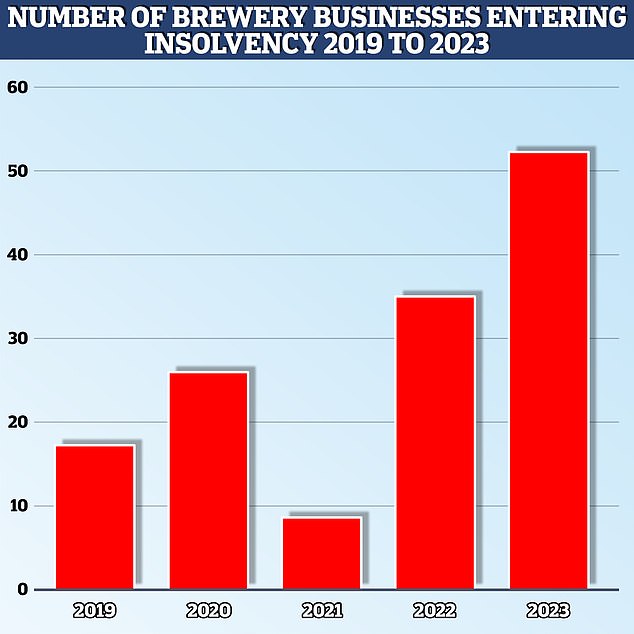

- The number of insolvencies increased to 52 in 2023, according to recent data

- Rising costs and lower demand in pubs threaten the sector

Craft breweries are increasingly under threat as rising costs and lower demand push them further into insolvency.

The total number of business bankruptcies in the sector increased from 35 in 2022 to 52 in 2023, according to data from accounting firm Price Bailey.

Smaller breweries have been particularly hard hit by rising interest rates and higher costs, as many have been forced to rely on debt to finance equipment, raw materials and, in some cases, operating costs.

Closed: The number of craft breweries filing for bankruptcy increased again in 2023

While the data covers breweries that went into insolvency, it does not count those that were liquidated.

Some big names, such as Brew By Numbers, went bankrupt last year but were subsequently taken out of administration.

Price Bailey says rising interest rates and the reduction of the energy support package mean an increasing number of breweries have defaulted on loan payments, driving them into insolvency.

Matt Howard, head of insolvency and recovery at Price Bailey, says: ‘Many of these firms were banking on interest rates staying low, but as rates have risen sharply, many are unable to make their loan payments.

«The longer rates remain at current levels, the more brewers will fall into the red.

‘As rates have risen, banks are putting pressure on breweries to raise capital and repay interest on loans. This has been the final nail in the coffin for many breweries.’

At the same time, craft beer production has not yet recovered from the pandemic, which has undoubtedly compounded the problems of craft brewers.

A report from the Society of Independent Brewers (Siba) found that average annual production for 2022 remained 11 percent below 2019 levels.

Consumer demand has also slowed, largely due to the cost of living crisis, which has done little to help sales.

“As many microbreweries struggle to make a profit in the first few years of business, it only takes a brief downturn in the market for unsustainable debt to accumulate,” Howard says.

The difficulties in the pub industry are also having a knock-on effect on craft breweries selling small batches to local pubs.

Siba said last year that more than a fifth of consumers had not visited a pub in the last 12 months, as well as a significant drop in the overall number of beer drinkers.

Pub closures hit a record high last year: 769 businesses had to close their doors last year, up from 518 closures in 2022.

“Pubs are less willing to take risks with new beers when consumer demand is uncertain,” Howard says.

Rob Fink, founder and CEO of independent non-alcoholic brewery Big Drop, says the growth of the sector has created difficulties in getting beer to shelves.

“The independent sector is now so vocal that trying to make yourself heard is becoming increasingly difficult.”

Larger brewers are getting into the craft beer sector, either by developing their own products or by acquiring smaller brands.

It means supermarkets are allocating less shelf space to smaller, often more expensive brands, especially in the economic context.

Howard adds: ‘While many multinational brewers are making extraordinary profits, smaller independent companies are generally much more exposed to market risks.

“While 2024 will already see an improvement in trading conditions for brewers, we are likely to see many brewers fall by the wayside as the sector continues to consolidate around fewer premium brands.”