- A branding firm representing Tiger Woods has contacted a course in North Wales.

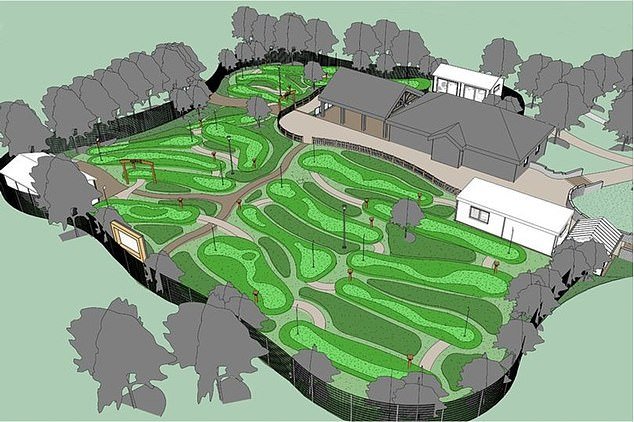

- New playground and party course on Anglesey would be called PuttStroke

- However, there are concerns that it could mislead golf fans with a similar name.

A branding firm representing Tiger Woods has issued a “cease and desist” letter to a Welsh golf course over fears that fans could be misled by a name similar to one of the legend’s own companies.

The new play and play golf course in Anglesey, north Wales, is being opened by local professional golfer Matthew Wharton and would be called PuttStroke.

However, the premium mini-golf experience has attracted the attention of a firm that represents Woods, 48.

The daily publication that JA Kemp, a leading patent and trademark firm in London, has contacted Wharton because of similarities between the proposed name and PopStroke, a company partly owned by golf icon Woods that operates in the United States.

JA Kemp intervened after detecting a previous article about the proposal published on the Daily Post website last month, in which Wharton, 50, cheekily said: ‘I’m taking inspiration from several of the mini-golf courses designed by Tiger Woods and his team.

A trademark firm representing Tiger Woods has sent a ‘cease and desist’ letter to a golf course.

Matthew Wharton hoped to name his play-and-party golf course in North Wales PuttStroke.

“I call it Puttstroke, but I might have to think again if I get a warning letter from Tiger.”

Now that his name has been called out, due to a “substantial risk of confusion,” according to JA Kemp, Wharton, 50, has asked for help finding a new nickname for the company.

Wharton admitted: “I was a little surprised to receive the letter.

‘It arrived shortly after I announced the company. I was surprised that it caught Tiger’s attention so quickly, but I guess in a way it’s a big compliment – maybe it shows that he’s worried about the competition!

‘I am happy to accept the request and look for a new name. I have decided to look to the public for inspiration to see if they can suggest something suitable. I’d be happy to hear ideas for the new name, as long as it’s not Putty McPuttFace or something.

“We live in a Welsh village and are trying to promote the Welsh language, so it would be good to hear suggestions for names that translate well and put Welsh first.”

In the US, PopStroke offers 13 luxury clubhouses, indoor playgrounds and 18-hole golf courses with premium turf, with a goal of reaching 50 nationwide.

Wharton’s Golf Mon company uses the former Llangefni golf course and driving range, which closed in 2018.

Construction work on the new project has already begun, with floodlit greens that mirror traditional golf clubs but allow for later play, and dining facilities, including a pizzeria already operating on site.

Woods finished the Masters at the bottom of the standings, up 16 points for the week.

There was a moment of levity when a handshake with a tree went viral on social media

Woods found himself in the unusual position of finishing the Masters at the bottom of the standings in Augusta, Georgia, shooting 77 on Sunday to finish 16+ in the tournament.

However, fans of the golf great were treated to a moment of levity during the broadcast when the 48-year-old appeared to shake hands with a tree, which quickly went viral on social media.