Amazon founder Jeff Bezos has sold a total of $4 billion in stock since last week, after selling $2 billion this week and $2 billion last week, regulatory filings revealed.

The move comes after it was learned that Bezos will establish his primary residence in Florida, taking advantage of the Sunshine State’s tax system.

Bezos stepped down as CEO of Amazon in 2021. His current title is CEO. In the space of a week, he dumped nearly 25 million shares of the company. These are the first shares he has sold since he stepped down as CEO.

Earlier this month, Bezos, consistently named one of the richest people in the world, said he would sell 50 million of his Amazon shares by 2025 through brokerage firm Morgan Stanley.

Despite the sales, Bezos remains Amazon’s largest shareholder, owning about ten percent of the company’s shares.

According to Forbes list of billionaires in real time, At the time of writing, Bezos is the third richest person in the world with a net worth of $190 billion, behind Elon Musk, who is worth $196 billion. At the top of the list is Bernard Arnault and his family with a net worth of $215 billion.

Amazon’s other large shareholders are mutual fund Vanguard Group, which owns 6.9 percent, asset managers BlackRock, which owns 5.8 percent, and investment firm State Street, which owns 3. 3 percent.

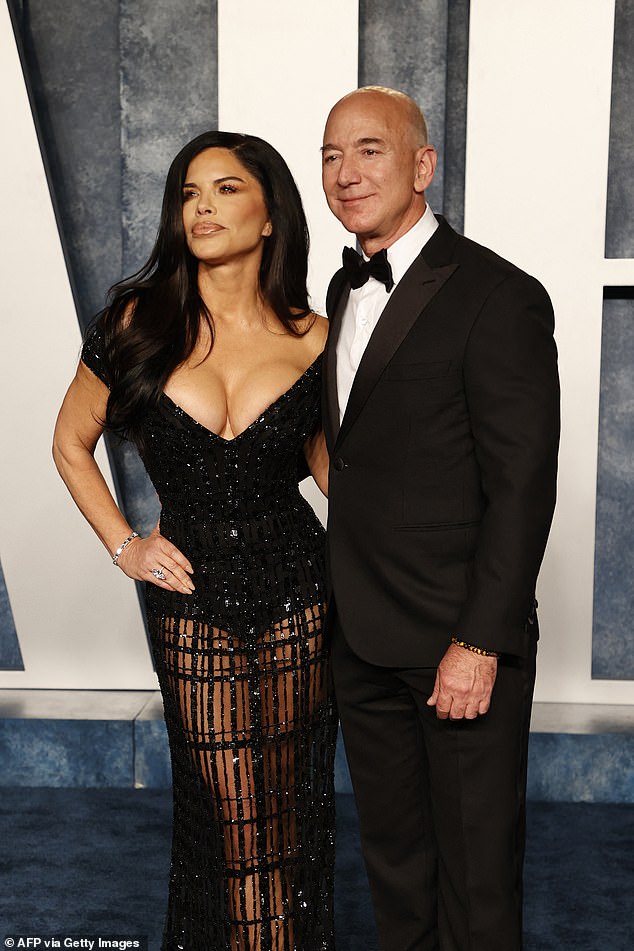

Bezos photographed with his fiancee Lauren Sánchez at the Vanity Fair Oscar party in 2023

Bezos has used most of the money raised from selling Amazon shares to fund his other ventures, including space exploration.

Since February 2023, Amazon shares have soared more than 50 percent and its price is approaching an all-time high. Its market capitalization is around $1.75 trillion.

Since February 2023, Amazon shares have soared more than 50 percent and its price is approaching an all-time high. Its market capitalization is around $1.75 trillion.

Bezos stepped away from Amazon to devote more time to his other projects, including rocket company Blue Origin and his philanthropy.

His address on stock filings is listed as Seattle, although he reportedly moved to Miami.

‘Lauren and I love Miami,’ he wrote on Instagram last year, referring to his fiancée Lauren Sánchez.

“Because of all that, I’m thinking about returning to Miami, leaving the Pacific Northwest,” he added.

Bezos announced he was leaving his former home in Seattle last year to move to Miami, purchasing two properties on the ultra-exclusive Indian Creek Island dubbed the “billionaire bunker.”

Bezos said the move was to be closer to his parents and to rocket launches at his Blue Origin space company, but it also carried a significant tax benefit.

Florida has no state income tax or capital gains tax, while Washington introduced a 7 percent capital gains tax on stock or bond sales of more than $250,000 in 2022.

By 2025, his Florida tax savings would cover the cost of Koru, the $500 million superyacht he bought last year.

The nine-figure sum that Bezos is expected to save by selling his shares over the next year means Amazon’s share price remains stable at its current level.

Bezos announced that he and Sanchez were moving from Seattle to Miami in a social media post last year.

If the value of the stock continues to rise, your tax savings would also be even greater.

Amazon has seen its stock price rise steadily over the past year.

He the technology stocks called “Magnificent 7” Apple, microsoftAlphabet, Amazon, Nvidia, Goal Platforms and Tesla was responsible for the vast majority of the S&P 500’s 24 percent growth in 2023.

And earlier this month, the retail giant reported that it had raised $170 billion in the final quarter of last year thanks to a surge in holiday shopping.

Amazon’s financial results beat analysts’ expectations and sent the stock soaring more than 8 percent in after-hours trading on Feb. 1.

Bezos and his fiancée Lauren Sanchez own several properties on Indian Creek Island, along with retired NFL star Tom Brady and former first daughter Ivanka Trump.

Bezos bought two mansions for $147 million and is reportedly looking to buy three more homes on the island.