Deputy Prime Minister Richard Marles says the government is still committed to the Uluru Heart Statement after Indigenous Voice’s resounding defeat in Parliament.

Australia woke up as every state and the Northern Territory recorded a No vote in the referendum, with the focus on the future and what comes next for Indigenous Australia.

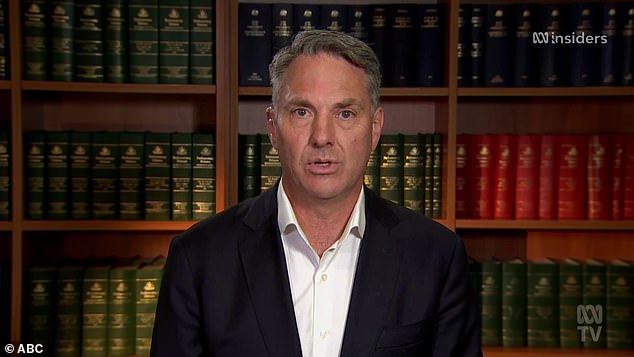

During an appearance on ABC’s Insiders program on Sunday, Mr Marles was asked whether the Albanian government would now support a truth-seeking process, one of the three main pillars of the Uluru Declaration, which are “Voice, Treaty and Truth”.

“We have made it clear that we support the Uluru Declaration from the Heart and that is part of it,” Mr Marles said.

The Uluru Declaration was created in 2017 and called on the government to first constitutionally enshrine a Voice of Parliament in the constitution.

But the ‘culmination of the agenda’ was always a Makarrata Commission, which would seek to implement treaties between Indigenous and non-Indigenous Australia and tell the truth about Indigenous Australia.

The Makarrata Commission was not part of the referendum question and remained a separate entity from the Voice proposal. Work on the commission was halted during the referendum process.

Mr Marles said of the Uluru Declaration: “We have made the main commitment to all that is contained therein and we will not abandon it.”

But Marles admitted he doesn’t have all the answers about how best to proceed in the face of such a resounding defeat at the polls on Saturday night.

The Uluru Declaration was created in 2017 and called on the government to first constitutionally enshrine a Voice in Parliament.

“We are committed to implementing the Uluru Declaration in its entirety,” he said.

“That is what we have conveyed to the Australian people and it has been our articulated position for a long time.”

Marles said the Australian people “always get things right” and “we need to let the dust settle” on what happens next.

‘I think in terms of what exactly the precise steps are from here is a question that we need to take time to resolve. “I think people can understand that.”

His reaffirmation of the Uluru Declaration from the Heart comes just hours after Prime Minister Anthony Albanese admitted defeat in an address to the nation.

Mr Albanese was asked directly whether his government remained fully committed to the Uluru Declaration, the three pillars of which are Voice, Treaty and Truth.

The Prime Minister said: ‘We have just had a referendum. We had a referendum and it was not successful. “I respect the result of that referendum.”

But he said the principles that led him to commit to the Declaration “will continue to guide him” for the rest of his term as prime minister.

“Our Government will continue to listen to people and communities,” he said.

‘Our Government will continue to pursue better outcomes for Indigenous Australians, their children and generations to come.

Marles said of the Uluru Declaration: “We have made the primary commitment to everything in it and we will not abandon it.”

There were tears at Yes campaign events on Saturday night when the referendum was defeated.

‘This is not just in the interests of indigenous Australians. “It is in the interest of all Australians to build a better future for our nation.”

The prime minister said the referendum result would not be “the end of the road” and “certainly not the end of our efforts to bring people together”.

‘The problems we sought to address have not disappeared, nor have the people of good will and good heart who want to address them.

‘And we will turn to them, with hope in our hearts, with faith in one another, with kindness toward one another.

‘Constitutional change may not have happened tonight, but it has happened in our great nation. Respect and recognition are provided at events. “The fullness of our story has begun to be told.”

The prime minister said the referendum result would not be “the end of the road” and “certainly not the end of our efforts to bring people together”.