Just a day before Chancellor Jeremy Hunt makes his final budget statement, the UK new car market in February recorded its record performance for two decades.

Since vehicles are big-ticket items, the sale of new engines often provides an indication of economic activity.

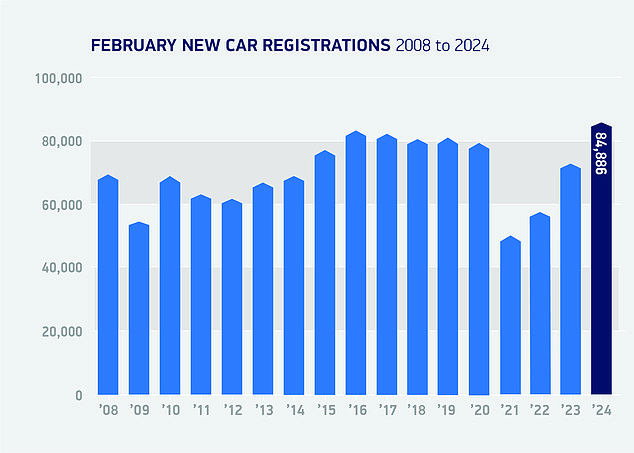

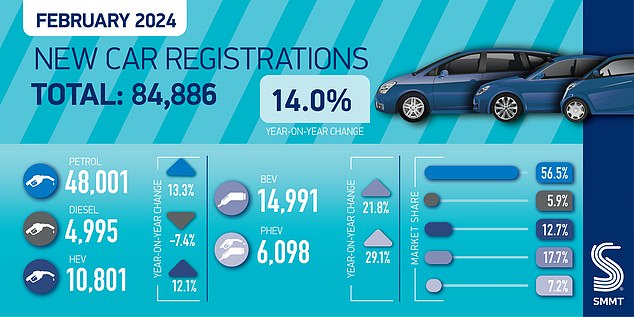

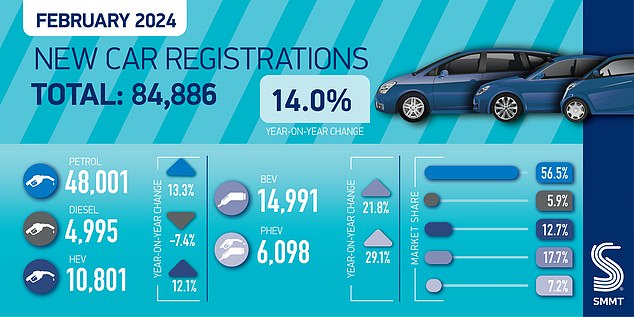

And the latest figures show car registrations rose 14 per cent to 84,886 units last month, the Society of Motor Manufacturers and Traders (SMMT) said on Tuesday.

However, a closer look at the data shows that it is primarily fleets and companies that are propping up the market, and the data shows that public demand for electric vehicles (EVs) continues to decline.

Last month’s new car sales data shows the UK new car market has recorded its best February in two decades.

SMMT figures show new car registrations rose 14 per cent to 84,886 units, the best figure since 2004.

Last month saw the highest total of new car sales in February since 2004, when more than 91,000 vehicles were registered, the automotive industry body confirmed.

This record month also marks the 19th consecutive month of growth, bucking the trend of February being traditionally a low volume month as buyers wait until March to register new registrations.

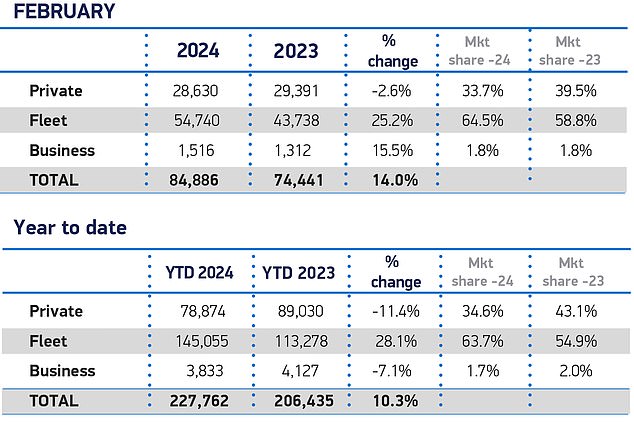

The main drivers of growth have been fleets investing in the most modern vehicles, with companies and fleets responsible for the entire increase in February.

Fleet registrations increased by more than a quarter (25.2 percent), while business registrations increased by 15.5 percent.

In stark contrast, private adoption has continued to struggle with a 2.6 percent drop, with private sales now accounting for just a third (33.7 percent) of the new car market share.

The UK new car market is growing very well, but is being driven by business and fleet sales making up all the growth, as private sales fell -2.6 per cent.

Gasoline cars account for the highest total sales and battery electric vehicles (BEVs) account for the second highest sales segment.

It is a similar case with battery electric cars, where fleet utilization far exceeds purchase by regular drivers.

Electric vehicle adoption outpaced the rest of the market, increasing 21.8 percent to a total of 14,991 registrations. This represents 17.7 percent of total registrations and is well ahead of last year’s 16.5 percent.

Addressing the tax triple whammy as the market embarks on its busiest month of the year would boost demand for electric vehicles, reduce carbon emissions and boost the economy. Mike Hawes, CEO of SMMT

However, private buyers account for less than one in five (18.2 percent) of new EVs registered in 2024 so far; the increase in adoption is entirely due to fleets.

Despite January marking one million electric vehicles hitting the roads in Britain, public demand for battery-powered cars has stagnated in recent months.

It couldn’t come at a worse time for automakers, as 2024 marks the first year the Zero Emission Vehicle Mandate (ZEV mandate) comes into play.

The ZEV mandate requires 22 per cent of new car sales to be electric by the end of the year, with individual manufacturers facing fines of £15,000 per car for each number below that threshold.

SMMT records show that, on average, automakers are about 4 percentage points below the target.

Ahead of Chancellor Jeremy Hunt’s Budget tomorrow, the SMMT and other leading industry figures are calling on the Government to cut taxes on electric vehicles and improve incentives offered to private buyers.

The SMMT calls for “fairer” taxation of electric vehicles ahead of Wednesday’s budget, as private adoption continues to struggle.

Mike Hawes, SMMT chief executive, said: “The new car market’s ability to deliver growth continues with its best February for 20 years and this week’s Budget is an opportunity to ensure growth is greener.”

“Addressing the tax triple whammy as the market embarks on its busiest month of the year would boost demand for electric vehicles, reduce carbon emissions and boost the economy.

“It will deliver a faster and fairer transition to zero emissions, putting Britain’s ambition for electric vehicles back on the fast track.”

For many private buyers, a bridge between gasoline, diesel and electricity are hybrid cars, which also recorded promising growth figures.

Steppingstone plug-in hybrids (PHEVs) had the largest proportional growth during the month, rising 29.1 percent to reach a 7.2 percent market share. Hybrids also increased by 12.1 percent, but year-on-year market share was slightly lower at 12.7 percent.

The Ford Puma was the best-selling new car last year, and the SUV is already the best-selling model for January and February of this year

The Tesla Model Y was the best-selling new electric car last year in the UK and is the only fully electric car to appear in the top 10 most popular new cars so far this year.

SUVs are very popular these days, it’s no surprise that six in 10 of the most popular cars last month were SUVs.

Ford Puma returns to the top of the sales table

The most popular models were the Ford Puma and two Volkswagens: the Golf and the T-Roc. Considering the huge popularity of SUVs, it’s no surprise that six in 10 of the most popular cars last month were SUVs.

The Puma takes first place this year to date, putting it on an early trajectory to be the best-selling car of the year for the second year in a row.

The Tesla Model Y, the best-selling new electric car of 2023, was the only electric car to appear in the top 10.

While there are still financial challenges that new car buyers must overcome in the current climate, the outlook is positive and new car growth continues post-pandemic.

Richard Peberdy, UK head of automotive at KPMG, said: “Continued pressure on household budgets and the higher cost of car finance means it remains a difficult economic period for many people looking to buy a car. new, and a challenge for those trying to buy a new car. sell them.

“Overall, the UK market continues to hold up relatively well to this challenge, driven by the flow of new vehicle supply, discounts at many service stations and export demand.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.