp’ on the West Lawn of Columbia University on April 24.

A rally in support of Israel takes place outside the gates of Columbia University on April 25, 2024 in New York City. Israel supporters are reacting to the growing number of college campuses across the country whose student protesters are setting up pro-Palestinian tent camps on school grounds.

The Columbia camp, which began last week, has sparked similar demonstrations on college campuses across the country, including those at Yale University, Boston University and Michigan University.

On Thursday, students in Austin and Southern California also clashed with authorities who were ordered to break up demonstrations.

Dozens of police dressed in riot gear also patrolled the perimeter of Columbia’s campus Wednesday, while security guards made sure that non-students did not enter the campus.

On Wednesday morning, the NYPD gave the students 48 hours to leave the camp or face arrest.

But defiant students have vowed to stay as hours dwindle into Friday morning.

Tahia, a New York resident in her 20s who was leading the demonstration on the sidewalk of 116th Street on Wednesday, said older protesters would also be present on surrounding streets as the student encampment continued.

“We are here in solidarity with the student camps in Columbia, and in full solidarity with their demands for divestment, for complete financial transparency,” Tahia, wearing a keffiyeh over her hair, told DailyMail.com.

“We will be here every day for the duration of the camp,” he added.

‘We will take to the streets to demand ever greater demand to stop the genocide in Gaza, an end to all US funding to Israel, an end to Western complicity with Zionism.

“The fact that 40,000 Palestinians have died, have been murdered, and that the United States is complicit in the 75 years of occupation by the Israeli state.”

As protesters began chanting ‘genocide, Joe has to go,’ he added: ‘There’s no way I’m voting for Biden.

‘I think the uncommitted vote speaks for itself.

‘Hundreds of thousands of people in the United States say the two-party system does not represent them.

“Whether it’s Biden or Trump, both sides are supporters of genocide…Biden does not represent us.”

He added that he considers Biden, Hillary Clinton and Eric Adams ‘war criminals.’

Khymani James is a rising senior at Columbia University with a long resume of activism.

A protest camp over the genocide in Gaza enters its second day, on the grounds of the University of Michigan, in Ann Arbor, Michigan, United States, on April 23.

NYPD officers watch as people demonstrate in support of Israel outside the Columbia University campus amid the student protest camp in support of the Palestinians.

President Mike Johnson held a news conference in Columbia in support of Jewish students Wednesday afternoon after describing the pro-Palestine protests as a sign of “a disturbing rise in virulent anti-Semitism on American college campuses.”

During the conference, the current speaker of the House of Representatives said that Jewish students and Israel “will never be alone” in the United States.

Tahia rejected this characterization, telling DailyMail.com that “students are on the right side of history right now.”

“We know that we are on the side of justice and peace and we will remain on that side,” he said.