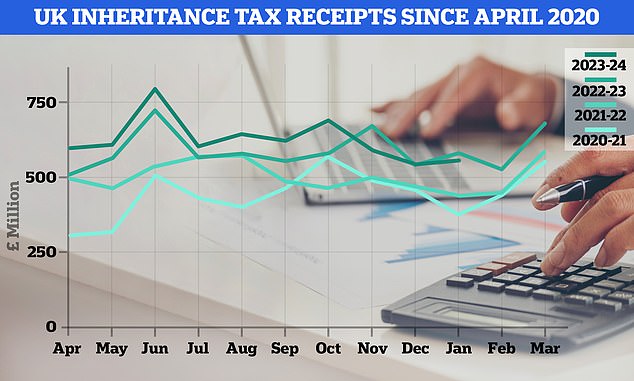

- IHT for the period was £400m higher than at the same time last year.

- Chancellor Jeremy Hunt under pressure ahead of next month’s budget

<!–

<!–

<!– <!–

<!–

<!–

<!–

The Treasury collected £6.3bn of inheritance tax revenue in the period from April 2023 to January 2024, new data from HM Revenue & Customs shows.

Inheritance tax receipts during the period were £400 million higher than at the same time the previous year.

According to analysis by Evelyn Partners, the Treasury is on track to receive record inheritance tax revenues of around £7.6bn in the current financial year, up from an all-time high of £7.1bn the previous year.

Chancellor Jeremy Hunt is under pressure to boost the economy in next month’s budget, with some calling for inheritance tax to be scrapped.

Rumors emerged in the run-up to last year’s Autumn Statement that Hunt would reform or scrap the inheritance tax, but no changes materialised.

Making money: The Treasury made £6.3bn from inheritance tax revenue in the period from April 2023 to January 2024.

On Wednesday, the Treasury said higher inheritance tax receipts in June 2022, November 2022, June 2023 and October 2023 could be attributed to “a small number of larger-than-usual payments”.

In June 2023, HMRC data showed bereaved families paid £1.2 billion in inheritance tax in just eight weeks.

Freezing exemption levels and, in many cases, rising property prices are helping to increase the number of households subject to inheritance tax.

The zero rate band, which is the rate at which an estate pays no IHT, has remained at £325,000, attracting an increasing number of people into its network.

This zero rate band has been in place since 2010 and Hunt has extended its freeze until 2028.

However, it is possible for people to make use of the “nil residence rate band” to give a primary residence to their children.

Under this rule, the allowance increases by £175,000, meaning parents or grandparents can pass on £500,000 each to their direct descendants before inheritance tax comes into force.

Whats Next? Chancellor Jeremy Hunt to announce new budget on March 6

Despised by many, the inheritance tax is often seen as a broader “tax drag” strategy, whereby tax thresholds and reliefs fail to keep pace with inflation or wage growth, leading to results in more taxes being paid.

Laura Hayward, tax partner at Evelyn Partners, said: “While a relatively small number of large estates typically account for the bulk of annual inheritance tax revenues, this is supplemented by thousands of more modest inheritances.”

He added: ‘Minor housing crises, such as those we have seen in the last year, will do little to dent this trend. And although the Covid effect on mortality, which at one point increased total inheritance tax collections, has now almost exhausted, inheritance tax collections continue to rise.’

On whether Hunt could alter inheritance tax rules in next month’s budget, Hayward said: “Whether due to If the leaks at the Treasury are plugged, or if there is a change of heart in Nos 10 and 11, the budget rumor mill has gone silent on the issue of inheritance tax.

“Despite being paid by a small proportion of the estates, IHT is unpopular and has attracted attention as one of the taxes the Chancellor could cut in the Spring Budget, in a final roll of the fiscal dice before it begins the electoral battle itself”.

And he added: “As inheritance tax Although the cut would have little immediate impact on the financial situation of households, it is perhaps more likely that a compromise on the inheritance tax will appear in the Conservative manifesto rather than the Budget, particularly as it could attract and motivate some of the party’s main voters. ‘

Nicholas Hyett, investment manager at Wealth Club, said: “The Government appears to be backing away from possible tax cuts in the March budget.

‘And with inheritance tax a growing source of income, you can see why the Chancellor might find it difficult to reduce this most unpopular tax. “Any deficit would mean higher taxes or less spending elsewhere.”