Americans are staying in their homes before selling them for twice as long as in 2005, and the baby boomers are to blame.

The typical homeowner spends 11.5 years in their home today, up from 6.5 years two decades ago, according to a new report from Redfin.

Researchers said the trend is being driven by older homeowners who are not “financially incentivized” to move. The lack of homes on the market drives up prices.

It comes after former Oppenheimer analyst Meredith Whitney told DailyMail.com that house prices will finally start to fall as more seniors start downsizing, thus freeing up housing.

According to Redfin’s analysis of US Census Bureau data, housing tenure peaked at 13.4 years in 2020.

The typical homeowner spends 11.5 years in their home today, up from 6.5 years two decades ago, according to a new report from Redfin.

This comes after former Oppenheimer analyst Meredith Whitney, pictured, told DailyMail.com that house prices will finally start to fall as more seniors start downsizing, thus freeing up housing.

The analysis also found that millennials were more likely to stay in their homes for shorter periods, in part because they change jobs more frequently than previous generations.

Two in five baby boomers (those born between 1946 and 1964) have lived at home for 20 years or more.

By comparison, less than 7 percent of millennials (born between 1981 and 1996) have lived in their home for ten years or more.

The report notes: ‘The majority (54 percent) of baby boomers who own homes own them for free and with no outstanding mortgage.

‘For that group, the average monthly cost of owning a home – which includes insurance and property taxes, among other things – is just over $600.

“Almost all boomers who have a mortgage have a much lower rate than they would have if they sold and bought a new home at current rates of 7 percent.”

But researchers noted that older homeowners “hanging on to their homes” is “a hurdle for young first-time buyers trying to enter the market.”

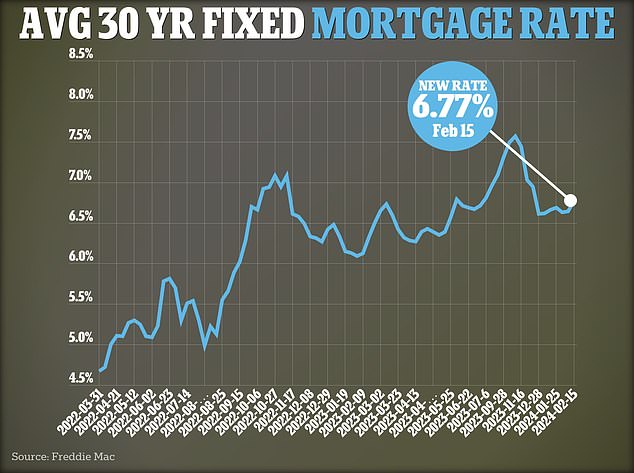

The average rate on a 30-year fixed home loan hit 6.77 percent, up from 6.64 percent last week, according to figures from government-backed lender Freddie Mac.

The findings echo comments made by Whitney, an analyst dubbed the “Oracle of Wall Street” after she accurately predicted the 2008 financial crisis.

Their research shows that around 90 per cent of the housing stock is owned by people over 40, while 74 per cent is owned by people over 50.

However, he says there is a lot of churn going on in stores as more of these older owners start selling, freeing up inventory and lowering prices.

Whitney told DailyMail.com: ‘It makes logical sense that many of these owners will start downsizing in the next decade. There are almost 35 million homes; That’s a huge number to get through the system.

“My advice to owners is: if you want to sell, you better do it as soon as possible.”

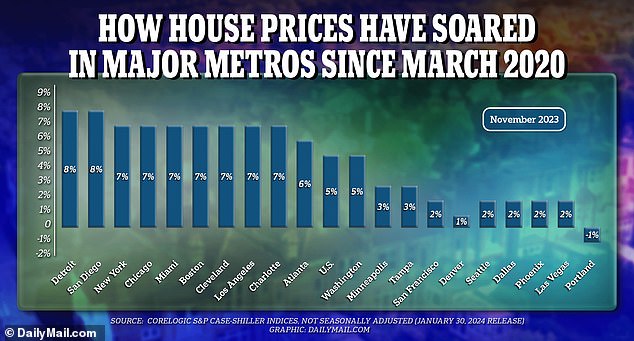

During the pandemic, the median home price in the United States soared from $303,465 in March 2020 to $402,045 in December 2023, Redfin figures show.

Many families were caught up in the so-called “race for space” as they looked for larger houses and gardens to spend the confinement. A widespread shift to working from home also freed workers from their city center properties.

But home prices have remained elevated since then, even though mortgage rates soared in response to the Federal Reserve funds rate hitting a 22-year high.

The average rate on a 30-year mortgage is currently around 6.77, about double what it was two years ago, figures from government-backed lender Freddie Mac show.

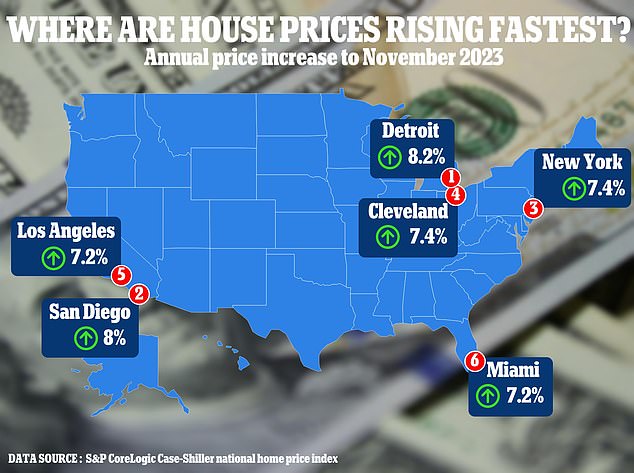

In the year through November 2023, home prices in Detroit rose 8.2 percent, according to the most recent data from the main measure of U.S. housing prices.

A recent report from CoreLogic shows how property prices have skyrocketed in certain US metropolitan areas.

In a normal market, this would be enough to curb demand for housing and therefore crush prices. However, several experts have noted that a widespread property shortage in the United States has kept home values artificially high.

Whitney insists there will not be a “crash” in house prices, but rather a delayed correction.

And some markets will do much better than others.

She said: ‘Every 60 years we see a similar type of seismic change in the American economy from an economic point of view.

‘Today we are seeing businesses move to tax-friendly states across the Sunbelt and into Texas, Tennessee and North Carolina. These are the real estate markets where growth will persist.

Whitney insists there will not be a “crash” in house prices, but rather a delayed correction.

It notes that homeowners have built up $21 trillion in equity in their homes over the past decade, so any price decline is unlikely to seriously hurt them.

And some markets will do much better than others.

She said: ‘Every 60 years we see a similar type of seismic change in the American economy from an economic point of view.

‘Today we are seeing companies move to those tax-friendly states across the Sunbelt and into Texas, Tennessee and North Carolina. These are the real estate markets where growth will persist.