Table of Contents

The Chancellor has said that the freeze on income tax thresholds will finally end from 2029.

Frozen thresholds have led to a colossal stealth tax raid in recent years. While neither the Labor Party nor the previous Conservative government have increased headline income tax rates, people will pay more in the coming years as the thresholds lag behind inflation and pay rises.

Rishi Sunak started the freeze in 2022 and, although current chancellor Rachel Reeves was expected to extend it, she announced in the autumn budget that it would stop after the 2028 to 2029 financial year.

This is good news, but by then the “fiscal drag” will have affected workers for seven consecutive fiscal years. We explain what it is and how it raises money.

Frozen: Income tax thresholds will remain at the same level until 2029, meaning more people will pay higher tax rates

Income tax thresholds

Income tax applies to income from employment and self-employment, but also to pension income, rental income and interest on savings.

You usually do not have to pay income tax on all your taxable income due to tax-free allowances, i.e. personal allowance.

The tax-free personal allowance means no income tax is paid on everything you earn between £0 and £12,570, but those earning more than £100,000 have it phased out.

The official tax rates for England, Wales and Northern Ireland are 20 per cent, 40 per cent and 45 per cent.

> How income tax works and who pays the most

Tax bands

- The personal allowance means most will not pay any tax on the first £12,570.

- Basic rate income tax of 20 per cent is paid between £12,571 and £50,270

- Higher rate income tax is paid at the rate of 40 per cent between £50,271 and £125,140

- An additional rate of 45 per cent income tax is payable on income over £125,141

What does it mean to freeze income tax thresholds?

Income tax is a major source of revenue for the Government, accounting for a quarter of the total tax collected each year.

Labor’s manifesto pledged to keep income tax rates at their current level during the election, meaning they would not be able to increase the tax directly.

But the Chancellor can raise money through the back door by freezing income tax thresholds at their current level.

This is due to something called fiscal resistance. If allowances and thresholds do not increase with inflation or wages, the amount people can earn tax-free, or at a lower rate, falls behind, and the government raises more money.

As wages tend to rise over time, more low-income people get caught in the tax net and the number of taxpayers in higher rate bands increases.

Former chancellors Rishi Sunak and Jeremy Hunt implemented this under the Conservative government and it will continue until April 2029.

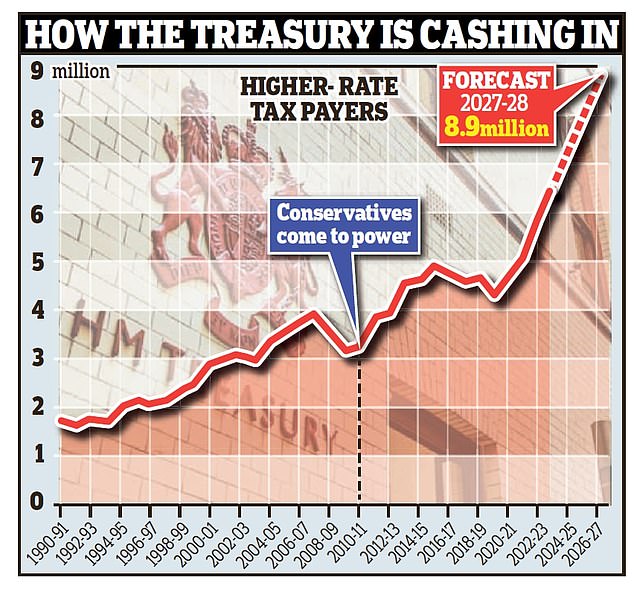

Land grabs: Higher income tax rates applied to 3.2 million people in 2010; now they reach 7.4 million and the figure will continue to increase, says the IFS

Fiscal ballast in action

The fiscal drag effect has been enormous in recent years, due to high inflation.

Total inflation has been 22 percent in the consumer price index since tax thresholds were last raised in April 2022.

The basic rate threshold frozen at £12,570 means more people have to pay income tax and the real (inflation-adjusted) value of the tax-free allowance decreases.

Keeping the higher rate threshold at £50,270 also means more people are paying more of their income into the 40 per cent bracket.

Similarly, the £100,000 threshold at which personal allowance starts to be deducted has not increased in line with inflation. If it had, it would be around £153,000, after the previous Conservative government froze the thresholds in 2021.

An IFS report found that by 2027/28, 8.8 million taxpayers will pay higher tax rates, compared to 7.4 million in 2023/24.

The Office for Budget Responsibility predicted earlier this year that the freeze will raise £33.6 billion in the 2028/29 financial year.

What do frozen thresholds mean for your savings?

The tax burden also affects savers and investors, taxing more of people’s savings interest, dividend income and capital gains.

This is due to our complicated tax system, which means your income tax thresholds decide other reliefs.

For example, interest on savings of up to £1,000 per year is covered by the personal savings allowance for a basic rate taxpayer.

You don’t need to pay taxes on interest on savings until they exceed your personal savings allowance; You will then pay your tax rate on the sum above that amount.

But if you are a higher rate taxpayer, the threshold is reduced to £500 and you will lose 40 per cent of any interest accrued on your savings above that figure. And additional rate taxpayers receive no personal savings subsidy, so they pay a 45 percent tax on all of it.

This has become more important as savings rates have increased, meaning more people are affected even if they have smaller funds.

That’s why it’s important to open a cash Isa so your savings are protected from any taxes that would be incurred on interest.

> How to reduce taxes on savings interest

Frozen thresholds also affect your investments if you own stocks, funds or investment trusts that pay dividends or sell any investments for a profit.

If you are a higher rate taxpayer, you will have to pay an additional capital gains tax or dividend tax.

Capital gains tax rates were increased in the Budget, from 10 per cent to 18 per cent for basic rate taxpayers and from 20 per cent to 24 per cent for higher rate taxpayers.

The tax-free allowance for dividend income has been reduced to £500 from April 2024, down from £1,000 in the previous tax year. Before that it had been £2,000.

If your dividend income is greater than your personal allowance (which also takes into account all your other taxable income) plus your tax-free dividend allowance, you will pay dividend tax in accordance with your income tax bracket.

Dividend tax rates are currently 8.75 per cent for basic rate taxpayers, 33.75 per cent for higher rate taxpayers and 39.35 per cent for additional rate taxpayers.

> How to reduce the amount of dividend tax you pay

What do frozen pension thresholds mean?

Pensioners are also now hit by frozen thresholds, largely due to the triple lock on state pensions, which ensures they rise in line with inflation, income or 2.5 per cent.

This means that pensioners receiving the full state pension, which is currently £11,502.40, plus some private pension income, are likely to default on the personal allowance. Then they will have to pay income tax.

HMRC figures show more pensioners than ever are now paying tax, with more than half a million more paying income tax between 2023/24 and 2024/25.

This means there are now almost 9 million people aged 65 and over paying tax on their income, almost double the amount they paid in 2010/11.

This will only increase in the coming years if the government continues with its triple lock promise.

The state pension will rise to £11,975 from next April, in line with September’s earnings figure of 4.1 per cent.

This means the state pension will only need to rise by 4.97 per cent to £12,570 next year for the full state pension to exceed the personal allowance.

SAVE MONEY, MAKE MONEY

3.75% APR Var.

3.75% APR Var.

Chase checking account required*

4.91% 6 month solution

4.91% 6 month solution

Increase in interest rates at GB Bank

free stock offer

free stock offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: 3.69% gross. T&Cs apply. 18+, UK residents

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.