Struggling families are facing a deepening cost of living crisis as the average council tax bill surpasses £2,000 for the first time.

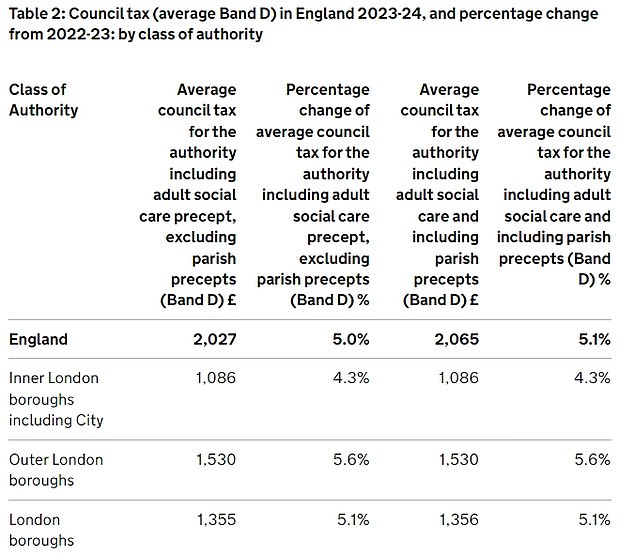

The latest rise represents another blow to struggling homeowners after government statistics revealed the average council tax bill for a Band D property will hit a record £2,065 in 2023-24.

Meanwhile, more than 1 million homeowners with variable rate mortgages will see their payments rise by hundreds of pounds a year after the Bank of England raised interest rates to 4.25 per cent.

The move was backed by Chancellor Jeremy Hunt, who said rising prices were “strangling growth”.

And the Bank governor raised the possibility of further problems from further rate hikes.

Do you want to know how much your council tax could increase by? Type the name of your local authority in the box below to reveal the planned increase:

New figures from the Department of Levelling, Housing and Communities show the average charge for a Band D property will be £2,065 by 2023-24.

The total is £99 more than the current financial year figure, an increase of 5.1 per cent, but residents can expect worsening services as bosses say they must make massive cuts to balance the books.

At the same time, millions of households are receiving unwanted letters from energy companies warning that their fuel bills will soon rise by £67 a month when the Government’s rebate scheme comes to an end.

The economic shocks come just a day after inflation rose again to 10.4 percent in the year to February, driven by rising food prices caused by shortages of salads and vegetables. Rishi Sunak had previously promised to halve the headline rate by the end of the year.

The Governor of the Bank of England attempted to reassure the public about both rampant price increases and fears of a banking crisis.

And offering a ray of hope, he said inflation will have fallen sharply by summer.

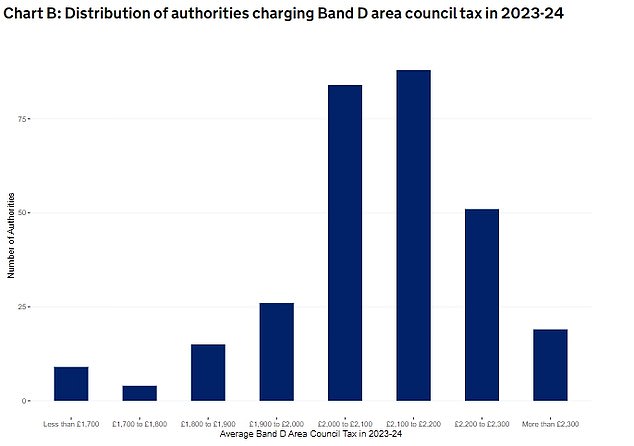

This graph shows the number of authorities imposing different levels of Band D council tax.

The economic shocks come just a day after figures showed inflation unexpectedly rising to 10.4 per cent, a blow to Rishi Sunak’s promise to halve inflation by the end of the year.

Food prices are rising by a staggering 18.2 per cent – a 45-year high – amid shortages of salads and vegetables, while the price of going out for a pint has also soared.

Bailey said he expected rampant inflation to come down a lot as families head on vacation this summer, but hinted that rates could continue to rise until it is brought under control.

“We know people are worried about the cost of living and rightly think inflation is too high,” Mr Bailey said.

‘They may also be worried about what they have heard about the banks in recent days.

‘That is why we have taken measures in both cases.

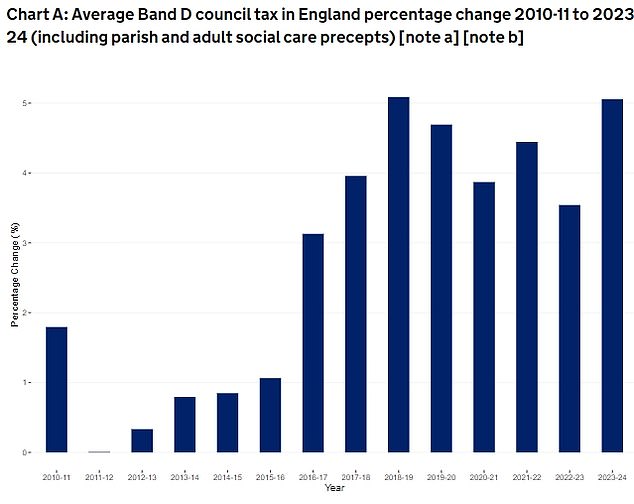

Bills have risen rapidly in recent years. However, bus routes, street lighting, recycling centers and community health could still be cut as councils try to protect frontline services.

‘Low and stable inflation is the basis of a healthy economy. Raising rates is the best tool to reduce inflation.

“We think inflation will start to fall quite quickly before the summer.”

Chancellor Hunt said: “With rising prices strangling growth and eroding household budgets, the sooner we get inflation under control, the better for everyone.”

“That is why we support the Bank of England’s actions today and will continue to play our part in this fight by being responsible with public finances, as well as providing cost of living support worth an average of £3,300 per household over this year and next. next. .’

But Labour’s shadow chancellor, Rachel Reeves, said: “Today’s announcement on interest rates will be a source of great concern for families across the country, who will be thinking about the impact this will have on their finance”.

“The Government believes the cost of living crisis is over, but the reality is that too many families are facing a conservative mortgage penalty and struggling with skyrocketing food prices.”

In last year’s Autumn Statement, Jeremy Hunt allowed local authorities to increase rates by up to 5 per cent without holding a referendum.

Money-saving expert Martin Lewis has previously urged Brits worried about council tax rises to check if they are in the right group. Otherwise you could save thousands of pounds.

Lewis explained: ‘Once upon a time, back in 1991, in time for the launch of its new council tax system, the Government needed all land properties to be included in a valuation band.

“But time was short and the job was big, so those responsible asked real estate agents and other people for help.

“However, even with the help of all the real estate agents, they didn’t have time to gather the detailed information, so they set out to do it quickly by pairing up and driving down countless streets, assigning each property a band at a glance.

“They became known as ‘second gear tits’ as most of the time they didn’t even stop their cars, let alone get out of them.”

Many households have therefore been in the wrong council tax bracket since 1991 and many feel they should be in a different bracket today.

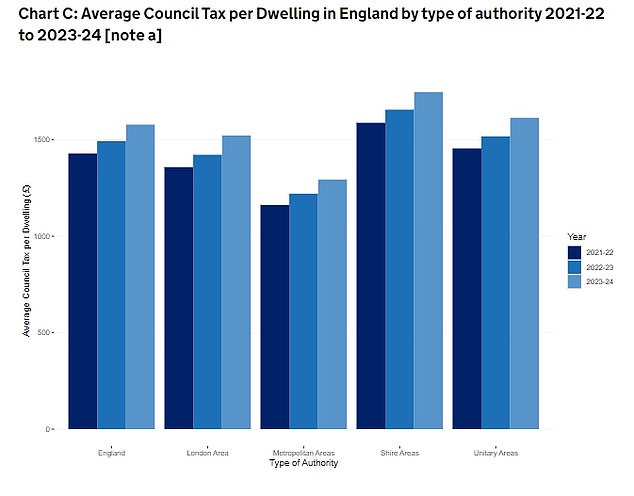

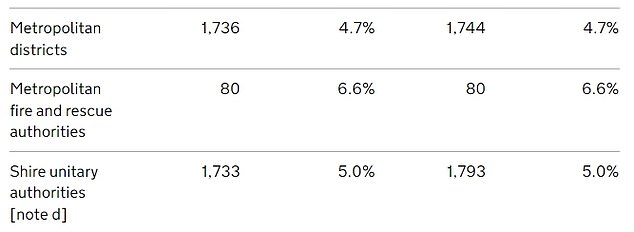

This shows how much your council tax bills will increase depending on the type of area you live in.

You can challenge your gang if you think they are wrong and get back any money you overpaid.

However, it’s worth noting that you may have your band changed and have to pay more council tax, so be careful before taking on the challenge.

Lewis explained that people in England and Wales should lodge their challenges with the Valuation Office Agency (VOA), which can be accessed on the Government website.

Alternatively, you can call VOA on 03000 501 501 for England or 03000 505 505 for Wales or email ctinbox@voa.gov.uk.

You will need to provide the addresses of up to five similar properties in a lower municipal tax band in your immediate area, as well as providing detailed information about the type of property in which you live.

The challenging process is different if you live in Scotland and Lewis says you should visit the Scottish Government website for more information.