<!–

<!–

<!– <!–

<!–

<!–

<!–

The eye-popping price a cafe charges for bacon and egg rolls and iced coffee shows just how out of control Australia’s cost of living crisis has become.

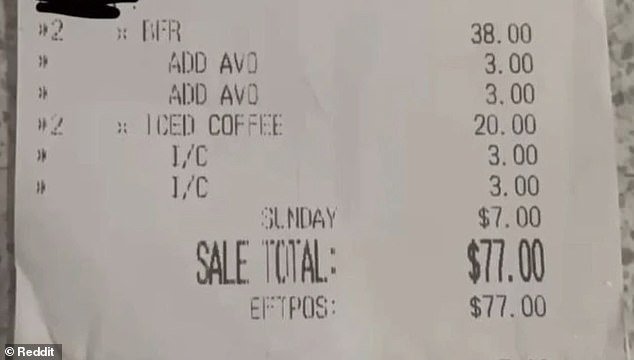

A man posted his receipt for two rolls and two coffees at a beachside café in Darwin to Reddit and revealed he was charged a whopping $77.

He said the rolls were “really nice” but had to do a “double take” when they saw the astronomical price – prompting one commenter to say the drug “meth is cheaper”.

The receipt showed the bacon and egg rolls were $19 each, but there was an additional charge of $3 per roll. roll to add avocado.

The iced coffees were $10 each, but the man and his guest wanted ice added to their drinks so that was another $3 each.

A man posted his receipt (pictured) for two rolls and two coffees at a beachside cafe in Darwin to Reddit, revealing he was charged a whopping $77

The receipt showed the bacon and egg rolls were $19 each, but there was an additional charge of $3 per roll. roll to add avocado (stock image)

That brought the price to $70, but since it was a Sunday, they also charged an extra 10 percent on top, bringing the total budget to $77.

Commenters were shocked by the prices, with one writing “Darwin: where meth is cheaper than iced coffee.”

“That’s why I don’t go out anymore,” said another.

Others commented on the extra charge for being open on weekends.

“The audacity to add a Sunday supplement,” wrote one.

The steep addition to have avocado on the rolls was seen as proof that the ‘Boomers’ were right. It’s the avocado man’.

This was a reference to older generations who sometimes said that the reason young people can’t afford a home is because they spend too much money on coffee and avocado on toast.

Although inflation in Australia has fallen significantly to a two-year low, many Down Under are still feeling it.

The consumer price index fell to 4.1 per cent. in the year to December, which was down from 5.4 per cent. annually in September.