Table of Contents

Jeff Bezos has surpassed Elon Musk as the world’s richest person for the first time in nine months.

Musk was dethroned from the top of the Bloomberg Billionaires Index after Tesla shares fell 7.2 percent on Monday, bringing his net worth to $197.7 billion, compared to Bezos’ $200.3 billion. .

It is the first time that Amazon founder Bezos, 60, has taken first place in the Bloomberg ranking since 2021.

While Amazon stock has more than doubled since the end of 2022 and is nearing an all-time high, Tesla is down about 50 percent from its 2021 high.

Most of Bezos’ fortune comes from his 9 percent stake in Amazon, where he is the largest shareholder, despite selling 50 million shares worth about $8.5 billion in February.

Bezos for the first time surpassed Microsoft Inc. co-founder Bill Gates as the world’s richest person in 2017.

But a big rally in Tesla stock left Bezos and Musk competing for the top spot for most of 2021.

At the end of 2021, Bezos fell far behind and this is the first time he has regained his position since then.

Here MailOnline looks at the other mega rich people on the list.

Most of Bezos’ fortune comes from his 9 percent stake in Amazon, where he is the largest shareholder, despite selling 50 million shares worth about $8.5 billion in February.

Musk was dethroned from the top of the Bloomberg Billionaires Index after Tesla shares fell 7.2 percent on Monday, bringing his net worth to $197.7 billion, compared to Bezos’ $200.3 billion. .

(3) Bernard Arnault 197 billion dollars

Bernard Arnault, Chairman and CEO of LVMH Moet Hennessy Louis Vuitton, and his wife Helene Mercier

Bernard Arnault is the Chairman and CEO of LVMH Moët Hennessy – Louis Vuitton, the world’s largest luxury goods group.

Born in Roubaix, France, on March 5, 1949, he began his career as an engineer at the construction company Ferret-Savinel and was promoted to various executive management positions before assuming the role of president in 1978.

Arnault, 75, remained there until 1984, when he carried out the reorganization of the Financière Agache holding company.

In 1989, he became a majority shareholder of LVMH Moët Hennessy – Louis Vuitton, of which he has been president and CEO ever since. Arnault is married with five children.

(4) Mark Zuckerberg $179 billion

Mark Zuckerberg and his wife Priscilla Chan. Zuckerberg is the founder, chairman and CEO of Meta, which he first founded as Facebook in 2004.

Mark Zuckerberg is the founder, chairman, and CEO of Meta, which he first founded as Facebook in 2004. He controls the company’s overall direction and product strategy.

Zuckerberg was born in White Plains, New York and studied computer science at Harvard University before moving to Palo Alto, California in 2004.

In October 2021, Facebook became Meta.

Zuckerberg is also co-founder and co-CEO of the Chan Zuckerberg Initiative (CZI) with his wife Priscilla, which they started in 2015 to help solve some of society’s most pressing problems, including improving education and fighting disease. .

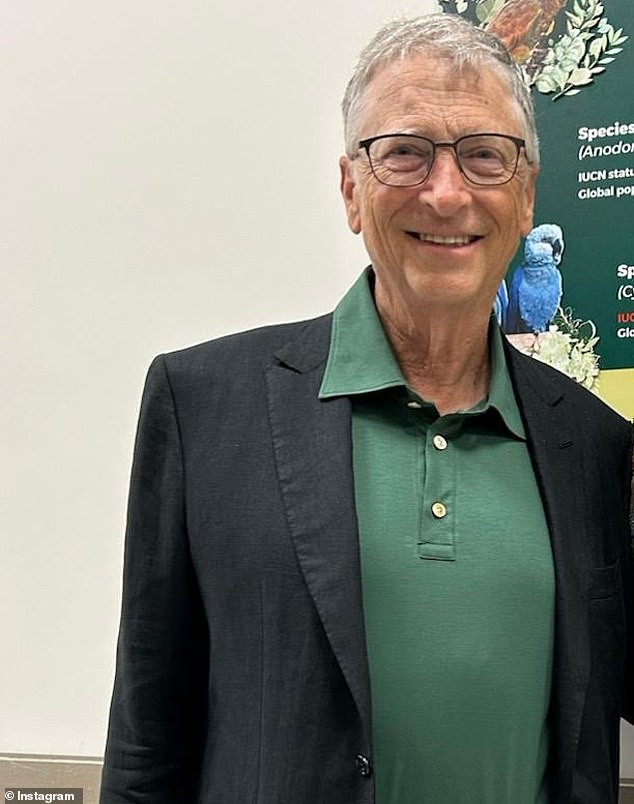

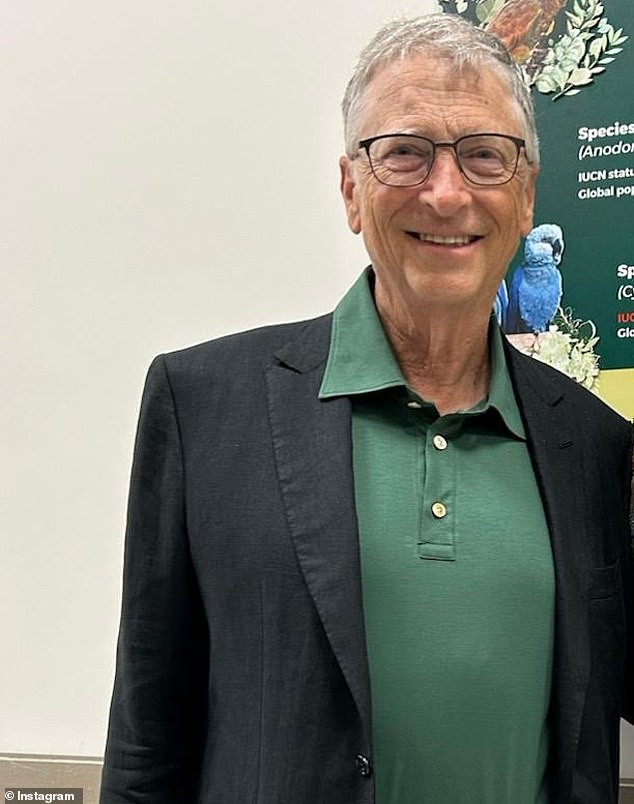

(5) Bill Gates $150 billion

Bill Gates co-founded Microsoft Corporation in 1975 with Paul Allen.

The company became the global leader in business and personal software and services.

In 2008, Bill made the switch to focus full time on the work of the Bill and Melinda Gates Foundation, which they still co-chair after their marriage ended in 2021.

As part of the divorce settlement, he transferred shares of public companies worth at least $6 billion to Melinda.

In March 2020, when Gates left Microsoft’s board, he owned about 1.3 percent of the company’s shares.

He is one of the largest owners of agricultural land in the U.S. and has made investments in dozens of companies, including Republic Services and Deere & Co.

He has also donated more than $59 billion to the Gates Foundation.

Bill Gates co-founded Microsoft Corporation in 1975 with Paul Allen

(6) Steve Ballmer $143 billion

Steve Ballmer is the former CEO of Microsoft and led the company from 2000 to 2014.

Ballmer led Microsoft as CEO after the first dotcom crash. He joined the company in 1980 after dropping out of Stanford’s MBA program.

It tried to close the gap with Google in search capabilities and Apple with mobile phones.

In 2014, he retired from Microsoft and bought the NBA’s Los Angeles Clippers for $2 billion, which is now worth $4.65 billion, according to Forbes.

In 2022, Ballmer and his wife Connie donated about $425 million to the University of Oregon to form an institute for the mental and behavioral health needs of the state’s children.

Steve Ballmer is the former CEO of Microsoft and led the company from 2000 to 2014.

(7) Warren Buffett $133 billion

American businessman and philanthropist Warren Buffett is chairman and CEO of Berkshire Hathaway Inc, which owns dozens of companies, including Dairy Queen and Duracell.

Warren and his late wife Susan raised three children: Susie, Howard and Peter.

He is now married to Astrid Menks Buffett and lives and works in his hometown of Omaha, Nebraska.

Buffet bought stocks for the first time at age 11 and filed his taxes for the first time at age 13, before becoming one of the most successful investors of all time.

Buffet has promised to donate more than 99 percent of his fortune.

American businessman and philanthropist Warren Buffett is chairman and CEO of Berkshire Hathaway Inc, which owns dozens of companies, including Dairy Queen and Duracell.

(8) Larry Ellison $129 billion

Larry Ellison is the founder and largest shareholder of the database company Oracle.

The company’s reported revenue was $50 billion in the year to May 31, 2023.

He owns more than 40 percent of the company, as well as a stake in Tesla, a sailing team, the Indian Wells tennis event and real estate.

Ellison stepped down as Oracle CEO in 2014 after 37 years in the role.

In 2020, Ellison moved to the island of Lanai in Hawaii, which he purchased almost entirely in 2012 for $300 million.

Ellison was on Tesla’s board of directors from December 2018 to August 2022 and still owns about 15 million shares of the company.

Larry Ellison is the founder and largest shareholder of the database company Oracle.

(9) Larry Page $122 billion

Larry Page stepped down as CEO of Google parent company Alphabet in 2019, but remains a board member and majority shareholder.

He co-founded Google in 1998 with Sergey Brin, who also had a PhD from Stanford. student.

They both invented Google’s PageRank algorithm for its search engine.

Page was CEO until 2001, when he was succeeded by Eric Schmidt. From 2011 to 2015, he became CEO of Alphabet.

Alphabet had reported revenue of $307.4 billion in 2023.

Larry Page co-founded Google in 1998 with Sergey Brin, who also had a PhD from Stanford. student

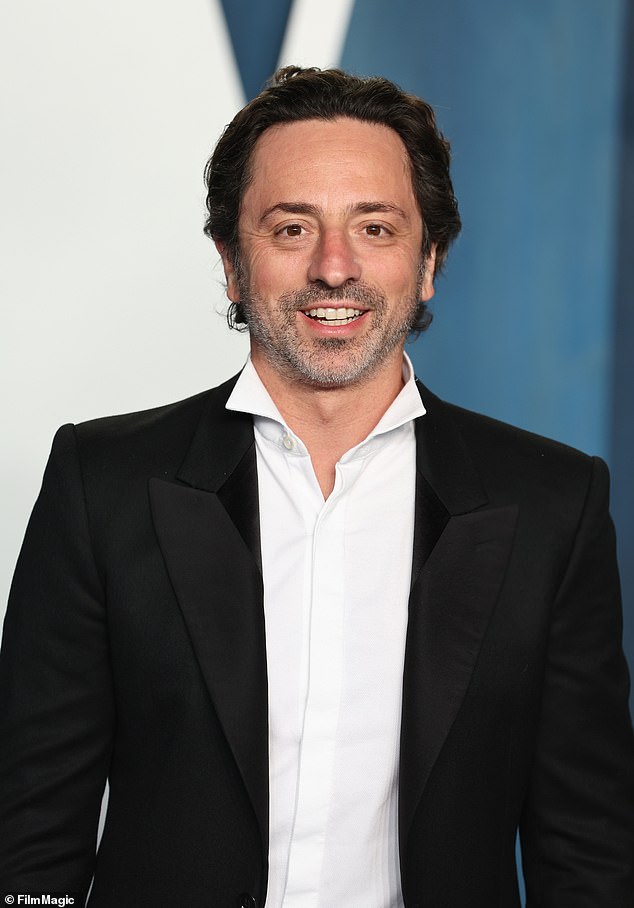

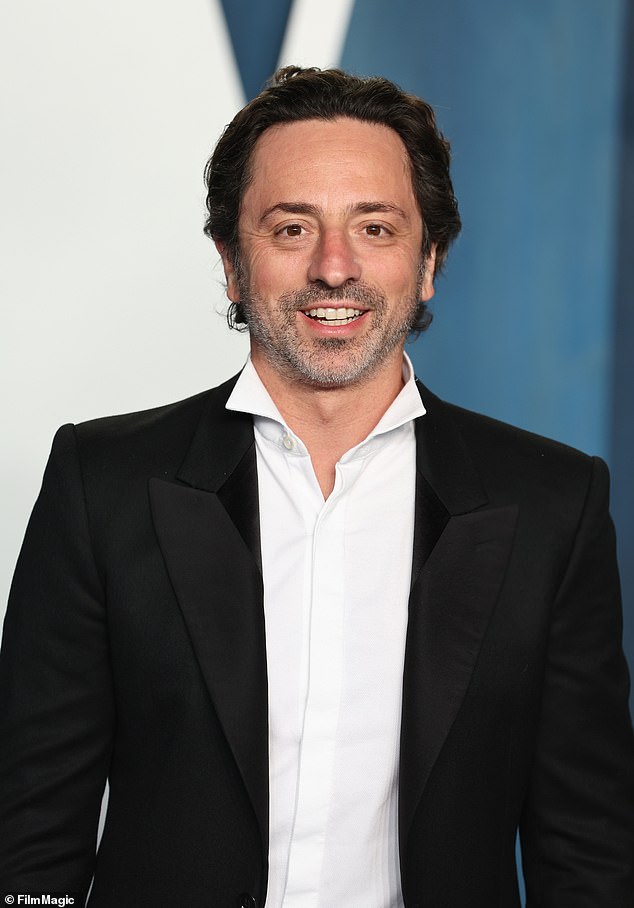

(10) Sergey Brin 116 billion dollars

Sergey Brin is a co-founder of Alphabet. The group’s divisions include Android, Gmail and YouTube.

Brin left his position as president of Alphabet in December 2019, but remains a board member and majority shareholder.

He moved from Russia to the United States at the age of six.

Google went public in 2004 and began trading as Alphabet in 2015.

Brin left his position as president of Alphabet in December 2019, but remains a board member and majority shareholder.