<!–

<!–

<!– <!–

<!–

<!–

<!–

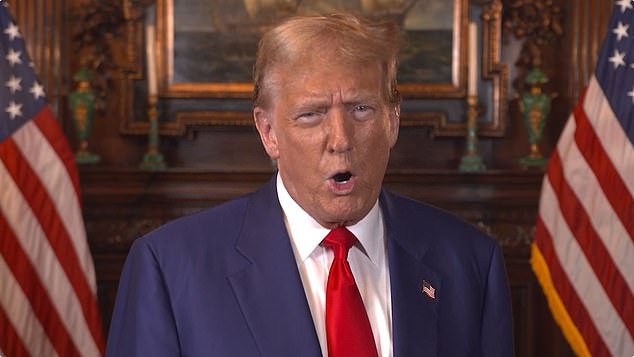

Donald Trump said abortion policy should be left up to the states as he finally revealed his stance on the highly controversial issue after mocking it for months.

The former president did not specify a time period in which he would or would not support abortion in the video of his long-awaited announcement published on Truth Social.

Trump celebrated the Supreme Court overturning Roe v. Wade in June 2022, sparking two years of debate over how abortion should now be handled at the state and federal level.

The 77-year-old also said in the four-and-a-half-minute video that he believed in exceptions to the right to terminate a pregnancy in cases of rape, incest and to save the mother’s life.

Donald Trump said abortion policy should be left to the states as he finally revealed his stance after mocking it for months.

“We have abortions where everyone wanted it from a legal standpoint, the states will determine it by voting or legislation or maybe both, and whatever they decide should be the law of the land,” Trump said in the video.

He also accused Democrats of believing in “executing the baby after birth.”