Child benefit: If you do not claim it because you are not entitled to receive payments, you will not receive state pension credits

One million fewer families are claiming child benefit payments than a decade ago, new figures reveal, meaning many could be unknowingly falling into the trap of creating shortfalls in their state pension records.

Parents who are not entitled to child benefits and therefore do not claim them, stand to lose valuable credits – worth £329 a year, or £6,500 over a 20-year retirement – in what one expert calls a “hidden horror” of the system.

After rejecting parents’ pleas for years, the Government has promised to allow them to repair state pension records by creating new credit which they will be able to claim from April 2026.

But so far there are few details: no guarantee that these new credits will be accepted will be enough to solve the problem and, in the meantime, pending elections could cause delays.

Former Pensions Minister Steve Webb, who has campaigned with This is Money on the issue for the past six years, today called for urgent action to protect parents’ state pensions.

Almost no one is aware that there is a relationship between child benefit and the amount of state pension that could be received decades from now.

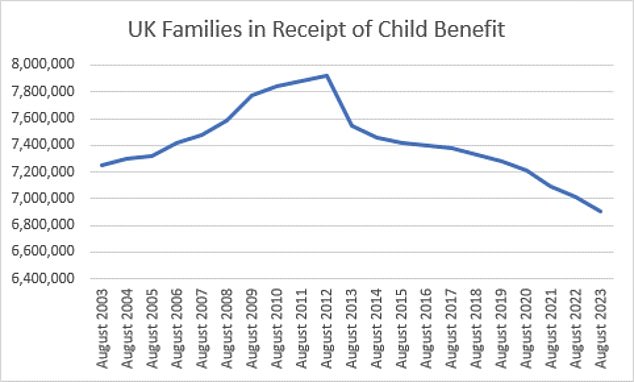

This became a problem because the number of families claiming it fell after a controversial reform in 2013.

Child benefit: Claims have plummeted, meaning some parents will have holes in their state pension records, until the government proposes a solution due in spring 2026.

Child benefit was reduced for those earning more than £50,000 a year, or eliminated entirely for those earning more than £60,000, something officially known as “high income child benefit burden” or HICBC.

The rules were relaxed earlier this month, so child benefit begins to be phased out if one member of the household earns £60,000 and payments stop completely at £80,000.

HMRC today published figures showing that around 1 million fewer families are now claiming child benefit payments, down from a peak of 7.92 million in the summer of 2012.

Before the rule change in January 2013, the number of families receiving child benefit increased each year, but the following year there was an immediate drop of 370,000, and the decline has continued since.

HMRC figures show that in August last year, 7.65 million families in total were claiming child benefits, 47,000 fewer than the previous year.

Some 6.91 million received payments, 106,000 less. There were 741,000 families who claimed but chose not to receive the money.

Currently, parents can apply for child benefit but tick a box to opt out of payments and only get state pension credits.

STEVE WEBB ANSWERS YOUR QUESTIONS ABOUT PENSIONS

Anyone who has not already done so is urged to do so now, rather than waiting for the Government to fix the problem by offering new credit in several years’ time.

For now, your state pension credits will only be backdated for three months when you register late, but you will be in the system and the hole in your record will stop getting bigger.

Parents who lose credits can recover them before they retire by working and paying National Insurance for enough years, or by qualifying to receive them in some other way, such as being a carer.

But this is not guaranteed, and parents will not necessarily be rich in their own right, or remain married to a partner whose high income disqualified them from receiving child benefit, when they reach retirement age.

MPs have questioned the delay in patching holes in state pensions for parents and have called for more details on “simplification” plans to help them claim valuable credits.

Steve Webb, now a partner at LCP and This is Money’s pensions columnist, has previously called it a “duct tape” solution to create another NI credit for those who didn’t get a first credit because they were postponed claiming child benefit . .

Commenting on the latest claims data published by HMRC, he says: ‘These latest figures show the dramatic impact of the high-income child benefit charge, which left one million families without benefits in just over a decade.

‘A major knock-on effect is that hundreds of thousands of parents may have lost vital National Insurance credits towards their state pension.

‘Although the government has proposed a new way of crediting people, we are still missing important details and there is a risk that these new credits will suffer from the same non-acceptance problems that we see in the existing system. This issue must be resolved urgently.”

Helen Morrissey, head of retirement research at Hargreaves Lansdown, says: ‘Take-up of child benefits continues to fall as parents do everything they can to avoid the dreaded tax on high-income child benefits. income.

‘But avoiding the charge today can have a severe impact on their long-term income, because they also risk losing valuable National Insurance credits towards their state pension.

‘Child benefit is a benefit that carries National Insurance credits to help preserve parents’ entitlement to the state pension during time they are out of work.

‘Not stating this leaves gaps in people’s records, leading to lower state pensions. It is a true hidden horror of the system that more people need to know about.”

Morrissey says ticking a box to get the National Insurance credit but not the child benefit payment saves him the administrative headache of completing a self-assessment tax return, but the continuing drop in applications suggests not everyone is aware that they can do it.

In the meantime, she says the new higher threshold for the tax charge for high-income child benefit means more families will not be affected, but until a system to help claim NI credits is in place, we will continue watching them get lost without knowing it.

A government spokesperson says: ‘We have raised the threshold for the High Income Child Benefit (HICBC) charge, which will allow 170,000 families to stop paying the charge this year.

‘We also plan to end the injustice for single-income families by administering HICBC on a per-household basis from April 2026 and will consult in due course.

“We are developing comprehensive plans to raise awareness of the new retrospective National Insurance credit system and ensure parents do not lose their entitlement to the state pension.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.